Global Markets Push to All Time Highs as Optimism, Fear of Missing Out and Pullback Risks Shape Investor Sentiment

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

Global equity markets extended their rally into late September, with major indices touching fresh record highs. Big Tech continued to drive gains, while optimism around rate cuts supported broader risk appetite. Yet the mood is far from settled: investors are increasingly wary that markets may be “priced for perfection,” with valuations clustered in a handful of names.

At the same time, some cautionary voices grew louder. Universa’s Mark Spitznagel warned that U.S. equities could still rise another 20% before facing a severe correction, citing fragile underpinnings that leave investors vulnerable to sharp reversals (Reuters). Adding to unease, the World Economic Forum flagged structural headwinds that could drag global growth by 2026, while S&P Global revised its 2025 U.S. GDP forecast down to just 1.9% well below trend.

Markets reacted to these cross-currents with bouts of volatility. Fed Chair Jerome Powell’s reluctance to confirm imminent cuts gave the dollar strength, pushing equities lower midweek, though by week’s end indices regained ground as investors repositioned around capital flows and tech strength.

The Week That Was (September 22 to September 28, 2025)

Markets spent the week balancing optimism and unease. Fresh record highs underscored investor confidence in mega cap tech and hopes for future Fed easing, but beneath the surface, macro concerns and policy uncertainty tempered enthusiasm. The rally felt increasingly narrow, leaving investors torn between chasing momentum and guarding against concentration risk.

Market Sentiment & Tone

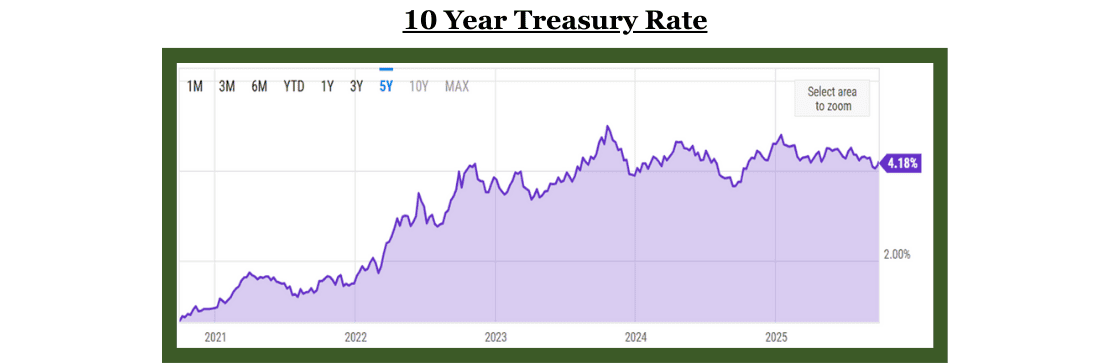

The week reflected a tug-of-war between optimism and caution, as investors navigated mixed signals from economic data and corporate earnings. The S&P 500 slipped about 0.3% for the week, while the Nasdaq Composite underperformed, falling around 0.7%. Meanwhile, the 10-year U.S. Treasury yield edged up to roughly 4.18%, underscoring lingering inflation and growth concerns. The Dollar Index (DXY) firmed midweek following Powell’s cautious remarks on the Fed’s policy outlook, before easing slightly toward the end of the week.

Monday, September 22

On Monday, September 22, equities opened higher, extending momentum from the Fed’s first rate cut since December 2024, with the S&P 500 and Nasdaq reaching intraday records on strong megacap tech demand. Federal Reserve President Alberto Musalem spoke at a Brookings Institution event, supporting the 25-basis-point rate cut as a precautionary measure for the labor market. He noted inflation remains above target, but policy is modestly restrictive, and cautioned against further easing while balancing employment and inflation risks.

