The Week That Was and The Week That’s Ahead:

Yields, Equities, Commodities, and the Indicators Shaping December

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

In this weekly edition, we review key market developments from the past week across equities, commodities, and macro indicators, highlighting how investor sentiment evolved amid shifting policy expectations. We also outline major data releases, earnings announcements, and policy events to watch in the coming week that could influence market direction and sector performance.

The Week That Was (November 24-November 30, 2025)

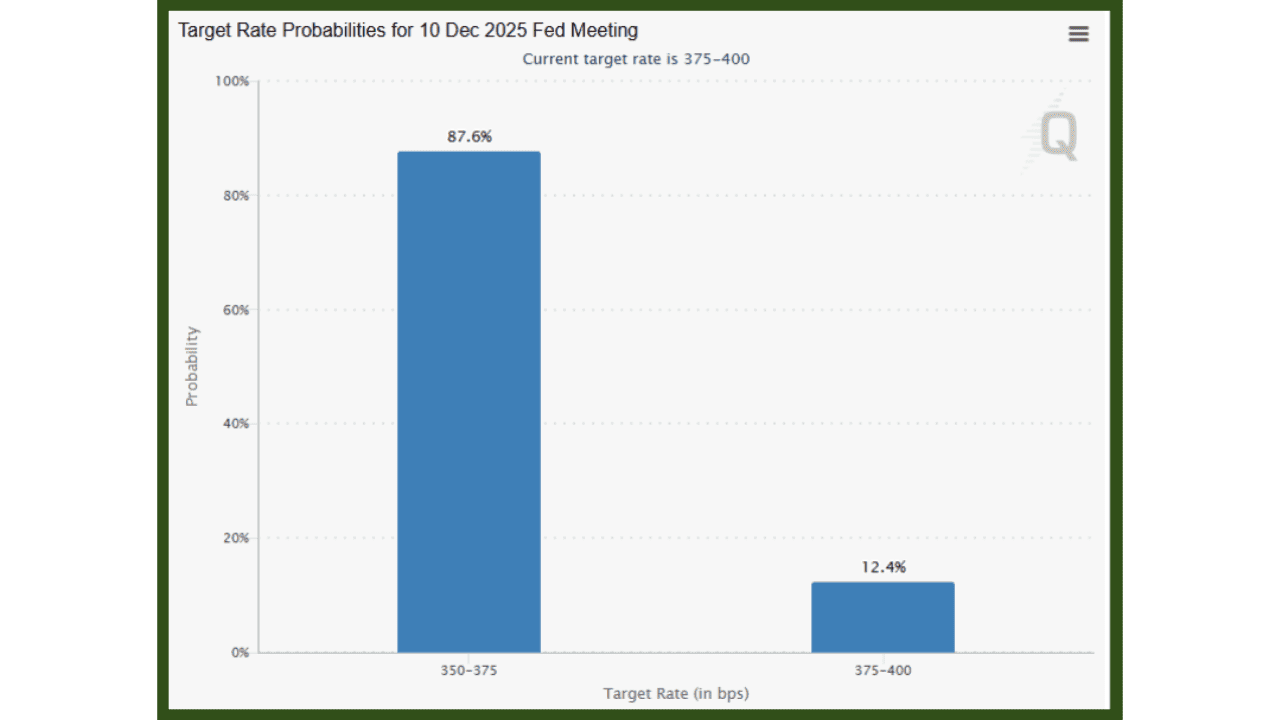

U.S. markets ended last week (November 24 to November 30, 2025) on a strong note as optimism around a near-term Federal Reserve rate cut fueled a broad rebound in risk assets. Investor sentiment improved after a volatile start to November, with dovish Fed commentary and easing Treasury yields lifting appetite across equities, commodities, and precious metals. Rate-cut odds for December climbed above 85%, helping offset lingering concerns over consumer softness and rich AI-driven valuations.

Despite a shortened Thanksgiving week and a temporary CME Group outage that briefly froze global futures trading, equities rallied as traders rotated back into technology and growth sectors.

The S&P 500 rose 3.20% last week, climbing from 6,636.54 on November 24 to 6,849.09 by November 28, marking its strongest Thanksgiving-week performance since 2008. The Nasdaq Composite advanced 3.92%, led by mega-cap technology names like Alphabet and Tesla, which surged on renewed AI optimism and semiconductor expansion commentary.

