The Week That Was and The Week That’s Ahead: Yields, Equities, and Fed Expectations Moving into Year-End

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

“The Week That Was & The Week That’s Ahead” is a weekly market brief highlighting major economic data, policy developments, and corporate earnings shaping investor sentiment. It summarizes the most important events from the past week and outlines key catalysts to watch in the week ahead helping readers stay informed and prepared for upcoming market moves.

The Week That Was (December 15-December 19, 2025)

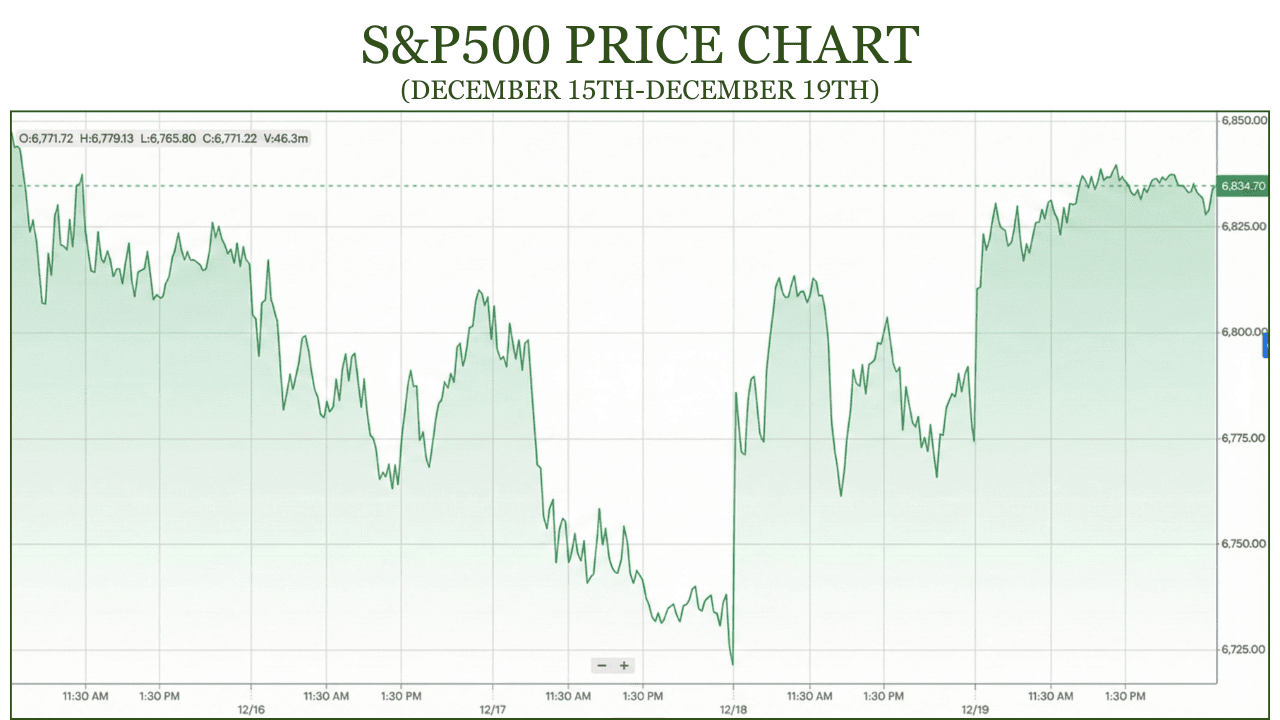

Last week, the S and P 500 declined by 0.37 percent, opening at 6,860.19 on Monday and closing at 6,834.50 on Friday. Trading throughout the week was choppy, with rallies repeatedly met by profit taking following the market’s recent advance. Mid-week weakness was driven by a pullback in technology stocks, as investors locked in gains in some of the strongest year to date performers. Late week buying helped the index recover from its mid-week lows, but the rebound was insufficient to offset earlier declines, leaving the S&P 500 modestly lower on a weekly basis.

