U.S. Markets Weather Shutdown Uncertainty: Key Highlights and Outlook

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

U.S. markets began the week confronting an unusual mix of political gridlock and weakening economic momentum. The federal government shutdown has frozen key economic reports, leaving investors without their usual data compass and forcing reliance on private surveys and Fed commentary. Confidence remains fragile as signs of a cooling labor market emerge and corporate hiring slows.

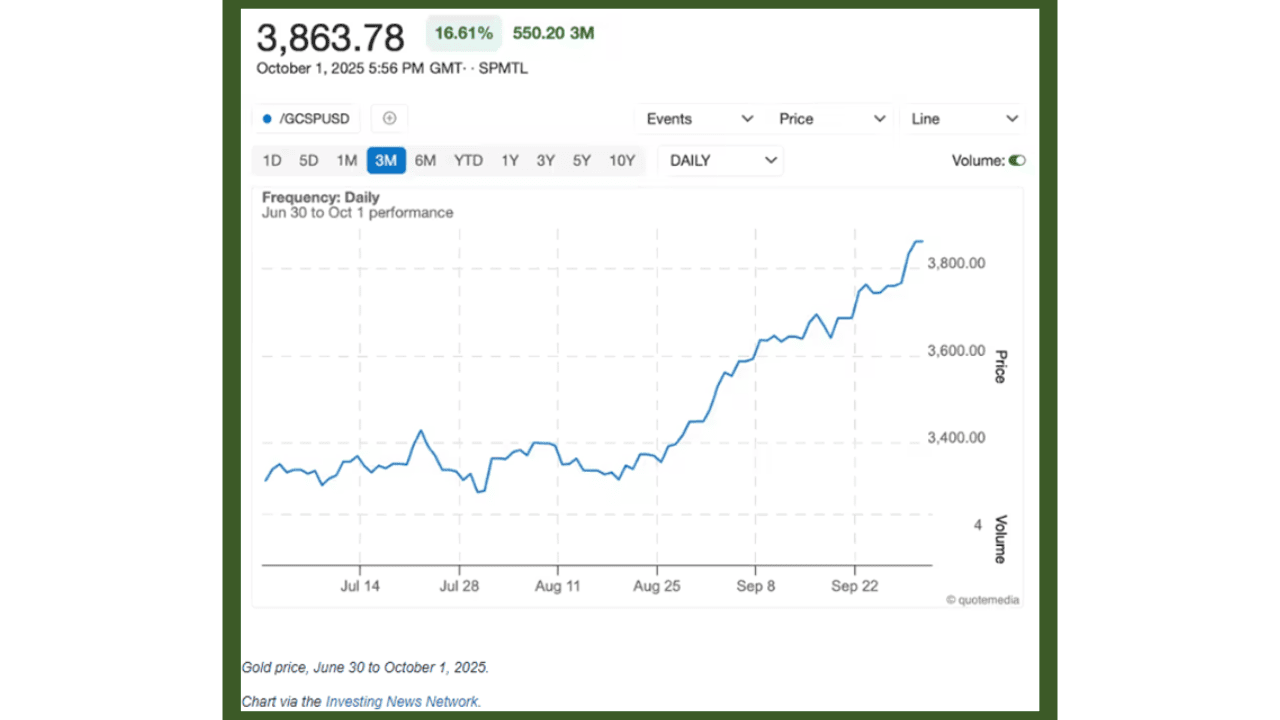

Despite these headwinds, risk appetite has held up so far, supported by hopes for easier policy later this year and the ongoing strength of large-cap technology. At the same time, safe-haven demand is building, with gold extending its rally and Treasury yields swinging as traders struggle to gauge growth and inflation without official data.

The Week That Was (September 29 – October 5, 2025)

Markets opened steady despite hawkish remarks from Fed officials but focus quickly shifted to the risk of a federal shutdown that could freeze key reports such as nonfarm payrolls and CPI. The market is left to rely on private data and alternative inflation trackers, heightening the risk of policy decisions made without a clear economic compass.

Market Sentiment and Tone

Investor sentiment this week balanced political uncertainty with market resilience. Despite the U.S. government shutdown on October 1, the S&P 500 rose 0.81%, the Nasdaq 0.77%, and the Dow 0.97%, led by megacap tech. Gold extended its seven-week rally, climbing about 1.39% for the week to $3,908.9 per ounce, while the U.S. Dollar Index softened. The 10-year Treasury yield settled near 4.19% amid mixed economic signals. Overall, sentiment was cautiously optimistic, though weak labor data and limited government releases highlighted underlying fragility.

Retail Sales Hold Up Amid Data Blackout (Tuesday, September 30)

With the federal shutdown halting key releases, investors turned to private indicators for clues on consumer health. The Redbook Retail Sales report showed a 5.9% year-over-year (YoY) gain for the week ending September 27, offering one of the few timely reads on household spending. Though less comprehensive than official data, the result suggested consumer demand remained steady despite labor softness and rising caution over credit conditions.

