The Week That Was and The Week That’s Ahead:

Yields, Equities, and Fed Expectations Moving into Year-End

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

“The Week That Was & The Week That’s Ahead” is a weekly market brief that highlights key economic events, policy developments, and major corporate earnings shaping investor sentiment. It recaps the most important news from the past week and outlines what to watch in the days ahead, helping readers stay informed and prepared for upcoming market moves.

The Week That Was (December 1st-December 5th, 2025)

The S&P 500 ended the week slightly higher, gaining 0.85% to close near 6,870.40, just below its record high. The index opened around 6,812.30 and recovered late in the week, supported by renewed optimism that the Federal Reserve could begin cutting rates in early 2026. Market sentiment improved as traders increased bets on policy easing following softer economic data. Technology and communication services stocks led the gains, reflecting continued confidence in AI-driven growth sectors, while overall equities held firm amid mixed economic signals and modestly higher Treasury yields ahead of the Fed’s final meeting of the year.

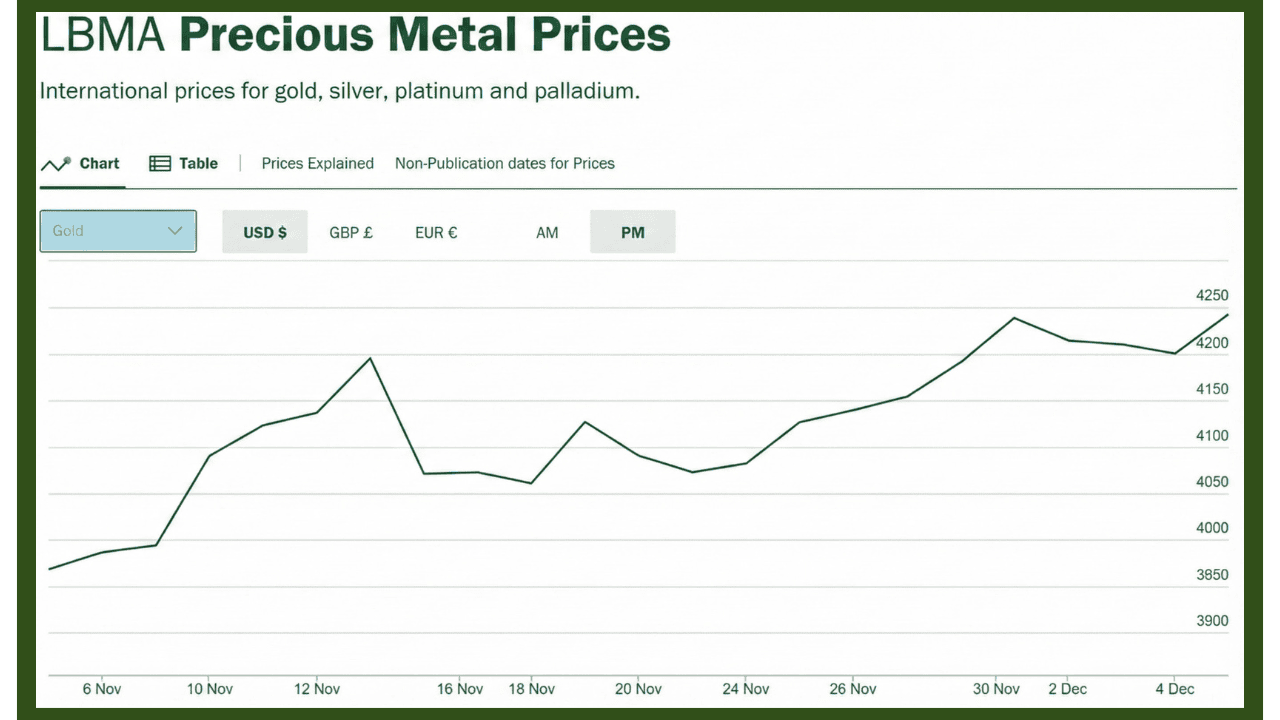

Gold edged lower over the week, slipping 0.26% to close near $4,243.00 per ounce, down from $4,254.10 at the start of the week. The slight pullback came as U.S. Treasury yields firmed and the dollar strengthened, reducing demand for non-yielding assets. Even if real rates remain low, expectations of less aggressive rate cuts and rising nominal yields tend to dampen investor appetite for gold, which offers no income return.

