Trump’s 2025 Economic Agenda: Market Impact and Investor Insights

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

Introduction

The 2025 economic agenda of President Trump have attracted significant attention in markets this year. With a second term focused on tax reforms, tariffs, and bolstering U.S. manufacturing, investors are eager to understand how campaign promises could translate into real policy and how these policies may impact company profits and stock prices. In this Digest, we review key questions about the potential market effects of Trump’s economic plans, highlighting both the opportunities and risks for investors.

Why did we choose to review President Trump’s 2025 economic agenda in this Digest?

Policy has been highly visible in markets this year. Trump’s second term is centered on tax changes, tariffs, and support for U.S. manufacturing, all areas that can move company profits and stock prices. Our goal is to show how turning campaign talk into policy can drive sector winners and losers, something many investors miss until after prices move.

Do presidential policies really move markets or is that overstated?

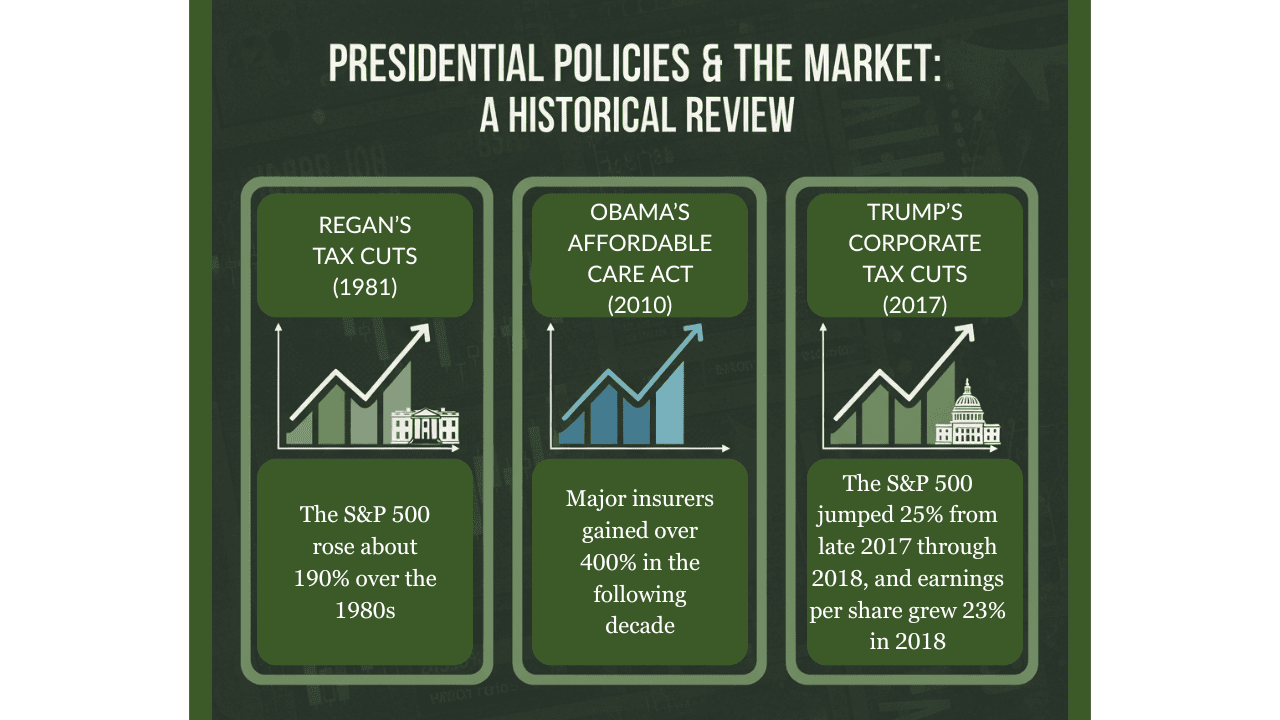

History shows they do. After President Reagan’s 1981 tax cuts, the S&P 500 rose about 190% over the 1980s. When President Obama signed the Affordable Care Act in 2010, UnitedHealth and other major insurers gained over 400% in the following decade. Similarly, when President Trump cut the corporate tax rate from 35% to 21% in 2017, the S&P 500 jumped roughly 25% from late 2017 through 2018, and S&P 500 earnings per share grew 23% in 2018. These examples illustrate that presidential policies can have substantial market impact.

How quickly do markets respond when campaign promises to become real policy?

