Blog

How Are Trump 2.0 Policies Redefining the Rules of Investing in 2025?

10.10.25 03:31 PM - Comment(s)

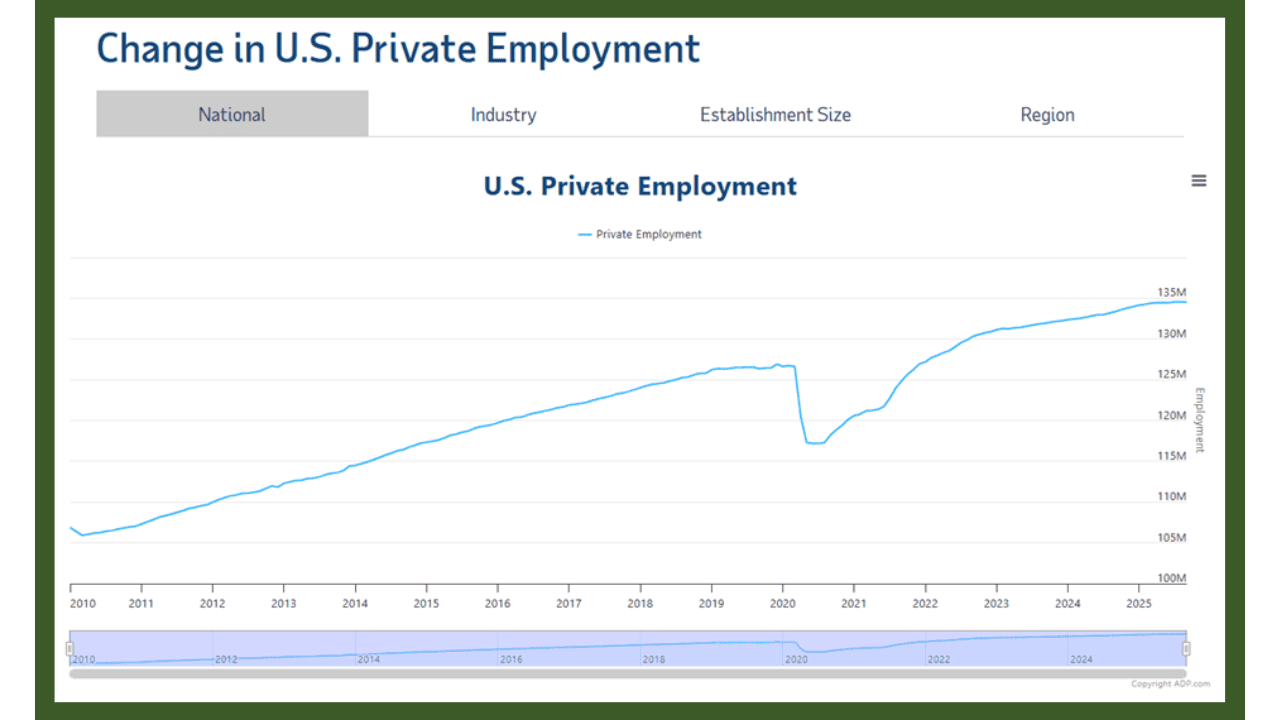

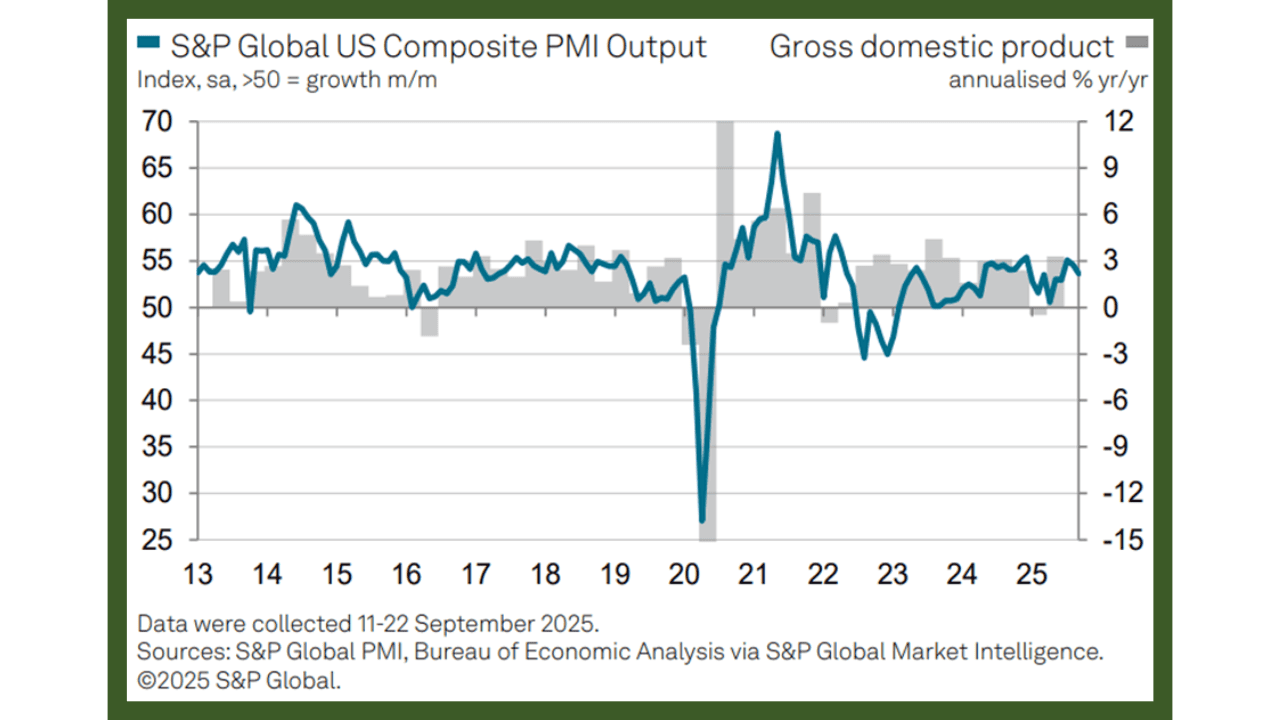

From tariffs to tax reform and energy rollbacks, U.S. markets are being reshaped by politics, not profits. Explore how Washington’s next policy moves could determine which sectors thrive and which falter as investors navigate the most policy-driven year since 2018.

Markets Hold Firm Amid Shutdown: What’s Next for Investors?

06.10.25 02:12 PM - Comment(s)

Discover how U.S. markets navigated political gridlock, a government shutdown, and fragile labor signals last week. Read the weekly recap and outlook for October 5–12, 2025, including market sentiment, earnings insights, gold’s rally, and what to watch as shutdown delays key economic data.

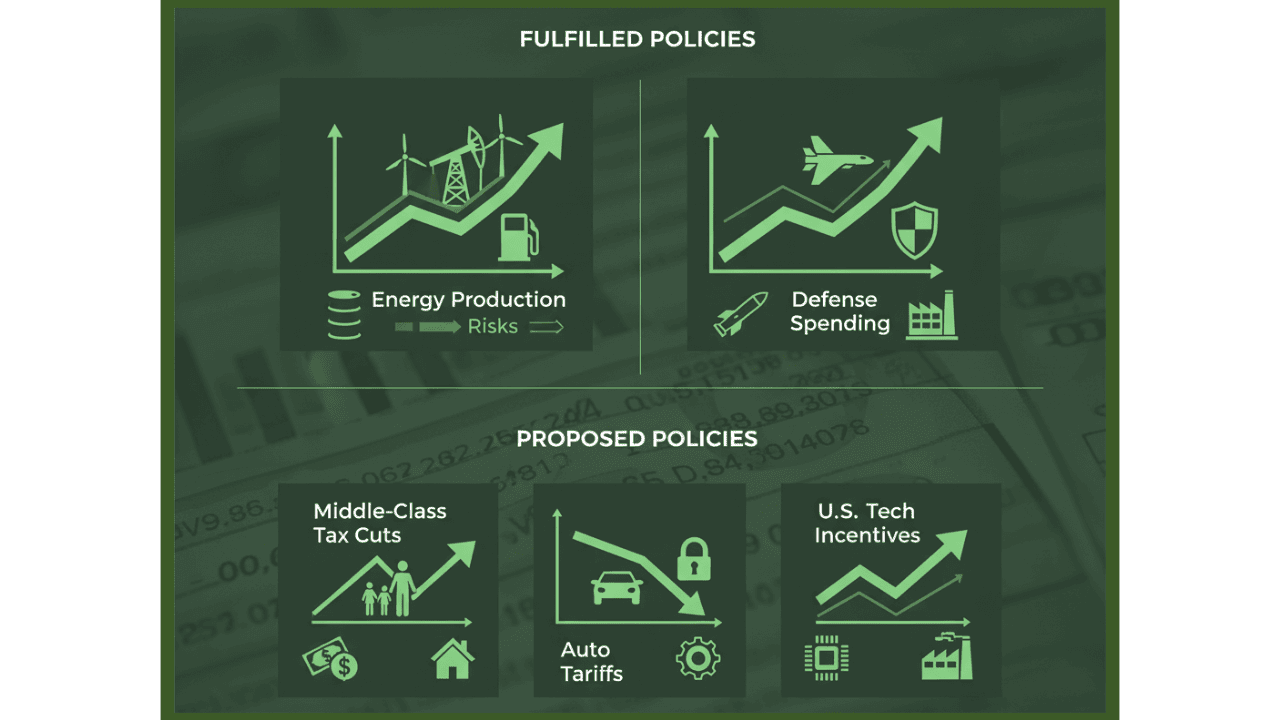

Reviewing President Trump’s 2025 Economic Agenda: What Investors Need to Know

06.10.25 04:25 AM - Comment(s)

Explore President Trump’s 2025 economic agenda, its market impact, and key opportunities for investors. Learn which policies have been implemented and which pending proposals could shape sector performance.

Global equities hit record highs as Big Tech drives momentum, but caution looms with fragile growth forecasts and Fed uncertainty. Read this week’s market recap and the outlook for key U.S. data ahead.

Is AI Creating the Next Semiconductor Supercycle?

29.09.25 02:12 PM - Comment(s)

Explore how AI-driven demand is fueling growth in logic and memory chips while auto, IoT, and analog segments recover slowly. Learn why semiconductors are entering a new supercycle and what it means for investors.

Categories

- Uncategorized

(14)

- Market Commentary

(46)

- Advisory

(1)