The Fed Walks a Tightrope: Cutting Rates to Support Growth While Inflation Lingers

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

Mid-September concluded with markets digesting the Federal Reserve’s widely anticipated policy move, which delivered a 25 basis point rate cut amidst a backdrop of persistent inflation and a cooling, yet resilient, labor market. While investors found some relief in the Fed's commitment to easing, Chair Powell’s cautious tone and updated economic projections left open questions about the pace of future cuts and the ultimate trajectory of the economy.

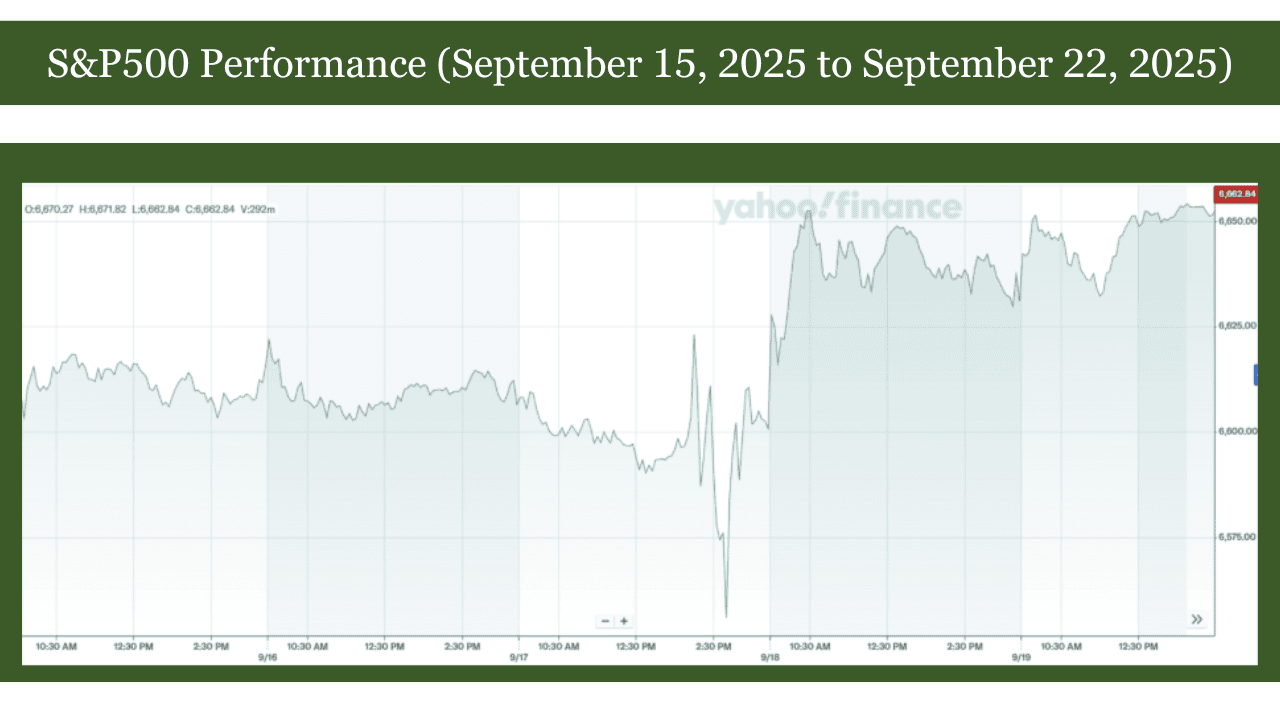

Equity markets saw a mixed reaction, with early gains giving way to some profit-taking as the details of the Fed's outlook were absorbed. Attention now swiftly turns to the week ahead, which brings crucial housing market data, manufacturing reports, and further insights into corporate sentiment, all poised to test whether the Fed's measured approach can foster stability or if fresh volatility looms.

The Week That Was (September 15 to September 21, 2025)

The third week of September was unequivocally dominated by the Federal Reserve's policy decision. After weeks of anticipation, the Fed delivered a 25 basis point rate cut, a move largely priced into the markets. However, the accompanying "dot plot" and Chair Powell’s press conference revealed a more nuanced outlook, suggesting a slower path to further easing than some aggressive doves had hoped for.

Markets initially rallied on the rate cut announcement but pared some gains as investors parsed the Fed's updated projections, which hinted at continued vigilance against inflation. Treasuries saw modest movements, reflecting the balance between the actual cut and the cautious forward guidance. The week also saw significant earnings reports from several bellwether companies, adding another layer of complexity to market sentiment.