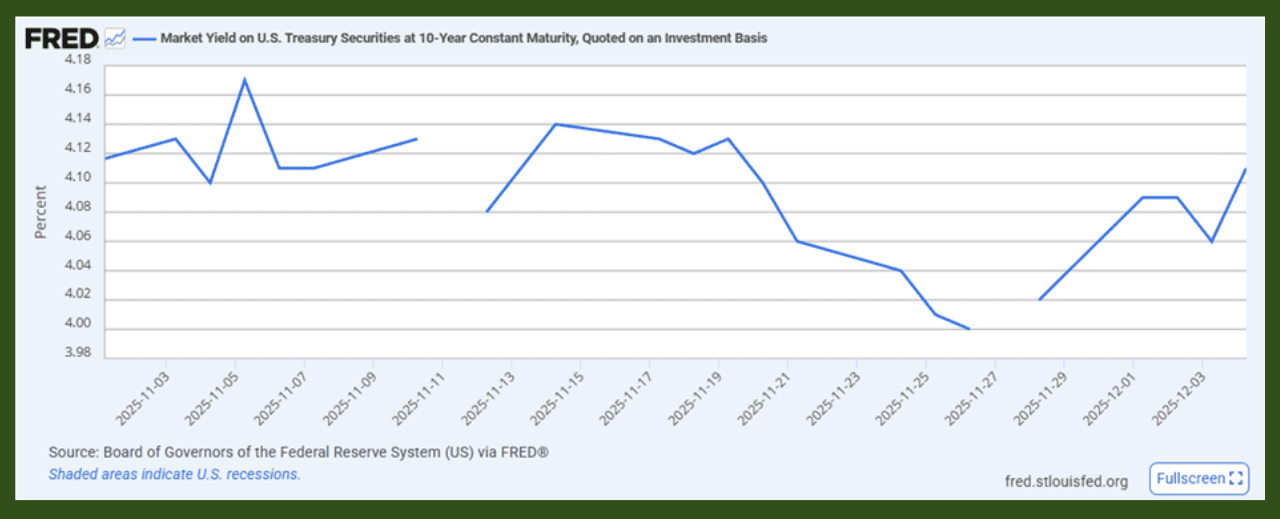

The 10-year U.S. Treasury yield inched higher during the week, rising from 4.09% on December 1 to 4.11% by December 4, reflecting modest upward pressure in long-term borrowing costs.

