Blog

Why does AI create such massive new energy demand?

24.09.25 03:54 PM - Comment(s)

Artificial intelligence is fueling unprecedented demand for electricity, reshaping utilities, grids, and energy markets. Explore how nuclear, renewables, and natural gas are positioned to power the data-center boom and what it means for investors.

Post-Powell: Will the Fed’s Measured Easing Stabilize Markets or Stoke New Uncertainty?

22.09.25 02:16 PM - Comment(s)

Markets reacted cautiously to the Fed’s September 2025 rate cut as Jerome Powell signaled a measured easing path. Explore weekly highlights, S&P 500 and Treasury moves, and what to watch in housing, manufacturing, and durable goods data.

Is Fed Independence at Risk? What Investors Need to Know - Q&A

16.09.25 12:42 AM - Comment(s)

Recent Fed developments raise concerns about political interference in monetary policy.From historical lessons to today’s market signals, discover what risks to watch, howportfolios may be affected, and why Fed independence is critical for investor confidence.

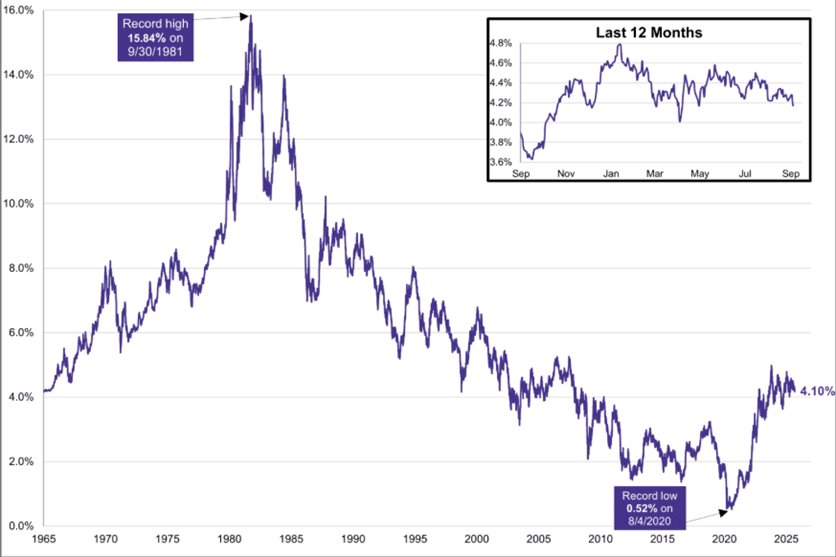

Will Powell’s September Move Deliver Relief or Renew Volatility?

15.09.25 02:25 PM - Comment(s)

Markets brace for the Fed’s September policy decision amid sticky inflation, weak jobs data, and hopes for a 25 bps cut. What lies ahead?

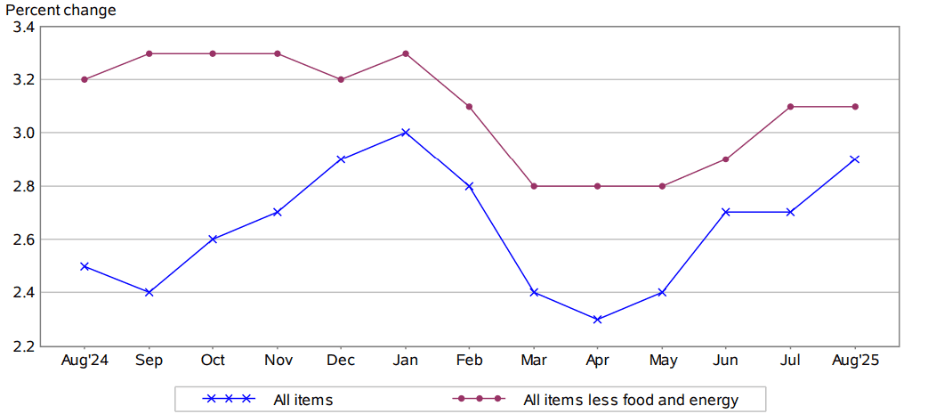

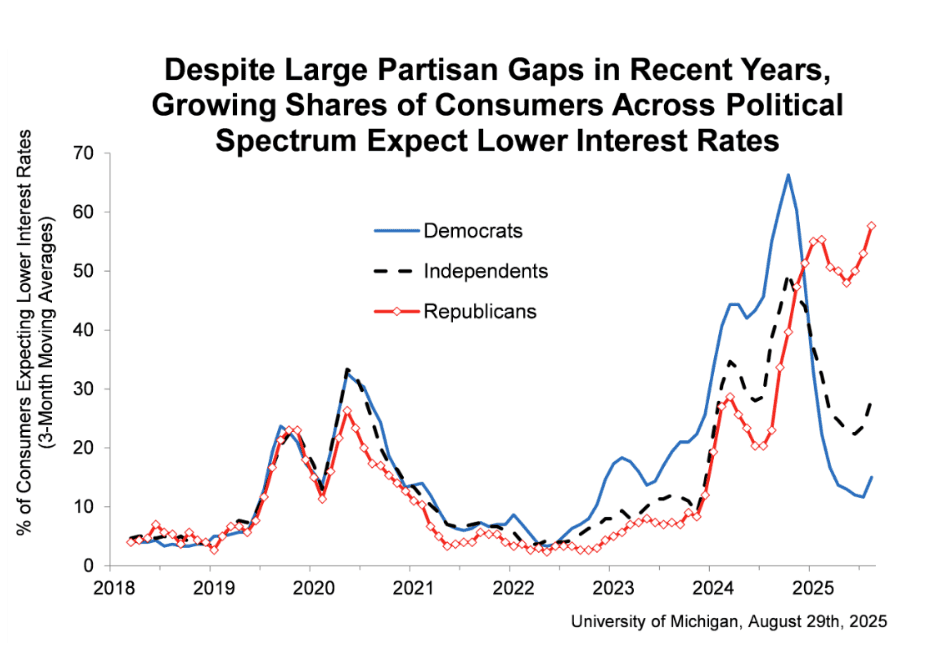

Can This Week’s CPI, PPI, and Sentiment Data Keep the Market Rally Alive?

08.09.25 02:31 PM - Comment(s)

Markets opened September with weak labor data & Fed turmoil. All eyes now on CPI, PPI & consumer sentiment to test Fed rate cut bets.

Categories

- Uncategorized

(14)

- Market Commentary

(46)

- Advisory

(1)