Market Sentiment & Tone

Investors approached the week with a clear focus on the Fed. The 25 basis point cut provided a degree of relief, yet Chair Powell’s emphasis on data dependence and the persistent challenges of inflation kept a lid on exuberance. The equity markets reflected this mixed sentiment; initially positive, they ended the week with minor adjustments as the full implications of the Fed’s communication settled in.

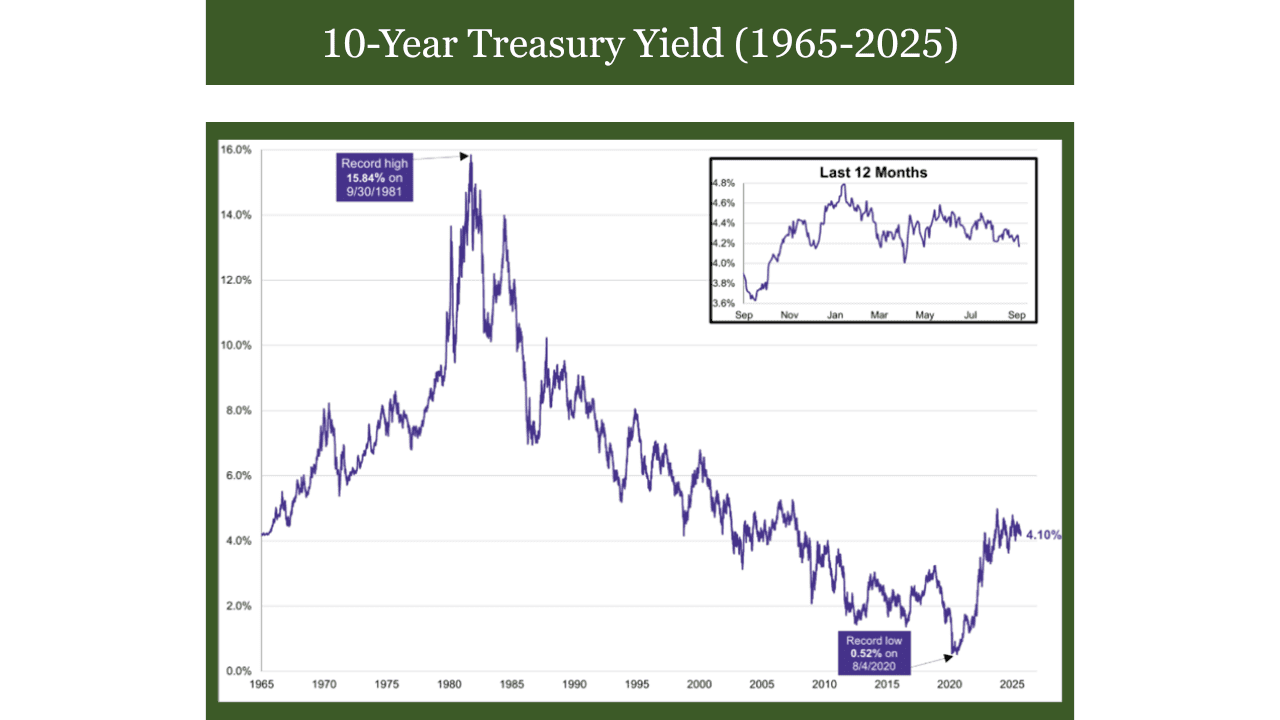

The S&P 500 rose 0.92% for the week, while the Nasdaq rose 1.74%, highlighting renewed momentum in growth-oriented sectors. U.S. Treasuries saw modest movement, with the 10-year yield closing near 4.09%, slightly higher than the prior week as markets absorbed the Fed’s tempered outlook.

Import & Export Price Indexes (Tuesday, September 16, 2025)

The August 2025 U.S. Import and Export Price Indexes released by the BLS offered a mixed picture on global cost pressures. Import prices saw a modest decline of 0.2% month-over-month, suggesting some easing in international supply chain costs, particularly for industrial supplies and raw materials. This could provide a slight tailwind for domestic inflation moderation.

However, export prices also edged down by 0.1%, potentially indicating weaker global demand for U.S. goods and services. While lower import prices are generally positive for consumers, the overall trend suggests that while some external inflationary pressures are dissipating, the global economic environment remains complex, with potential implications for corporate revenues and trade balances.

Federal Reserve Policy Decision (Wednesday, September 17, 2025)

The much-anticipated Federal Open Market Committee (FOMC) meeting concluded with a decision to lower the federal funds rate by 25 basis points, bringing the target range down from 4.25% - 4.50% to 4.00% - 4.25%. This move marked the first rate cut since December 2024, signaling the Fed's pivot towards supporting economic growth amidst signs of a cooling labor market.