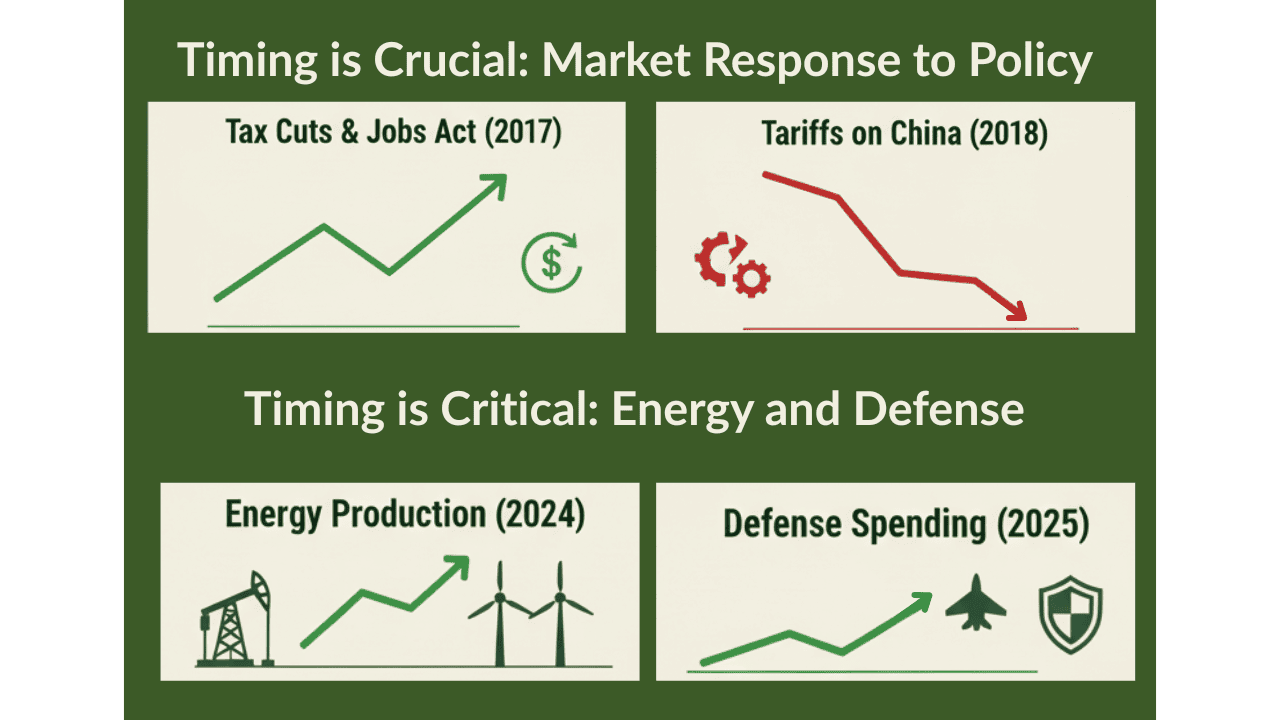

Markets often react within months. Following the 2017 Tax Cuts and Jobs Act, S&P Global reported that S&P 500 companies raised 2018 profit forecasts by 7–8% in a single quarter, and the market rallied almost immediately. Conversely, when tariffs on China were announced in 2018, the Philadelphia Semiconductor Index fell nearly 20% between June and December. Timing is critical: understanding when policy will actually be signed can help investors position themselves to benefit from—or avoid—the resulting market moves.

Which promises have been fulfilled so far and what has that meant for investors?

Several energy and defense policies have already translated into action. U.S. oil production reached a record 13.3 million barrels per day in 2024 after expanded drilling permits and the rollback of methane regulations. This helped the SPDR S&P Oil & Gas Exploration ETF (XOP) rise about 18% over the last 12 months. Defense spending also increased to $895 billion in the 2025 federal budget, supporting defense stocks like Lockheed Martin and Northrop Grumman, which remain near record highs.

Where could unfulfilled pledges create the next opportunity or risk?

Some major campaign promises remain proposals, including middle-class tax cuts, new tariffs on imported autos, and larger incentives for U.S. tech manufacturing. If enacted, these policies could benefit industrial equipment makers, construction materials companies, and U.S. semiconductor manufacturers. However, if they stall in Congress or face legal challenges, investors who moved early could face pullbacks. The key takeaway is to monitor actual policy progress rather than relying solely on campaign speeches.

Conclusion

President Trump’s 2025 economic agenda shows how closely policy decisions can influence market behavior. Investors can benefit by understanding which campaign promises have already been implemented and which remain proposals. Policies in energy and defense have already led to measurable gains in relevant sectors, while proposed measures such as middle-class tax cuts, new tariffs on imported autos, and incentives for U.S. tech manufacturing could create new opportunities or risks depending on their progress through Congress and regulatory processes. Timing and implementation are crucial, as markets often respond quickly once policies are enacted or announced. For investors, the lesson is to focus on actual policy developments rather than relying solely on campaign rhetoric. By tracking policy actions carefully, investors can better identify sectors likely to benefit, avoid potential setbacks, and make informed decisions that reflect the current economic landscape.

Interested in going deeper on the above topics? Our FREE Basic Digest provides 3-5 pages of summarized insights to keep you informed on key themes impacting the market.

Or consider leveling up to our paid Premium Digest. Typically running 15-20 pages long, the Premium Digest goes much deeper on a given theme, expanding on historical precedents and providing a bit of visibility into Calisade's institutional insider trading research.

Calisade's Elite Digest is our institutional grade offering, typically 25-35 pages chock full of charts, graphs, historical insights, and, perhaps most importantly, stock tickers that are directly impacted by these themes.

📩 Click to explore Basic, Premium, and Elite Access and see what top investors are reading.