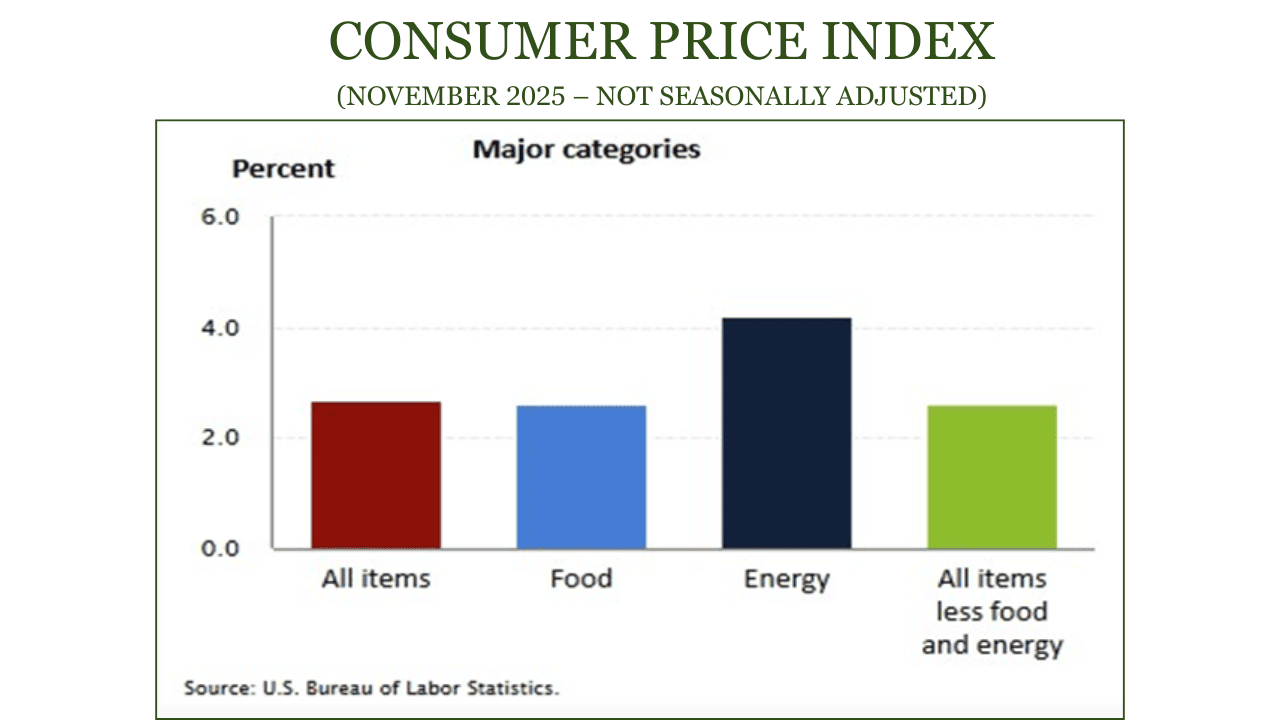

According to the November CPI report, headline inflation rose about 2.7% YoY (year over year), while core CPI increased roughly 2.6%, remaining above the Federal Reserve’s target. Energy inflation stood out as the strongest component, rising approximately 4.2% YoY, reflecting continued volatility in fuel and utility prices. The seasonally adjusted index for all items less food and energy rose 0.2% over the 2 months ending in November. This pattern indicates that disinflation is progressing, though unevenly, with goods prices easing faster than services. The persistence of services inflation suggests a gradual return to price stability and implies that further progress will likely require some softening in labor market and demand conditions, reinforcing the Fed’s incentive to keep policy restrictive for longer even as headline inflation trends lower.