Chair Powell, in his post-meeting press conference, reiterated the Fed's commitment to achieving its dual mandate of maximum employment and price stability. He emphasized that future policy decisions would remain data-dependent, indicating that the path to further easing is not predetermined and will be influenced by incoming inflation and employment figures. The updated Summary of Economic Projections (SEP) showed a slight upward revision to core PCE inflation forecasts for 2025, reinforcing the cautious stance on aggressive rate cuts.

State Employment Data (Friday, September 19, 2025)

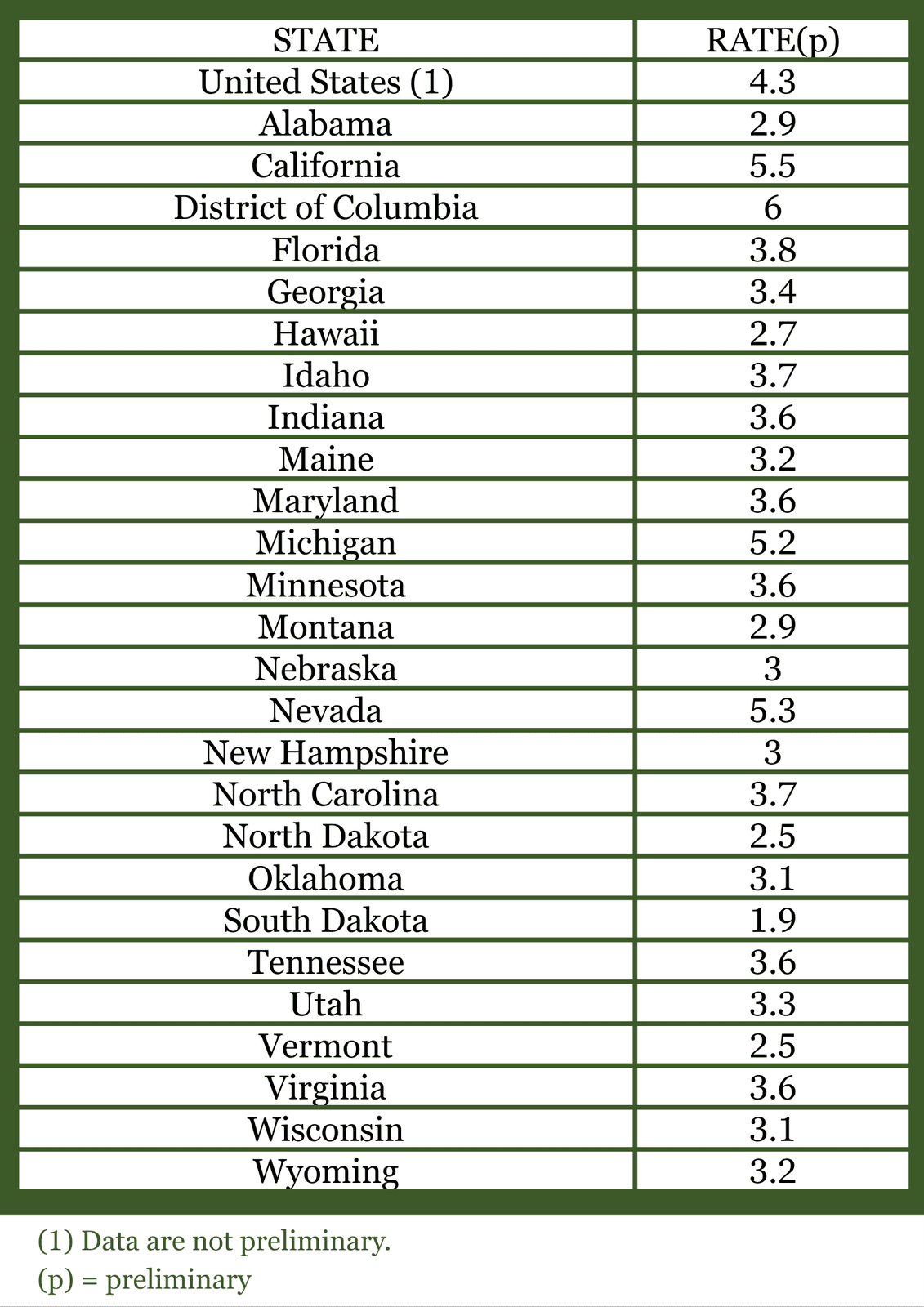

The August 2025 State Employment and Unemployment report showed broad stability, with the national unemployment rate holding at 4.3%. Rates rose in Delaware, Maryland, and Minnesota, declined in Colorado and Alabama, and were unchanged elsewhere.