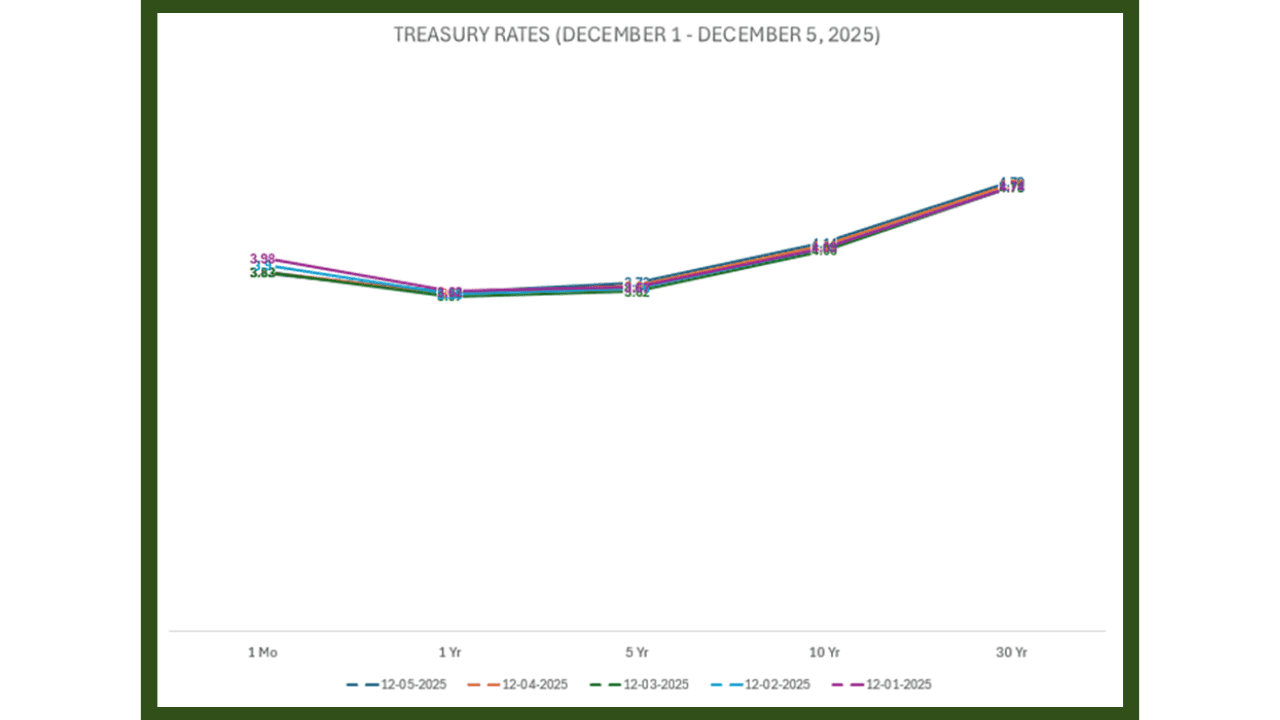

As of the close on December 5, 2025, U.S. Treasury yields showed a slightly upward-sloping curve, with the 1-year yield at 3.61% and the 10-year yield at 4.14%, based on end-of-day bond market data. The modest steepening came as investors demanded higher compensation for holding longer maturities. Yields moved higher during the week as markets priced in expectations of rising government borrowing and heavier Treasury issuance, driven by fiscal needs and AI-related infrastructure spending. Concerns over debt sustainability and a higher term premium added upward pressure on long-term rates, while profit-taking and portfolio repositioning ahead of key central bank meetings led to additional selling in Treasuries, lifting yields across the curve.

Economic data released last week offered a mixed view of U.S. momentum. The ISM Manufacturing PMI slipped to 48.2 in November from 48.7 in October, marking a ninth straight month of contraction and highlighting weakness in new orders and factory employment. In contrast, the ISM Services PMI edged up to 52.6, showing the service sector remains the economy’s main source of stability even as hiring slows.

Labor indicators added to concerns about cooling growth. The ADP National Employment Report showed a loss of 32,000 private-sector jobs in November, largely among small and mid-sized firms, reflecting tighter credit conditions and cautious hiring. The University of Michigan Consumer Sentiment Index fell to 51.0 from 53.6, as high borrowing costs and living expenses weighed on household outlooks heading into the holiday season.

Corporate earnings were concentrated in large-cap technology names. CrowdStrike (CRWD) reported strong quarterly results, with revenue and earnings exceeding expectations on continued demand for its AI-driven cybersecurity platform. Marvell Technology (MRVL) also delivered an earnings beat, supported by robust growth in data-center and AI infrastructure demand. Salesforce (CRM) posted better-than-expected results and raised its outlook, reflecting resilient enterprise-software spending and growing adoption of its AI-focused offerings.