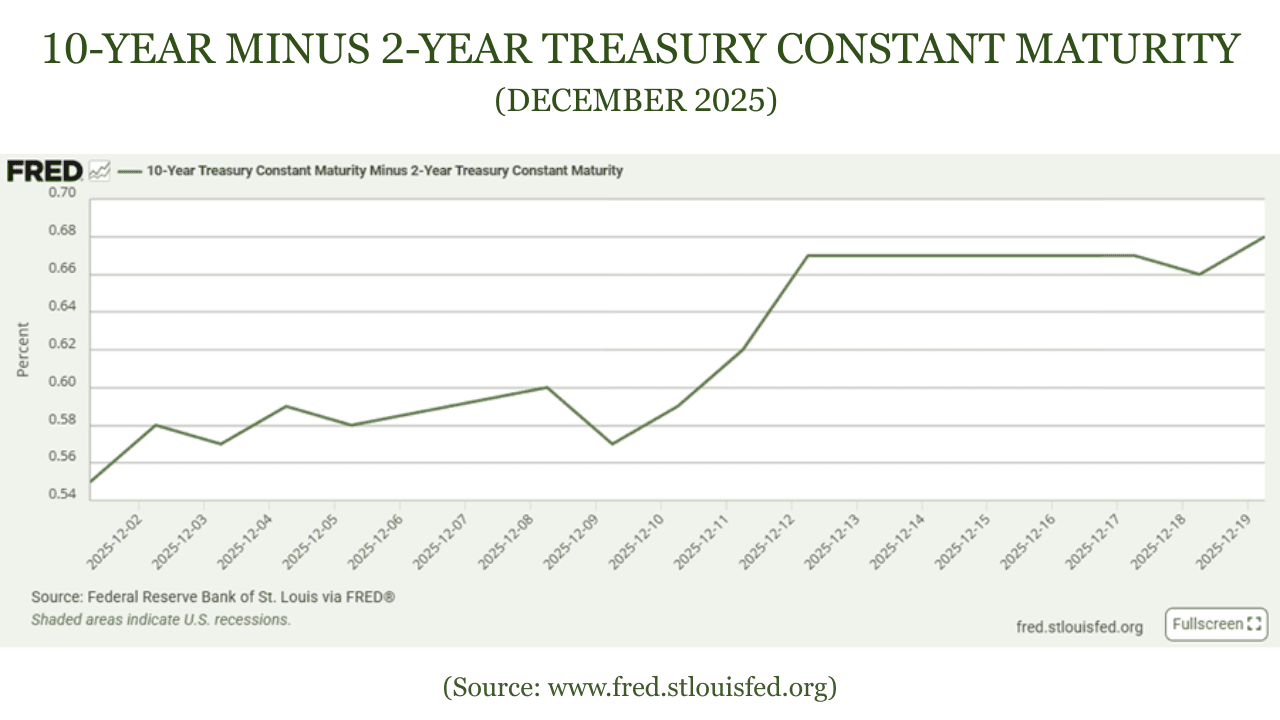

In fixed income markets, Treasury yields moved in a mixed fashion. The 10-year yield was largely stable before edging higher late in the week, while shorter dated yields drifted lower following the rate cut, resulting in a modest steepening of the yield curve. The move suggests investors are reassessing recession risks and the policy outlook for 2026 rather than pricing an imminent easing cycle.

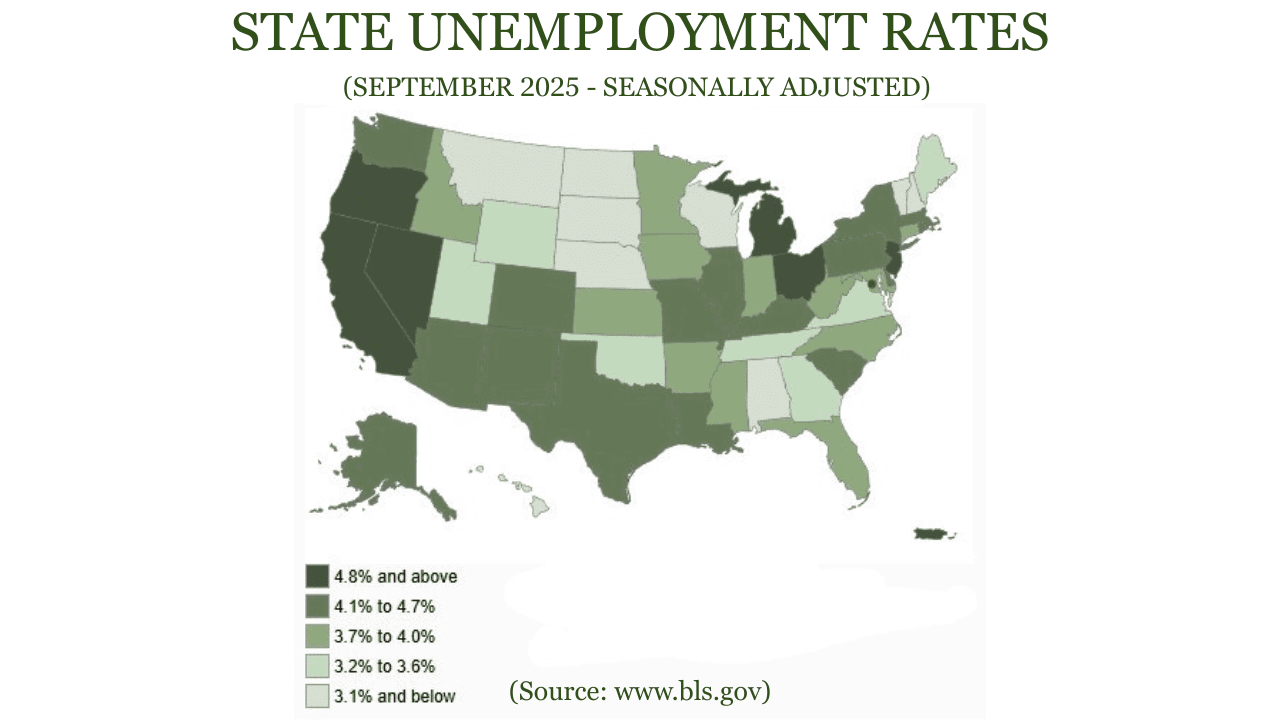

US labor market data for November point to a continued but orderly slowdown. Total nonfarm payroll employment increased by a modest 64,000 and has shown little net change since April, while the unemployment rate stood at around 4.6% (November 2025). Job growth was concentrated in health care and construction, while federal government employment continued to decline.