Tuesday, September 23

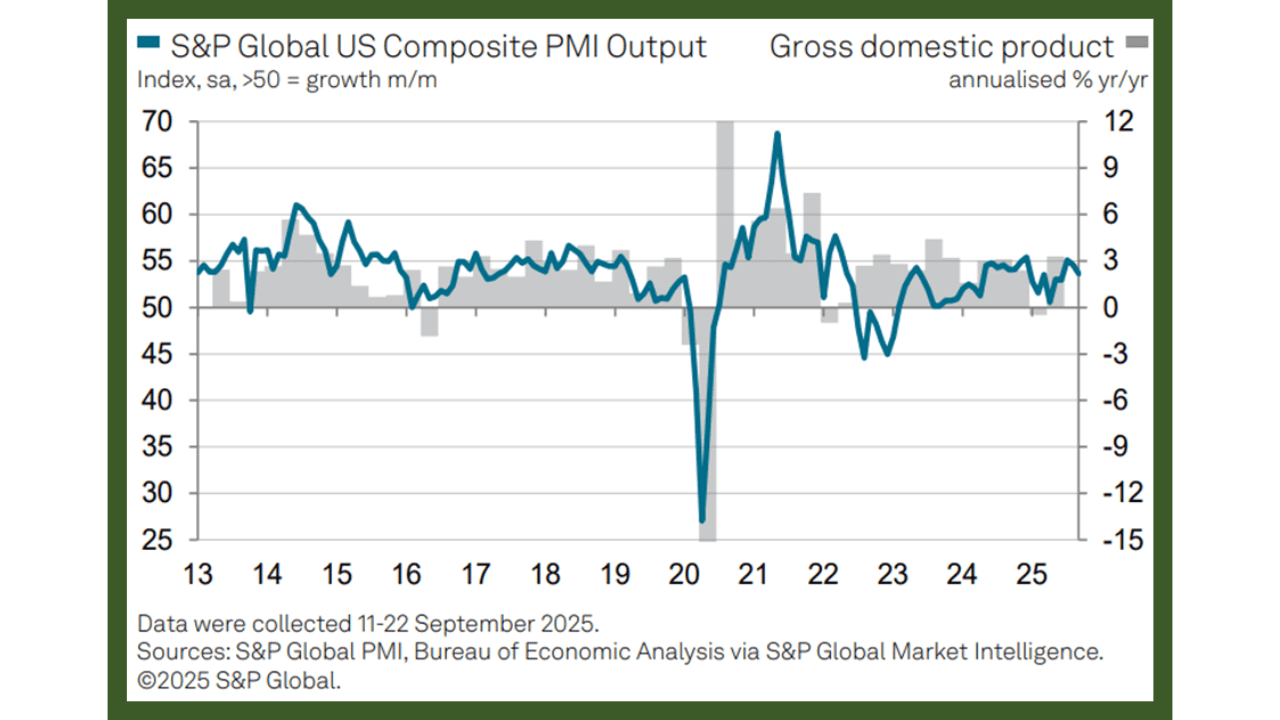

On Tuesday, September 23, U.S. markets consolidated as mixed global trade and activity data emerged. The S&P Global Flash U.S. Composite PMI fell to 53.6 in September from 54.6 in August, indicating a slowdown in business activity. Manufacturing remained near contraction levels, with the Manufacturing PMI dropping to 52.0 from 53.0, while the Services PMI eased to 53.9 from 54.5.