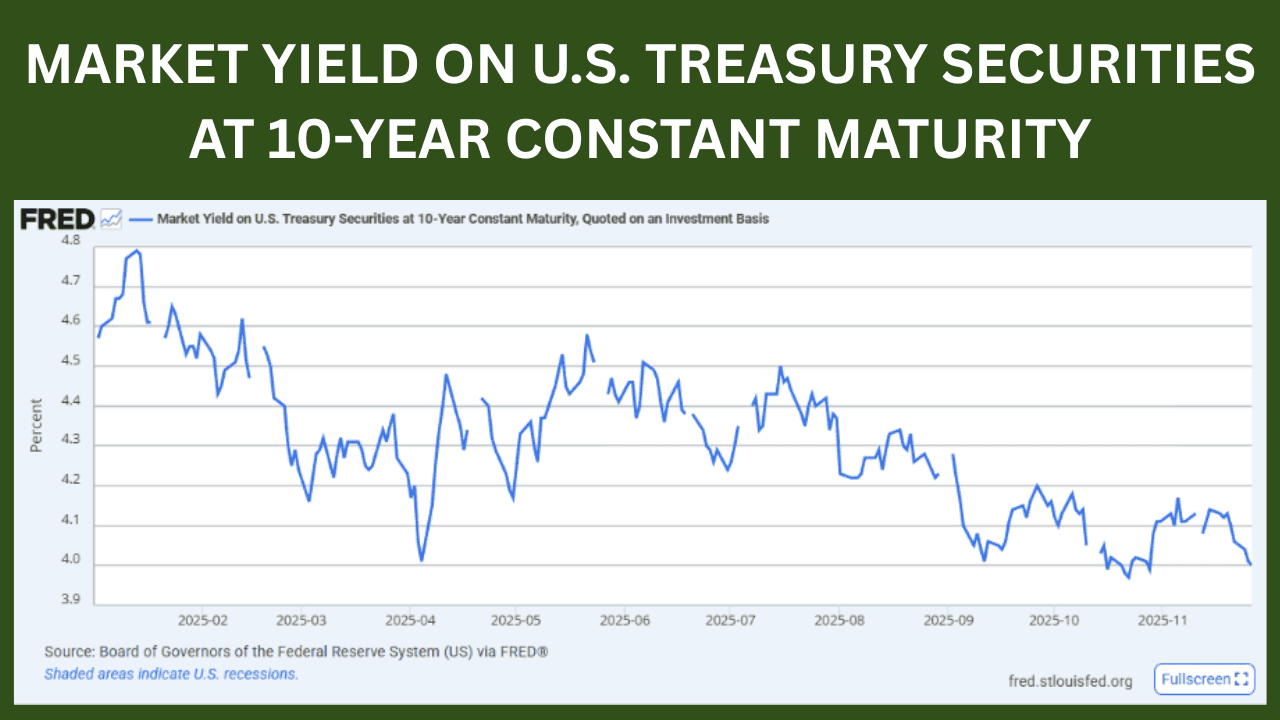

The U.S. 10-year Treasury yield eased to around 4.00% by November 26, 2025, its lowest level in nearly a month, as investors grew increasingly confident that the Federal Reserve would deliver a rate cut at the upcoming December 9-10th FOMC meeting. The move followed dovish commentary from multiple Fed officials and softer macro data that reinforced expectations of an imminent policy shift. The decline in yields provided a supportive backdrop for equities, driving renewed buying across cyclical and growth sectors. However, despite the broader risk-on tone, market breadth remained narrow, with gains concentrated in large-cap technology and AI-linked names.