Overall, the data painted an economy losing some steam but not stalling. Manufacturing and labor weakness contrasted with resilient services and solid tech earnings. Markets remained steady, with equities firm, and yields slightly higher as investors awaited the Fed’s final 2025 policy meeting for confirmation of an early-2026 rate-cut path.

The Week Ahead (December 8 – December 12, 2025)

The upcoming week features a high-impact mix of central bank decisions, labor-market data, and heavyweight corporate earnings. As investors look to close out 2025, attention will center on the Federal Reserve’s final policy meeting of the year and its implications for expected rate-cut timing in 2026. Alongside that, a dense lineup of tech and consumer earnings will test the durability of U.S. economic momentum and the market’s confidence in the AI-led growth narrative.

Labor Market Indicators and Wage Pressure (Tuesday, December 9)

The Job Openings and Labor Turnover Survey (JOLTS) for October 2025 will be released on Tuesday, December 9, at 10:00 a.m. ET. The report will offer valuable insight into hiring trends, voluntary quits, and labor market tightness, all key indicators feeding into the Federal Reserve’s inflation outlook. A continued decline in job openings would point to easing labor demand and moderating wage growth, strengthening the case for a potential policy pivot early in 2026. Conversely, an unexpected rise in openings could complicate the Fed’s easing narrative and can drive Treasury yields higher.

Wage Growth and Fed Policy Focus (Wednesday, December 10)

Wednesday begins with the release of the Employment Cost Index (ECI) for the third quarter of 2025 at 8:30 a.m. ET. The ECI, which tracks wages and benefits across industries, remains one of the Fed’s most watched indicators of structural inflation. Softer wage data would confirm that cost pressures are normalizing and support the case for rate cuts in early 2026.