Wage growth moderated in real terms, with real average hourly earnings for all employees increasing 0.8% YoY, reflecting a 3.5% rise in nominal average hourly earnings offset by a 2.7% increase in headline CPI.

From December 2024 to March 2025, gross job gains from opening and expanding private sector establishments totaled 7.4 million, while gross job losses from closing and contracting establishments amounted to 7.2 million, leaving net job creation modest. The near balance between gains and losses underscores ongoing labor market churn and confirms that underlying hiring momentum remains subdued.

Across the recent earnings calls, results broadly reflected a late cycle but resilient operating environment. Micron Technology delivered the most bullish update, driven by strong AI and data center memory demand with tight supply supporting margins. Accenture beat expectations but struck a cautious tone on forward growth despite strong AI bookings. FactSet posted steady subscription led growth with reaffirmed guidance, while Jabil showed improving margins and confidence from infrastructure and healthcare demand. On the consumer side, Nike beat earnings but faced margin pressure, Darden Restaurants highlighted resilient traffic and value driven demand, CarMax pointed to mixed auto demand trends, General Mills showed stable packaged food demand, and Conagra Brands reported softer volumes but maintained guidance. In services and transport, FedEx raised guidance on operational improvements, Cintas delivered another clean beat with raised outlook, Paychex showed steady payroll and HR growth, and Carnival Corporation stood out with strong bookings, higher yields, and a dividend reinstatement.

The Week Ahead (December 22– December 26, 2025)

As markets head into the Christmas week and the final stretch of the year, we wish all our readers a Merry Christmas and a peaceful holiday season. Trading conditions are expected to be thinner as investors shift into year end mode, but a concentrated set of US economic releases still has the potential to influence short term market sentiment. With positioning largely in place, the focus will be on whether incoming data reinforces a steady growth narrative or introduces fresh uncertainty.

US Gross Domestic Product Q3 2025 Initial Estimate and Preliminary Corporate Profits - (Tuesday, December 23)

The first official estimate of third quarter GDP will provide a comprehensive snapshot of US economic momentum, covering consumption, investment, government spending, and trade. Released alongside the GDP report, preliminary corporate profits will offer an early read on margin trends and earnings durability. Together, these data points are closely watched for their implications on equity valuations, credit conditions, and Federal Reserve policy expectations.

US Durable Goods Orders for November - (Tuesday, December 23)

Durable goods orders will give insight into business investment trends and demand for long lived manufactured products. Investors will focus on core capital goods as a proxy for corporate confidence and forward looking industrial activity, particularly in an environment of elevated financing costs and disciplined capital spending.

US Consumer Confidence for December - (Tuesday, December 23)

The December consumer confidence reading will help assess household sentiment heading into year end. This indicator plays an important role in shaping expectations for consumption, discretionary spending, and labor market resilience as inflation dynamics and interest rate expectations continue to evolve.

Richmond Fed Manufacturing Index for December - (Tuesday, December 23)

The Richmond Fed manufacturing index provides a regional view of activity across new orders, employment, and pricing pressures. While narrower in scope, it contributes to near term growth sentiment and helps frame the broader outlook for US industrial momentum.

Outlook

As we move into the Christmas week and the final days of the year, we wish all our readers a Merry Christmas and a peaceful holiday season. Markets appear to be settling into a period of consolidation, with disinflation progressing unevenly, labor market momentum cooling without a sharp downturn, and policy expectations increasingly focused on 2026. With markets entering a holiday shortened week, trading volumes are typically lighter and participation from institutional desks is reduced, leading to thinner liquidity and more muted follow through.

Frequently Asked Questions (FAQs)

1. What were the main drivers of market performance last week?

Market performance was driven by inflation data, Treasury yield movements, labor market signals, and corporate earnings. Investors balanced signs of ongoing disinflation with persistent services inflation while reassessing expectations for Federal Reserve policy heading into year-end.

2. Why did Treasury yields move in a mixed pattern during the week?

Treasury yields reflected shifting views on economic growth and the longer-term policy outlook. Shorter-dated yields edged lower, while longer-term yields moved higher late in the week, suggesting investors are looking beyond near-term data toward 2026.

3. What did the latest inflation data signal about the Federal Reserve’s policy path?

Inflation data showed progress in lowering headline inflation, but uneven improvement across categories. Sticky services inflation suggests the Fed may keep policy restrictive for longer, even as overall inflation trends lower.