The Week That Was and The Week That’s Ahead:

Jobs, AI, Retail, and the Signals Driving Market Direction

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

This edition of The Week That Was & The Week Ahead reviews a week shaped by shifting macro signals, cross-asset movements, and sector level developments across the U.S. economy. Market tone reflected a mix of data releases, earnings updates, and broader activity indicators returning to focus. Looking ahead, a concentrated set of economic reports and corporate results pointing to uneven labour-market momentum will help define the narrative into month end.

The Week That Was (November 17-November 23, 2025)

US markets navigated a volatile backdrop last week as cross-asset pressures intensified across crypto, rates, and macro data. The sharp unwinding in digital assets highlighted by Bitcoin’s drop to US $88,522 and more than US $1 trillion in crypto market value erased in recent weeks highlighted the derisking theme. Meanwhile, the long-delayed September jobs report showed a stronger than expected 119,000 payroll gain, but an uptick in unemployment to 4.4%, the highest since 2021, signaled uneven labor market momentum. Combined with uncertainty around the Federal Reserve’s next move, these factors kept investor sentiment fragile even as markets avoided a full shift into risk-off positioning.

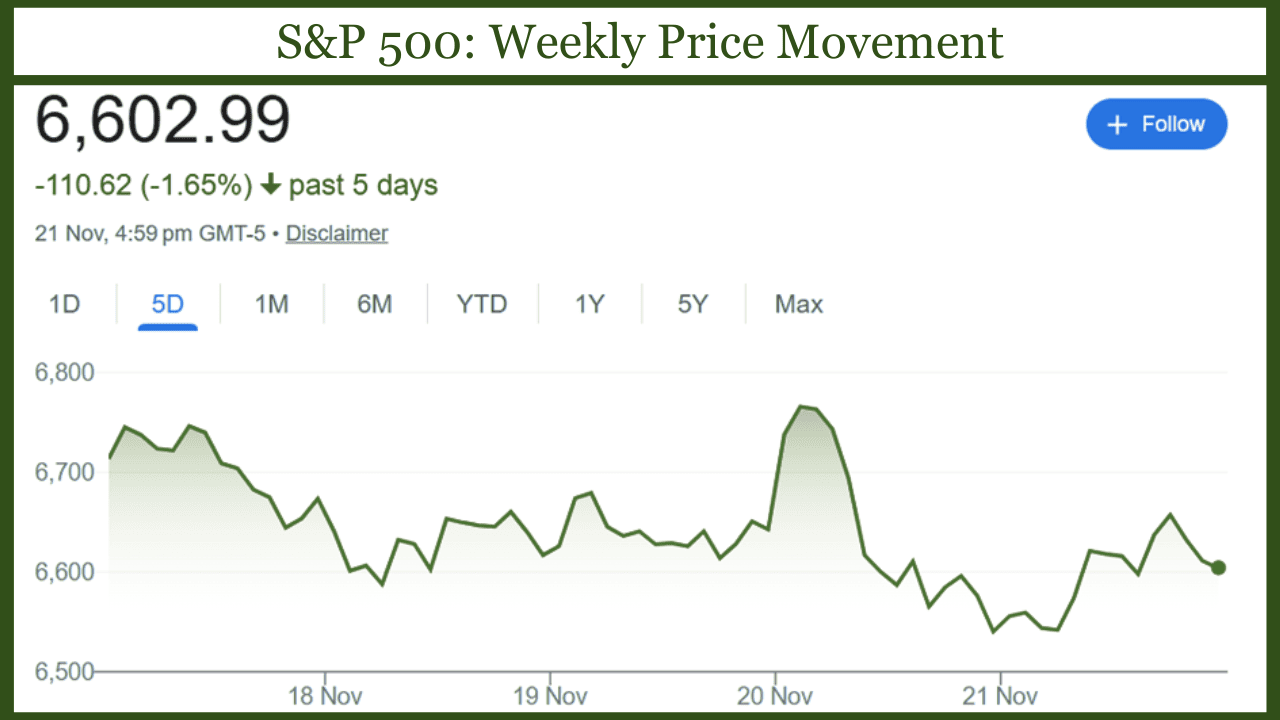

The S&P 500 moved –1.65% over the week. The index opened the week at 6713.61 on November 17 to 6603.65 on November 21. The index briefly saw support following Nvidia’s earnings, but the rebound was short lived as investors continued to trim exposure to richly-valued AI and mega cap technology names. The pullback reflected growing caution over whether heavy AI-related capital spending will convert into sustained earnings growth, alongside broader risk moderation ahead of upcoming economic releases. Nasdaq-100, the AI/mega-cap heavy index declined 2.61% last week. Index opened at 24890.10 on November 17 and moved to 24239.83 on November 21.