Government Shuts Down and Labor Weakness (Wednesday, October 1)

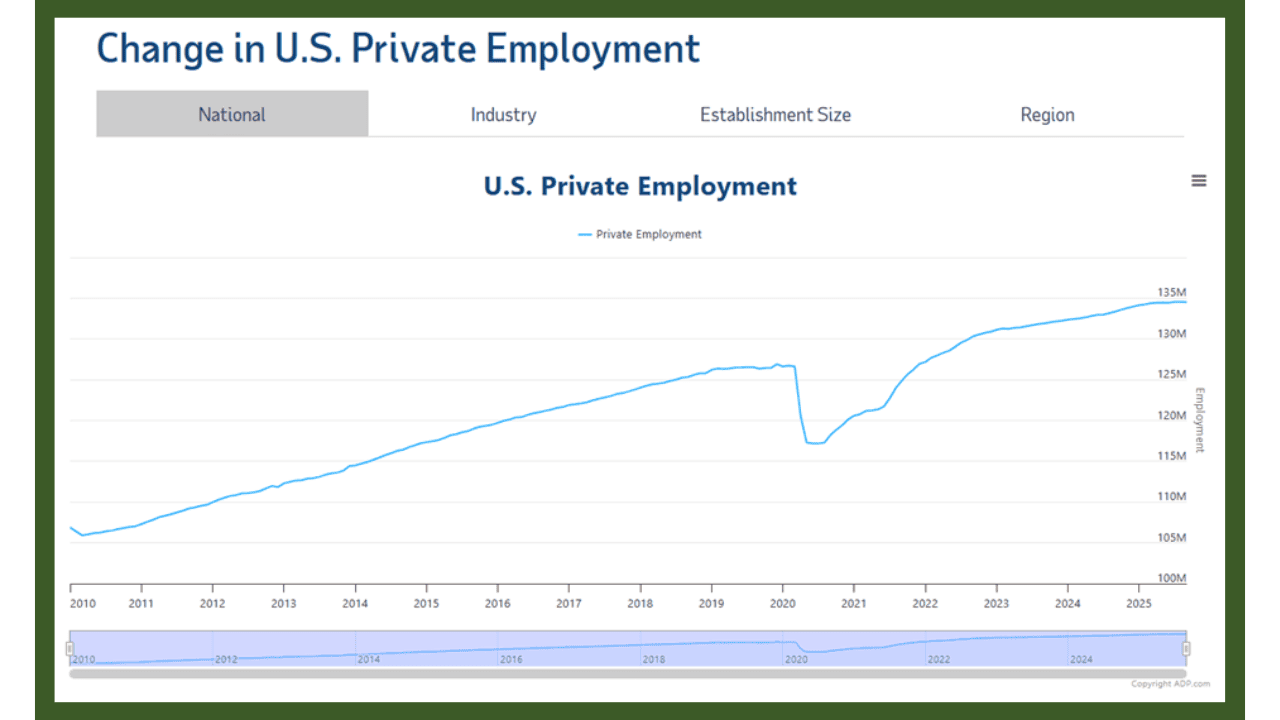

The federal government officially shut down at midnight, halting major economic releases. The ADP National Employment Report revealed a surprise 32,000-job loss in September, driven largely by small and mid-sized businesses, while large firms added 33,000 positions. Unlike past shutdowns that had little growth impact, this one arrives amid clear signs of a cooling labor market, heightening investor uncertainty.

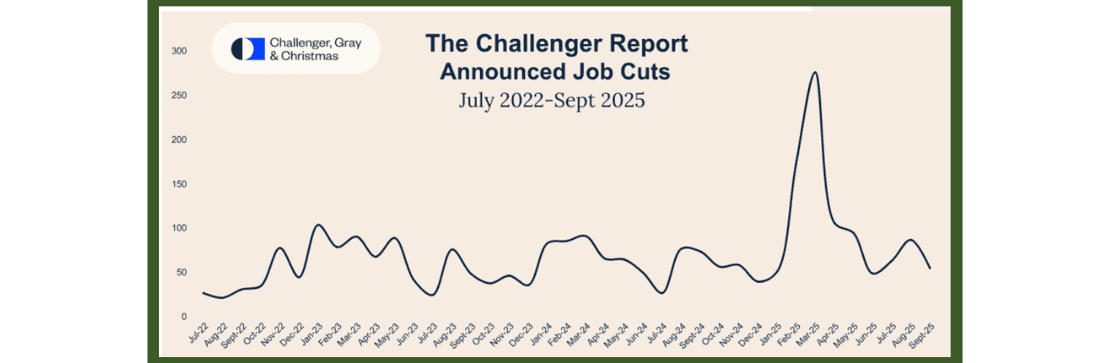

Layoffs Slow but Hiring Plans Collapse (Thursday, October 2)

With official data dark, Challenger, Gray and Christmas reported 54,064 job cuts in September, down 37% from August, but planned hiring for the year fell to 204,939 (the lowest since 2009). The sharp slowdown in hiring reinforced caution about consumer demand heading into the holiday season. Treasury liquidity remained thin, and yields whipsawed as investors reassessed growth.