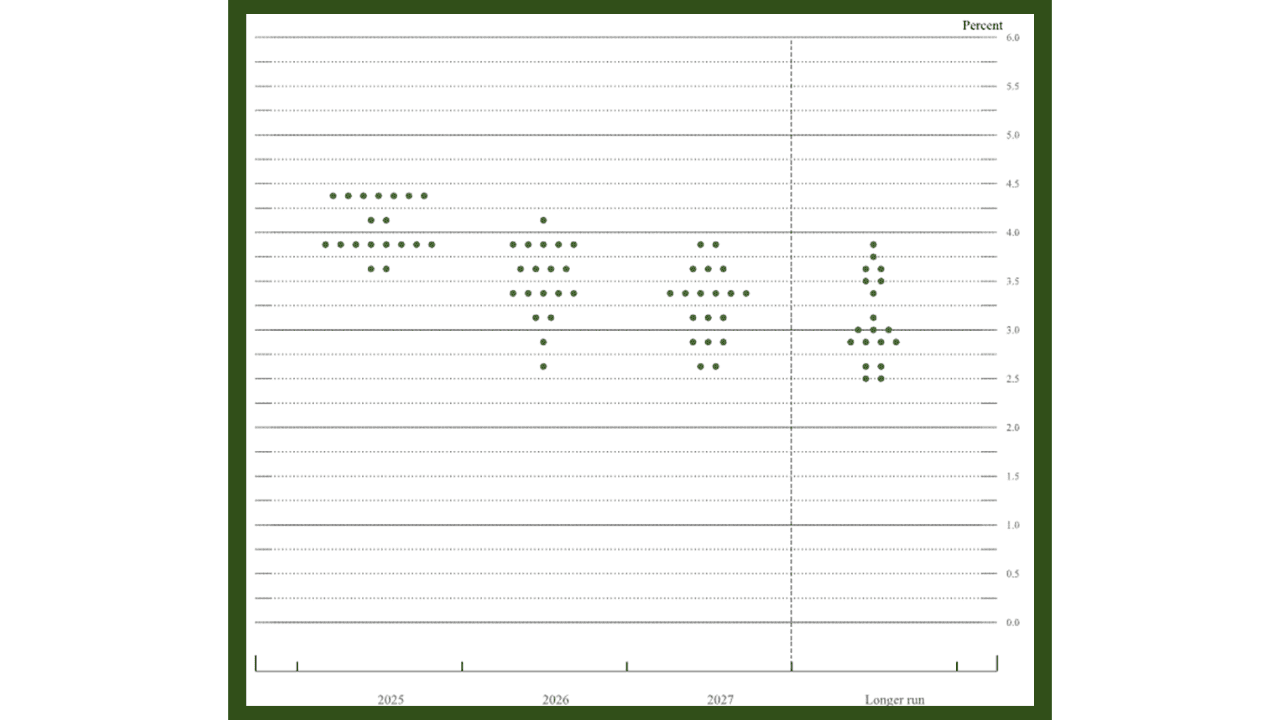

Later in the day, the Federal Open Market Committee (FOMC) will conclude its two day policy meeting with a rate decision scheduled for 2:00 p.m. ET. This is the final Fed announcement of the year and is expected to shape market positioning heading into 2026. While policymakers are widely expected to keep rates unchanged, investors will be watching closely for any indication that the central bank is preparing to begin cutting rates in the coming months. The tone of Chair Powell’s statement will be crucial, as markets look for confirmation that inflation is on a sustainable path lower and that the Fed is confident enough to pivot toward easing. Any hint of dovish language could lift equities and bonds, while a more cautious stance may temper expectations for early rate cuts.

FOMC Participants' Assessments of Appropriate Monetary Policy(Monetary Policy Report – June 2025)

Regional Employment Conditions (Thursday, December 11)

On Thursday, the Bureau of Labor Statistics will release the State Employment and Unemployment Report for September 2025, at 10:00 a.m. ET. Although not a market-moving data point, this report helps investors understand regional economic strength and employment concentration in key sectors such as manufacturing, construction, and real estate. Persistent weakness in high-cost housing states or industrial centers could reinforce the Fed’s cautious tone on growth.