States with unemployment rates significantly different from that of the U.S., August 2025, seasonally adjusted

Over the year, Oregon posted the largest increase in joblessness, while Indiana saw the steepest drop. Payroll employment was steady across most states, with Utah adding 8,300 jobs and the District of Columbia losing 5,300. Texas led in annual job creation with 195,600 positions, while South Carolina posted the strongest percentage gain at 3.1 percent. California’s rate remained high at 5.5 percent.

Corporate Earnings Spotlight

The week saw a continued narrative of bifurcation in corporate performance. Adobe (ADBE), for instance, reported stronger-than-expected earnings, driven by robust demand for its creative cloud and enterprise solutions, underscoring the ongoing strength in digital transformation and AI-related spending. This provided a positive boost for the tech sector.

Conversely, some consumer discretionary companies continued to face headwinds. Dollar General (DG), for example, saw its stock decline after issuing a cautious outlook, citing persistent pressure on low-income consumers from higher food and energy prices, as well as reduced discretionary spending. This reinforced the theme of an uneven economic recovery and the challenges faced by retailers catering to budget-conscious shoppers. These contrasting performances highlight the importance of selective investing in the current environment.

Political & Macro Backdrop

The aftermath of the Fed decision also brought renewed focus on fiscal policy debates in Washington, with discussions beginning on the upcoming budget cycle. Geopolitical tensions, particularly in [mention hypothetical region, e.g., Eastern Europe or the South China Sea], continued to simmer, contributing to broader market uncertainty, especially concerning energy prices and global trade flows. The U.S. dollar strengthened slightly against a basket of major currencies, reflecting safe-haven demand and the relative attractiveness of U.S. assets in a volatile global landscape.

The Week Ahead (September 22 to September 28, 2025)

The week ahead will pivot from monetary policy decisions to critical economic indicators, offering fresh insights into the health of the U.S. economy and the ripple effects of the Fed’s recent actions. Key reports on housing, manufacturing, and consumer confidence will shape market expectations and investor sentiment.

Trade Flows and Business Sentiment (Tuesday, September 23)

Two important reports are due on September 23. First, the Bureau of Economic Analysis (BEA) will release the U.S. International Transactions report for Q2 2025 at 8:30 a.m. ET, offering a detailed view of trade in goods and services, income flows, and cross-border financial activity. Markets will be watching to see if the current account deficit is widening or narrowing, as these shifts signal changes in export demand, currency dynamics, and global capital flows.

Later in the day, S&P Global will publish the flash September 2025 PMI readings for both manufacturing and services. These preliminary indicators provide a timely snapshot of economic momentum, with readings above 50 signaling expansion and below 50 indicating contraction. Stronger figures could reinforce the case for economic resilience and temper expectations for deeper rate cuts, while weaker data would support a more dovish outlook.

New Residential Sales (Wednesday, September 24)

Further insights into the housing market will come from the New Home Sales report. The U.S. Census Bureau is scheduled to release August 2025 New Residential Sales data on September 25, 2025, at 10:00 a.m. Eastern Time. This report measures the sales of newly constructed single-family homes. Unlike existing home sales, which reflect secondary market activity, new home sales indicate builder confidence and demand for new construction. A robust showing could point to underlying strength in consumer demand and a healthy construction sector, while a weak report might raise concerns about economic growth.

Durable Goods Order (Thursday, September 25)

Durable goods orders offer a gauge of business investment and consumer spending on long-lasting items, reflecting confidence in the economic outlook. The U.S. Census Bureau will release the preliminary August 2025 Durable Goods Orders report on September 25, 2025, at 8:30 a.m. Eastern Time. This data includes orders for everything from airplanes to appliances. An increase in durable goods orders, particularly in core categories (excluding transportation), would signal healthy business capital expenditures and consumer confidence, whereas a decline could suggest a cautious approach from businesses and consumers.

Outlook

The Fed’s recent rate cut has brought some clarity but also introduced new uncertainties regarding the pace of future easing. While the central bank is leaning towards supporting growth, its commitment to fighting inflation remains firm, creating a delicate balancing act. The upcoming week’s data on housing, manufacturing, and durable goods will be crucial in painting a clearer picture of economic momentum and will likely influence market sentiment and the Fed’s future rhetoric. We anticipate continued market volatility as investors navigate sticky inflation, uneven growth, and the nuanced signals from policymakers.