Corporate Earnings: Mixed but Resilient

Several companies reported results that offered insight into how corporate America is performing amid shifting market conditions.

- Nike (NKE) posted Q1 EPS of $0.49, compared with $0.70 a year ago, a decline of about 30%, though the result slightly exceeded analyst expectations and underscored the brand’s ability to maintain demand.

- Vail Resorts (MTN) reported a Q3 loss of $5.08 per share, compared with a loss of $4.70 in the same quarter last year, as seasonal factors and cost pressures continued to weigh on results.

- Carnival (CCL) reported EPS of $1.43, up from $1.27 a year earlier, supported by firm pricing and strong cruise occupancy.

- Progress Software (PRGS) delivered EPS of $1.50, rising from $1.22in the prior year, showing solid operational execution and disciplined expense control.

- Jefferies (JEF) earned $1.01 per share, above $0.40 in the comparable quarter last year, driven by varied activity across capital markets.

- Paychex (PAYX) posted EPS of $1.22, up from $1.16 a year ago, pointing to steady demand for payroll and HR services.

Global Backdrop Adds to Caution

Beyond the U.S., European PMI readings remained weak and China’s property sector troubles persisted, reinforcing fears of slowing global growth. These concerns drove investors toward gold and Treasuries, boosting safe-haven flows, while the dollar eased on expectations the Federal Reserve may adopt a more cautious stance if worldwide demand weakens further and the U.S. economy continues to lose momentum.

The Week Ahead (October 5 – October 12, 2025)

Markets enter another week shaped by the U.S. government shutdown, which continues to block major economic reports and force investors toward alternative indicators. With traditional data dark, private surveys, corporate earnings, and Fed communication will dominate attention. Volatility may remain elevated, particularly in Treasuries and gold, as traders price growth and inflation without their usual benchmarks.

Capitol Hill Negotiations Dominate Sentiment (Monday, October 6)

The week begins under the shadow of the shutdown, now stretching into a second week. Markets will watch closely for progress toward a funding deal, as each additional day heightens the risk of missed key releases such as September payrolls and CPI. Bond markets may stay thin and volatile, while equities could hold gains if investors sense a path to reopening. Fed officials including Williams and Daly are scheduled to speak, any hint that policy makers are uneasy about the data blackout could sway rate expectations.

Retail Insight Replaces Trade Data (Tuesday, October 7)

Official releases on International Trade in Goods and Services and Services Supplied Through Affiliates will not appear. Instead, investors can focus on the Redbook Retail Sales report for the week ending October 4, due at 8:55 a.m. ET. Though narrower than government retail data, Redbook offers one of the few real-time reads on consumer spending. A strong print could help support risk appetite, while weakness might fuel concern about holiday-season demand and pressure consumer discretionary stocks.

Labor Demand in Focus as JOLTS Delayed (Wednesday, October 8)

The Job Openings and Labor Turnover Survey (JOLTS) will not be released, leaving a gap in understanding labor market churn. Attention will shift to private labor demand trackers, especially Indeed’s Job Postings Index, which updates regularly and can flag turning points in hiring. Treasury yields could swing on any sign that labor demand is cooling faster than expected, reinforcing bets on Fed cuts.

Fed Minutes Missing and Jobless Claims (Thursday, October 9)

The market normally would have digested FOMC September meeting minutes and weekly jobless claims on this day, but both will be delayed. With no official labor or policy color, speeches from Fed governors will take on outsized importance. Bond traders may keep risk hedges in place, while gold could extend gains if policymakers sound uncertain.

Payrolls Postponed; Corporate Signals Fill the Void (Friday, October 10)

The crucial September nonfarm payrolls report will almost certainly be postponed. In its place, investors can rely on corporate earnings calls and sector-level trackers (especially from logistics and retail) to judge real-time employment and consumer demand. Companies such as UPS, FedEx, and large retailers may give indirect clues on labor and holiday spending, potentially driving consumer-linked equities and shaping bond market bets on growth.

Outlook

Markets enter the coming week without key U.S. data as the government shutdown persists, leaving investors reliant on private surveys, corporate earnings, and Fed speeches to gauge conditions. This data gap could fuel volatility and mispricing if alternative indicators surprise. Treasury yields may stay choppy, gold could hold its safe-haven bid, and the dollar may soften if policymakers sound cautious. Corporate commentary, especially from consumer, logistics, and tech companies, will shape views on demand and hiring. With limited clarity, the environment favors flexible positioning, risk management, and close attention to Washington headlines and Fed tone until reliable macro signals return.