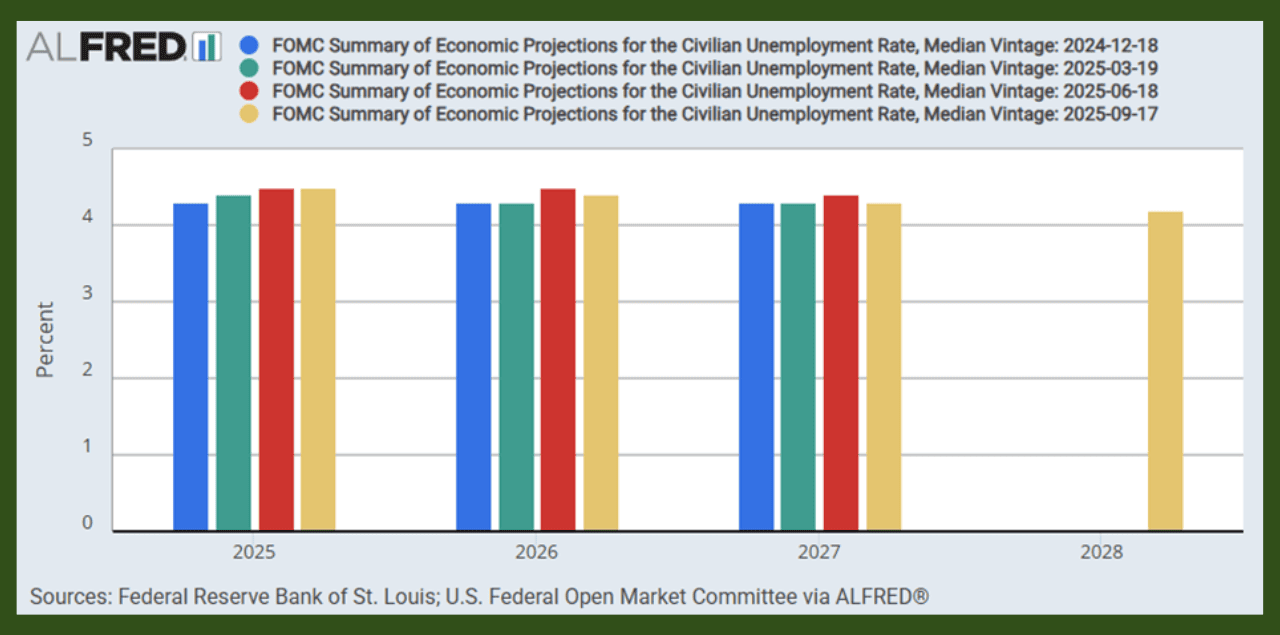

FOMC Summary of Economic Projections, September 2025

Earnings Reports Calendar (December 8 – December 12, 2025)

The corporate earnings slate this week includes several major names across technology, semiconductors, and retail. Each company’s results will offer meaningful insight into late 2025 demand trends and investor sentiment heading into the new year.

Adobe Inc. (ADBE) — December 10, 2025

Adobe is scheduled to report after market close. The company’s fourth quarter results are expected to highlight continued progress in its generative AI platform: Firefly and the monetization of AI features across Creative Cloud and Document Cloud.

Synopsys Inc. (SNPS) — December 10, 2025

Synopsys will also report on Wednesday. As a leader in electronic design automation software used in AI chip development, its outlook will provide a key read on semiconductor design activity and hyperscaler investment trends.

Oracle Corporation (ORCL) — December 10, 2025

Oracle is expected to announce results after the close, as confirmed by the company’s investor relations page. Markets will focus on growth in AI database adoption and cloud infrastructure revenue, both central to Oracle’s transformation strategy.

Broadcom Inc. (AVGO) — December 11, 2025

Broadcom will report after market close on Thursday. As a major supplier of AI accelerators and networking components, Broadcom’s performance will be a key indicator of enterprise technology spending and data center demand.

Costco Wholesale Corporation (COST) — December 11, 2025

Costco will also report Thursday. Its results will provide a timely look at consumer resilience heading into the holiday season and how household budgets are adjusting to elevated price levels.

Outlook

This week stands at the intersection of policy direction and corporate execution. The Fed’s message on December 10 will likely dominate short-term market sentiment, but corporate updates from AI-oriented firms such as Adobe, Synopsys, Oracle, and Broadcom will shape how investors view long-term productivity gains.

If labor-market indicators confirm softening wage pressures and the Fed hints at future easing, equity markets could extend their rally into year-end. Conversely, hawkish commentary or inflation persistence could trigger short-term volatility, particularly in rate-sensitive technology and consumer stocks.

Investors should brace for elevated movement midweek as monetary, labor, and earnings signals converge in one of the most consequential trading weeks of late 2025Conclusion

Overall, the past week set the tone for more data-driven market movement, with investors responding quickly to shifts in economic indicators and forward-looking commentary. As we move into a dense week of releases, the focus remains on how growth, inflation, and policy expectations evolve and how these signals translate into sector-level opportunities and risks.

Staying anchored to fundamentals while tracking near-term catalysts will be essential as markets navigate the final stretch of the year.

Frequently Asked Questions (FAQs)

1. What were the main factors driving markets last week?

Markets were influenced by slight gains in equities, modestly higher Treasury yields, and mixed economic data. Tech-sector earnings and expectations of early-2026 Fed rate cuts helped support overall sentiment.

2. Why did Treasury yields rise during the week?

Yields moved higher due to expectations of increased government borrowing, heavier Treasury issuance, and a higher term premium demanded by investors. Portfolio repositioning ahead of central bank meetings also contributed.

3. Which economic indicators signaled cooling U.S. momentum?

The ISM Manufacturing PMI remained in contraction at 48.2, the ADP report showed a loss of 32,000 jobs, and consumer sentiment declined. These pointed to softening growth, despite resilience in services.