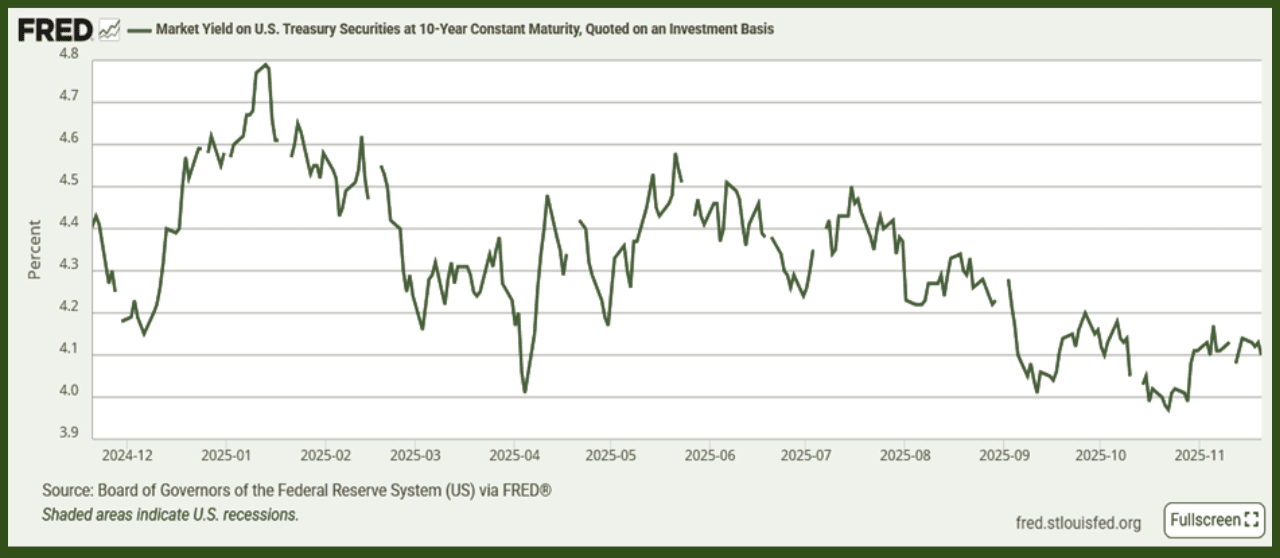

As of November 20, the U.S. 10-year Treasury yield hovered near 4.10%, holding within its recent range as markets digested mixed signals from the latest U.S. jobs report and evolving Fed expectations.