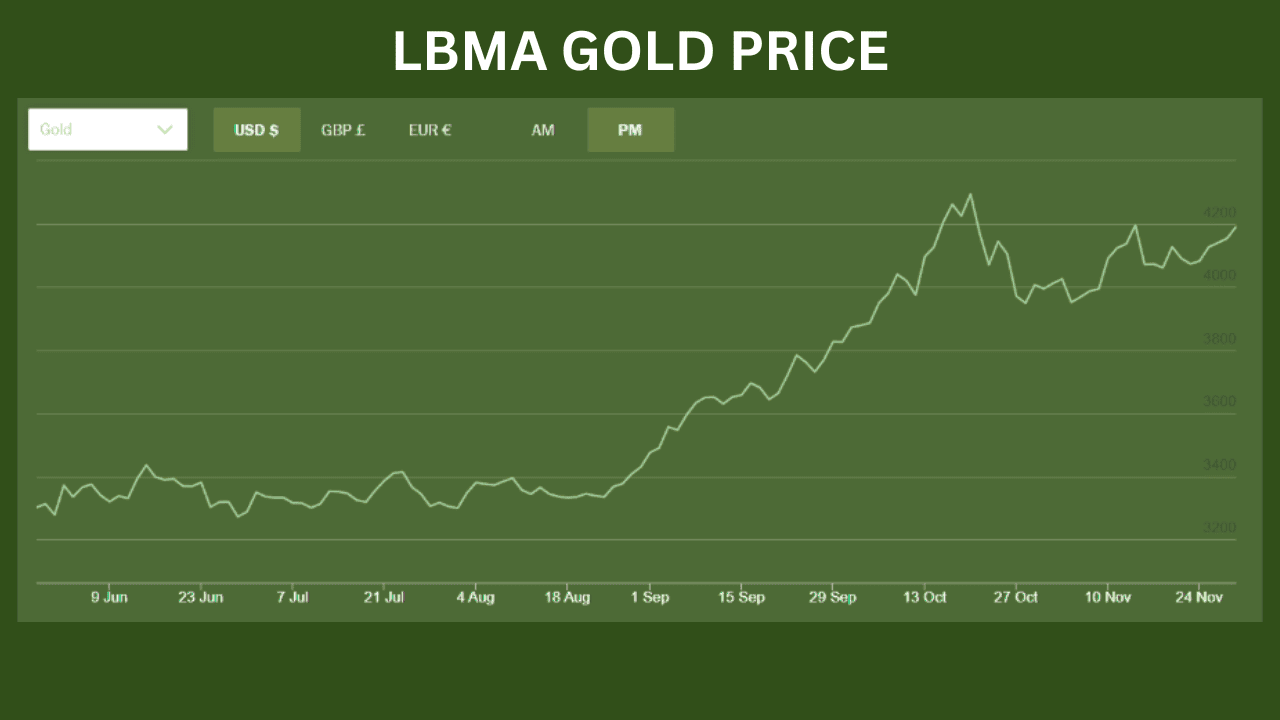

Gold extended its steady upward trend last week, advancing 3.03% as investors sought safe-haven exposure amid market disruptions and dovish rate expectations. Prices moved from $4,067.95 per ounce on November 24 to $4,191.05 by November 28, marking their strongest weekly performance since early October. According to Reuters, bullion climbed to a two-week high as traders increased bets on a December Federal Reserve rate cut, while a brief CME trading outage on November 28 prompted additional safe-haven demand. The rally was further supported by a softer U.S. dollar and easing Treasury yields, which lowered the opportunity cost of holding non-yielding assets. Gold has now logged four consecutive monthly gains, reflecting growing investor conviction that U.S. monetary policy will shift toward easing in early 2026.