Wednesday, September 24

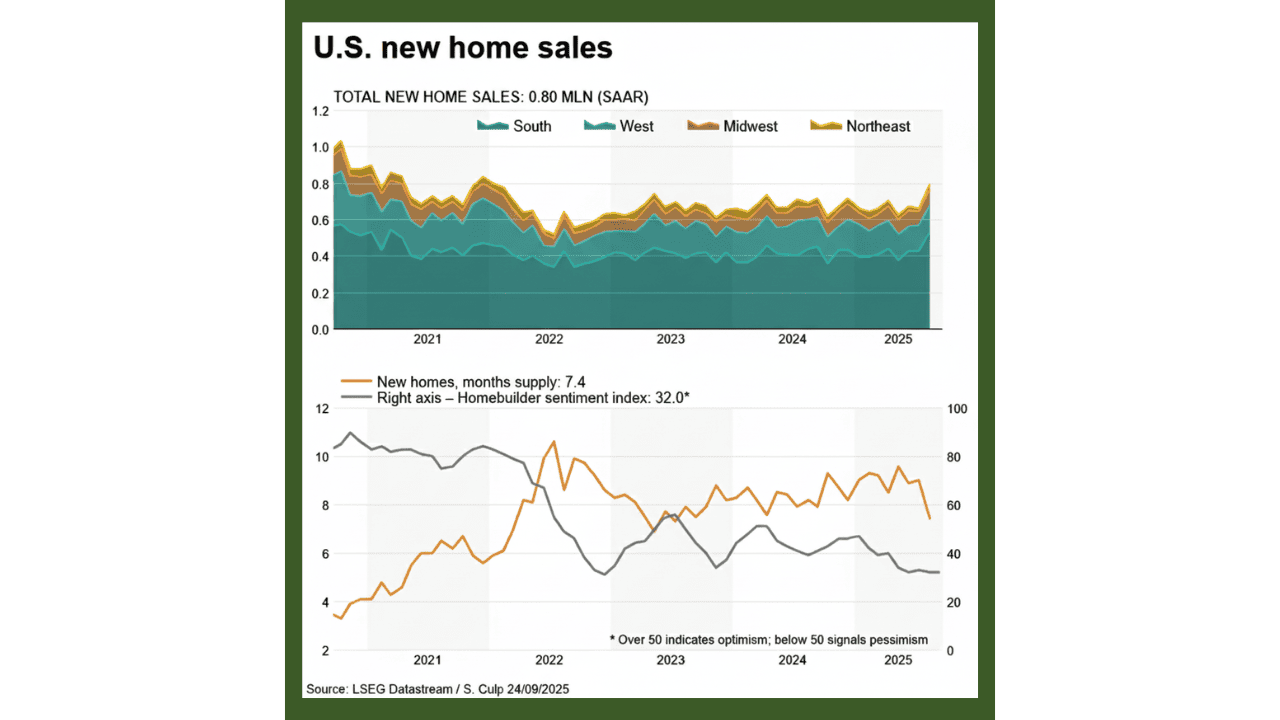

On Wednesday, September 24, 2025, housing data came into focus as August new home sales unexpectedly surged, hinting at steady demand despite high mortgage rates. Sales of newly built single-family homes jumped 20.5% in August to a seasonally adjusted annual rate of 800,000 units, the highest level since January 2022. This increase was attributed to a modest drop in mortgage rates, with the average 30-year fixed mortgage rate declining to 6.26%.

Despite the positive sales data, affordability concerns persisted. The median new home sale price rose to $413,500, up 1.9% from a year ago. Inventory levels remained tight, with new single-family home inventory declining for the third straight month to 490,000 residences marketed for sale, reflecting a 1.4% decrease from the previous month

Thursday, September 25

On Thursday, September 25, 2025, U.S. durable goods orders presented a mixed economic signal. Headline new orders rose 2.9% in August driven by strong demand in transportation equipment. However, core capital goods orders, excluding defense and aircraft which grew 0.6%, while shipments fell 0.3%, indicating a potential slowdown in business investment momentum.

Corporate Earnings Spotlight

Corporate earnings this week revealed nuanced trends across key sectors, highlighting both resilience and emerging pressures. Micron (MU) met expectations, though margin pressures from pricing competition signal ongoing challenges in the semiconductor cycle. Accenture (ACN) demonstrated robust growth in cloud and AI services, underscoring the accelerating shift toward digital transformation as a driver of sustainable revenue.

Costco (COST) benefited from strong membership renewals, yet elevated food and energy costs continue to weigh on profitability, reflecting broader inflationary pressures. AutoZone (AZO) and Jabil (JBL) reported steady performance, suggesting cautious consumer spending and industrial demand, with companies navigating a balancing act between growth and margin maintenance.

The Week Ahead (September 29 – October 5, 2025)

After a week marked by record market highs and growing caution over concentrated valuations, attention now shifts to a dense slate of economic releases that could steer sentiment into early October. Investors will be watching closely for fresh signals on growth, employment, and manufacturing momentum as they weigh the Federal Reserve’s next policy moves. Key labor and industrial data due in the coming days could determine whether the recent rally maintains its strength or faces renewed volatility.

Wednesday, October 1

The week kicks off with several important data releases. The ADP Employment Report will provide an early read on private payroll trends ahead of the official jobs report. Markets will also watch the ISM Manufacturing Index (September), a timely gauge of industrial activity, orders, and business confidence. In addition, the Metropolitan Area Employment and Unemployment report from the BLS will give localized insights into labor conditions across U.S. cities.

Thursday, October 2

The U.S. Census Bureau will release the August 2025 Manufacturers’ Shipments, Inventories, and Orders (M3) report on Thursday, October 2, 2025, at 10:00 AM ET, providing insights into business demand, supply chain activity, and inventory trends. The Weekly Initial Jobless Claims report, covering the week ending September 27, 2025, is also typically released on Thursdays at 8:30 AM ET by the U.S. Department of Labor; however, the official release date for this week has not yet been published.

Friday, October 3

Given the recent slowdown in job growth, with only 22,000 jobs added in August, well below expectations of 75,000, the upcoming data will be closely scrutinized. A stronger-than-expected report could dampen expectations for further rate cuts, while a weaker report might reinforce the case for dovish monetary policy

Outlook

Markets are approaching new highs but remain sensitive to concentration risk and potential policy surprises. Investor focus will be on upcoming inflation, labor, and spending data to determine if valuations are justified or if volatility could return. The interplay between optimism driven buying and underlying market fragility is likely to shape sentiment into early October. Beyond the data, investors will monitor Fed and other central bank commentary for guidance on the timing and pace of future policy shifts. Movements in the U.S. dollar and Treasury yields will remain pivotal for global liquidity and cross-asset flows.