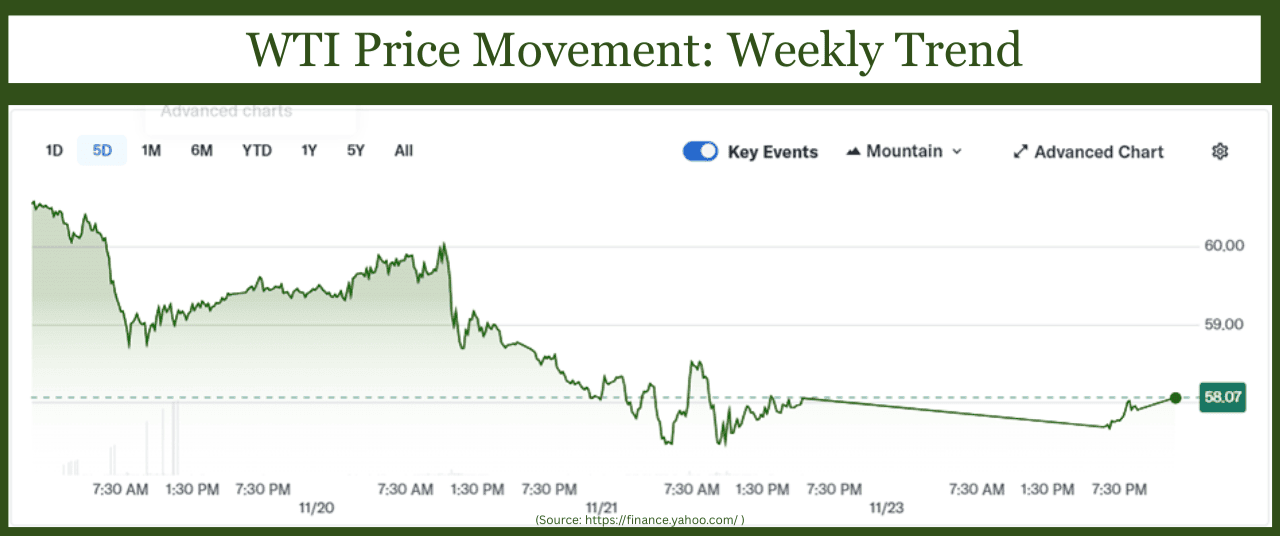

WTI Crude Oil traded slightly weaker, moving in a tight $59-$60 per barrel range before slipping toward roughly $58.06 per barrel by Friday. The decline was mild compared to two-week-ago levels but kept prices notably lower on a year-over-year basis, with crude still trading nearly 18% below levels seen a year ago.

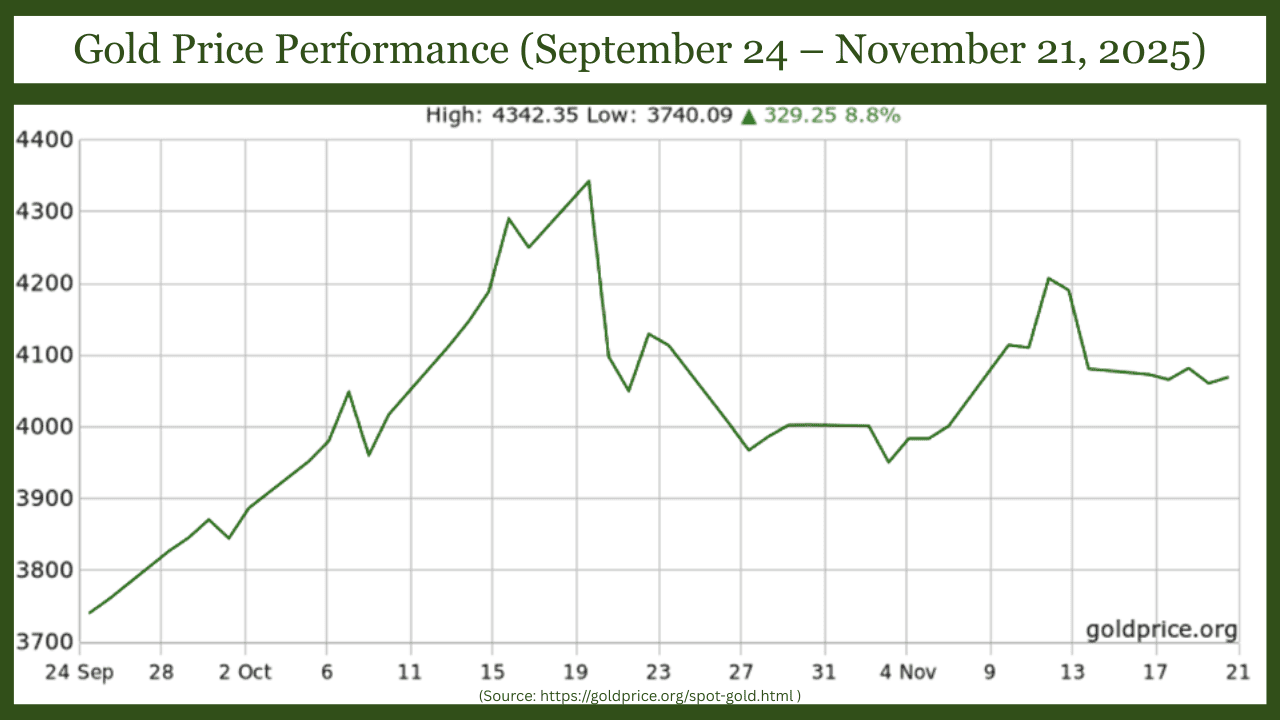

Gold moved 0.16% for the week, moving from $4,070.00 per ounce on November 17 to $4076.70 per ounce by November 21. Mid-November commentary notes that gold continues to trade above $4,000 per ounce, supported by safe-haven demand and expectations of medium-term rate cuts by the Federal Reserve, even as the U.S. dollar shows recent signs of strengthening.

