Logic, Memory, and AI: Positioning for the Next Semiconductor Expansion

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

Introduction

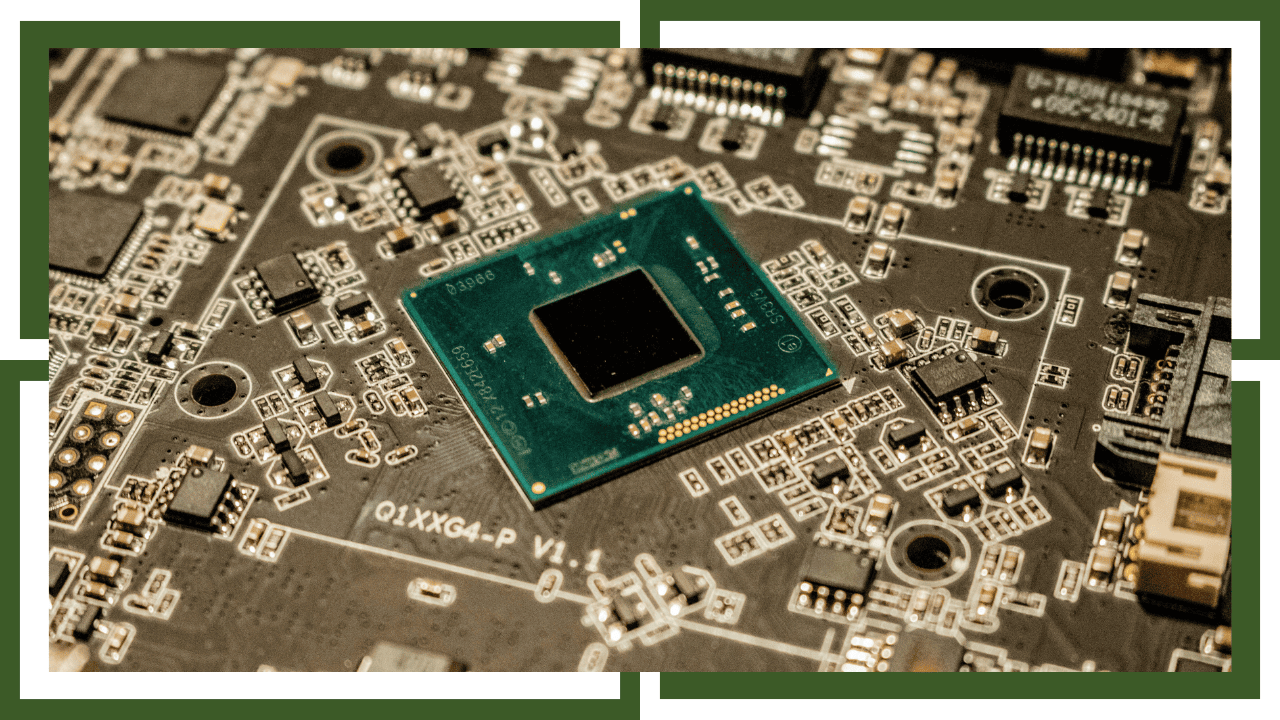

The semiconductor industry is experiencing one of its most interesting cycles in years. AI-driven demand for GPUs, high-bandwidth memory, and advanced networking is propelling growth in logic and memory segments, while auto, IoT, and analog chips navigate slower recoveries. In this Q&A, we discuss the current semiconductor landscape and what it means for investors.

Why did we decide to research the semiconductor industry now?

The semiconductor industry is showing a sharp split: logic and memory are booming, while auto, IoT, and analog segments are slowing. Semiconductors are cyclical, much like energy or real estate. Right now, logic and memory are in expansion, whereas auto and analog are still in correction. This divergence makes timing critical.

According to WSTS data, logic grew 37% YoY in H1 2025, and memory rose 20%. Analog and microcontrollers (MCUs) only achieved 4% growth, confirming that the industry is moving at two speeds.

What is a semiconductor, what segments make up the industry, and why do they matter?

Semiconductors are the “clay” of modern electronics, forming the basis for transistors and powering everything from phones and PCs to cars and data centers. The industry has seven main categories: logic, memory, analog, MCUs, discretes, optoelectronics, and sensors. Together, these segments form a trillion-dollar industry.

Each segment has its own cycle. Logic and memory see high growth but are highly volatile. Analog and MCUs grow more slowly, tied to automotive and industrial demand. Sensors and connectivity are currently in early recovery.

How big is the chip industry today, and where is it going?

Global semiconductor sales were $627 billion in 2024 and are projected to reach $700 billion in 2025—larger than the economies of Switzerland or Turkey. Looking ahead, the industry could hit $1 trillion by 2030 and $2 trillion by 2040, making it one of the fastest-growing sectors globally.

The market capitalization of the top 10 chip firms doubled from $3.4 trillion in 2023 to $6.5 trillion in 2024, showing significant capital flow into the sector.

Why are AI chips (logic and memory) growing so fast?

AI models require massive compute and memory. GPUs are paired with ever-larger high-bandwidth memory, fueling demand for companies like Nvidia, AMD, Intel, Samsung, SK Hynix, and Micron. The industry is focusing on premium products and better capacity management. AI chips represent high growth with commensurate risk and reward.

Nvidia has guided for $120 billion in data center revenue for 2025. Memory suppliers are raising DRAM contract prices by 15–30% in Q4 2025. This reflects structural tightness rather than just cyclical growth.

What about auto, IoT, and industrial chips—are they being left behind?

These segments are not left behind; they are simply slower in the cycle. Pandemic over-ordering led to excess inventory, so recovery lags AI by a few quarters. Long-term growth drivers like EVs, smart factories, and connected devices remain intact.

Automotive chip content per car has risen from $400 in 2013 to over $1,000 in 2023, indicating structural demand remains strong despite current weakness.

Is this semiconductor boom just another short-term trend?

Unlike past booms tied to PCs or smartphones, this cycle is driven by AI, which spans multiple devices and industries. This makes the current expansion broader and structural.

AI-capable PCs are expected to make up 50% of shipments in 2025, rising to 95% by 2029. Additionally, the $1 extra AI silicon per smartphone could generate $1.2 billion in annual revenue. This diffusion of AI demand suggests a supercycle rather than a temporary fad.

Closing Thoughts

The key takeaway is that understanding the divergence in semiconductor cycles — between AI-driven logic and memory growth versus slower analog and industrial segments — is critical for investors. Strategic positioning now can capture both near-term expansion and long-term structural growth, making this an extraordinary period in the semiconductor industry.

Interested in going deeper on the above topics? Our FREE Basic Digest provides 3-5 pages of summarized insights to keep you informed on key themes impacting the market.

Or consider leveling up to our paid Premium Digest. Typically running 15-20 pages long, the Premium Digest goes much deeper on a given theme, expanding on historical precedents and providing a bit of visibility into Calisade's institutional insider trading research.

Calisade's Elite Digest is our institutional grade offering, typically 25-35 pages chock full of charts, graphs, historical insights, and, perhaps most importantly, stock tickers that are directly impacted by these themes.

📩 Click to explore Basic, Premium, and Elite Access and see what top investors are reading.