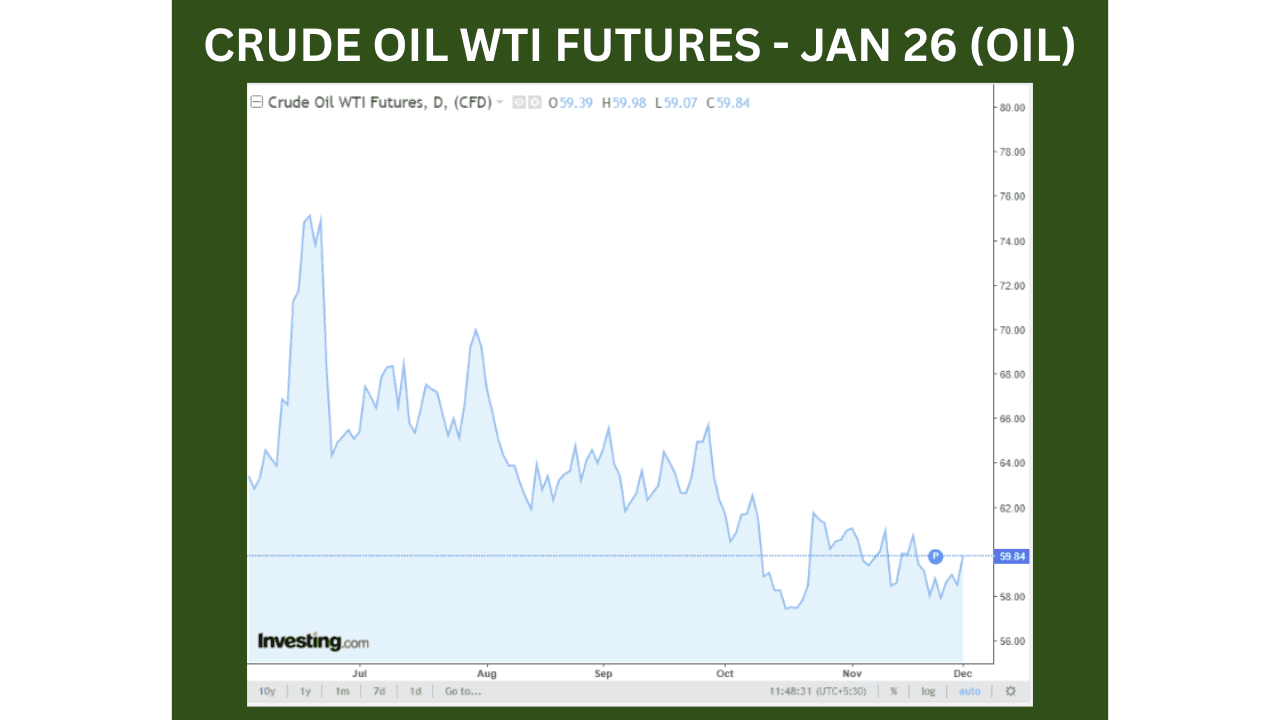

WTI crude oil also ended higher last week, gaining 0.86% over the period as front-month January 2026 futures rose from an opening level of $58.05 per barrel on November 24 to $58.55 per barrel on November 28, after touching an intra-week high of $59.64. The rebound was supported by improved sentiment and mild inventory drawdowns, though prices finished the week slightly below midweek highs amid persistent oversupply concerns.

Earnings releases last week further reinforced diverging sectoral trends. Zscaler reported a 26% year-over-year revenue increase in its fiscal first quarter, surpassing consensus estimates and lifting full-year guidance, reflecting strong cybersecurity spending amid rising AI adoption. However, retail and consumer-focused companies painted a more cautious picture. Many large U.S. retailers signaled reduced pricing power ahead of the holiday season, emphasizing promotions and discounting strategies to sustain demand. This restraint reflects sensitivity to cooling real income growth and persistent caution in household spending, suggesting a gradual deceleration in consumer momentum heading into early 2026.

Taken together, last week’s market action revealed the delicate balance between easing expectations and concerns about the durability of the AI trade and related valuations. The strong rebound across equities underscores investors’ willingness to lean risk-on while the Fed’s tone remains dovish, but the persistent dominance of a few mega-cap names continues to raise concerns about a concentrated market. The steady climb in gold highlights renewed hedging activity and signals quiet caution beneath headline optimism. Energy markets showed tentative stabilization, but weak consumer commentary tempers the growth outlook.

The Week Ahead (December 1 – December 5, 2025)

The upcoming week brings a packed macroeconomic calendar, with key releases across manufacturing, services, labor markets, and consumer sentiment. Given recent backlogs from the US government shutdown and renewed data-flow, investors will be watching for fresh signals on growth, inflation, demand, and labor conditions. These data points could meaningfully impact expectations for industrial activity, consumer demand and interest rates.

ISM manufacturing, early trade and labor data (Monday, December 1)

The week opens with the release of the ISM Manufacturing PMI for November at 10:00 a.m. ET. A strong PMI (above 50) would suggest the US manufacturing sector is stabilizing or expanding, a positive sign for industrial demand, commodity cycles, and corporate earnings in sectors linked to production and materials.

Labor market, services activity and broader macro data (Wednesday, December 3)

Mid-week brings the ADP National Employment Report (private-sector payrolls), as well as the ISM Non‑Manufacturing PMI (services sector activity), both due around 08:15 and 10:00 a.m. ET, respectively. These releases will provide a snapshot of hiring trends and service-sector momentum, vital for gauging consumer demand and overall economic health.

Consumer sentiment and labor market overview (Friday, December 5)

At the end of the week, the University of Michigan Consumer Sentiment Index will publish its preliminary December reading at 10:00 a.m. ET. This measure captures how households view the economy, their finances, and future prospects. Given recent inflation pressures and lingering macro uncertainty, our attention will focus on whether sentiment improves or deteriorates with implications for consumption, retail, and interest-rate expectations.

Earnings Reports Calendar (Dec 1–5, 2025)

- December 1, 2025 — CRDO is scheduled to report earnings before market open.

- December 2, 2025 — CRWD is scheduled to report after market close.

- December 2, 2025 — MRVL is also expected to report earnings this day.

- December 3, 2025 — CRM is scheduled to report.

- December 3, 2025 — SNOW also has an earnings report scheduled.

- December 4, 2025 — CHPT appears on the expected earnings list for this date.

Outlook

Frequently Asked Questions (FAQs)

1. Why did U.S. markets rally last week?

Markets moved higher mainly because investors grew more confident that the Federal Reserve may cut rates in December. Falling Treasury yields, dovish Fed commentary, and strong performance from large-cap tech stocks all contributed to the rebound.

2. What caused Treasury yields to fall below 4%?

Yields dropped as softer economic data and Fed officials' comments signaled that monetary policy may ease soon. Lower yields typically boost equities by reducing borrowing costs and supporting risk appetite.

3. Why did gold prices rise even while stocks were gaining?

Gold strengthened as investors looked for safety during the CME outage and amid broader uncertainty. A weaker dollar and rate-cut hope also supported prices.

4. What key data should investors watch this week?

ISM Manufacturing, ADP employment, ISM Services, and Consumer Sentiment will guide expectations for growth, inflation, and the December FOMC path.