The key earnings releases last week came from NVIDIA, Walmart, and Home Depot, offering important signals across AI infrastructure, retail spending, and home-improvement demand. NVIDIA reported about $57 billion in revenue, driven by roughly $51 billion from data-center sales and guided to $65 billion next quarter, underscoring strong demand for Blackwell-powered AI infrastructure. The print briefly triggered a global tech relief rally, though broader concerns around stretched AI valuations kept the Nasdaq on the defensive later in the week. Walmart posted 4.5% U.S. comparable sales growth and $179.5 billion in revenue, raised full year guidance, and announced a move to Nasdaq, signaling confidence ahead of the holiday season. Home Depot reported $41.4 billion in Q3 revenue and trimmed full year EPS guidance as slower housing turnover weighed on big ticket demand.

The Week Ahead (November 24 - November 30, 2025)

The upcoming week brings a mix of key economic releases and sector-diverse earnings that will help shape market sentiment after recent volatility. With delayed government data slated to resume and multiple indicators covering growth, inflation, and household demand, investors will be watching the macro calendar closely. Corporate updates across tech, retail, industrials, and mobility will further refine expectations heading into month-end.

Dallas Fed survey: Retail Data Expected this Week (Monday, November 24)

The week opens with the Dallas Fed Manufacturing Survey, which is scheduled for release on Monday. The delayed U.S. Retail & Food Services Sales report for September is expected sometime this week, but no specific date has been published yet due to backlog from prior reporting delays. Markets will watch the release closely as consumer-spending indicators have regained focus following recent volatility in tech and crypto.

Earnings span industrials, software, and clean energy, with Agilent, Zoom, Keysight, Symbotic, Semtech, Fluence Energy, WeRide, and Corporación América Airports offering updates on enterprise tech spending, robotics rollout, semiconductor demand, biotech research budgets, EV/autonomous development, and airport traffic. Consumer signals may come from Central Garden & Pet Co. and other retail-linked names, helping assess discretionary demand.

Consumer confidence and housing data take focus (Tuesday, November 25)

Tuesday brings key macro indicators including U.S. Consumer Confidence, the National Association of Realtors (NAR) Pending Home Sales Index, and regional activity readings from the Richmond Fed Manufacturing Index and the Dallas Fed Texas Retail Outlook Survey, giving a clearer read on household sentiment, housing momentum, and regional demand conditions.

Earnings lean heavily toward enterprise technology and retail, with updates from Alibaba, Dell, Workday, Zscaler, NetApp, Autodesk, Nutanix, and Analog Devices offering insight into cloud budgets, cybersecurity spending, and semiconductor demand. Consumer and holiday-season signals will come from DICK’s Sporting Goods, Best Buy, Urban Outfitters, Abercrombie & Fitch, and Kohl’s, while NIO, Arrowhead Pharmaceuticals, and Banco BBVA Argentina add colour on EV adoption, biotech progress, and Latin American credit conditions.

Growth, spending, and trade releases cluster mid-week (Wednesday, November 26)

Wednesday is currently expected to feature a dense macro calendar, with several key U.S. releases provisionally scheduled for that day, including the GDP Second Release, Personal Income & PCE Deflator, Advance Durable Goods Orders, and the Advance International Trade in Goods report, a combination that offers a comprehensive read on economic growth, inflation pressures, and capex/trade momentum. Additional indicators such as New Residential Sales, the Philadelphia Fed Non‑Manufacturing Survey, and the Corporate Bond Market Distress Index are also slated for release, providing further insight into housing, services demand, and credit conditions. Given recent reporting delays and ongoing schedule revisions, markets are likely to treat these timings as tentative until they are officially confirmed by the respective agencies.

Earnings remain lighter but focused on mobility, industrials, and energy. Updates from Deere & Co., Li Auto and EHang will help gauge demand for agricultural machinery, EV and autonomous aviation progress.

Light calendar as week nears close (Thursday, November 27)

Thursday is the Thanksgiving holiday in the US. Thus there are no major scheduled U.S. macro releases and no notable corporate earnings on the day. With limited fresh catalysts, market direction may largely depend on positioning into month-end and spillover effects from the heavy data and earnings earlier in the week.

Limited catalysts to end the week (Friday, November 28)

Friday has a light corporate calendar, with Spire Global among the few U.S.-based firms reporting, offering updates tied to satellite data and logistics tracking. With no major scheduled U.S. macro releases, market moves may largely reflect end-of-week positioning rather than new information.

Outlook

This week showed how quickly market sentiment can shift when crypto volatility, mixed economic data, and uneven earnings all hit at the same time. Even with strong results from major tech names, investors stayed cautious as questions around growth, employment, and the Fed’s next move remained unresolved. As we head into a data-heavy week, the market narrative will continue to be shaped by how consumers are spending, how inflation is trending, and whether corporate guidance holds up. Overall, it’s a period where staying flexible and data-driven matters more than ever.