U.S. Markets Stay Resilient Amid Shutdown as AI Optimism and Earnings Drive Gains

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

U.S. markets navigated a volatile but broadly constructive week, balancing uncertainty from the ongoing federal government shutdown with concerns over President Trump’s announcement of a “massive increase” in tariffs on Chinese imports. Investor sentiment was bolstered by resilient corporate earnings and renewed enthusiasm in AI and semiconductor stocks, highlighted by AMD’s partnership with OpenAI, which helped offset political and trade-related headwinds.

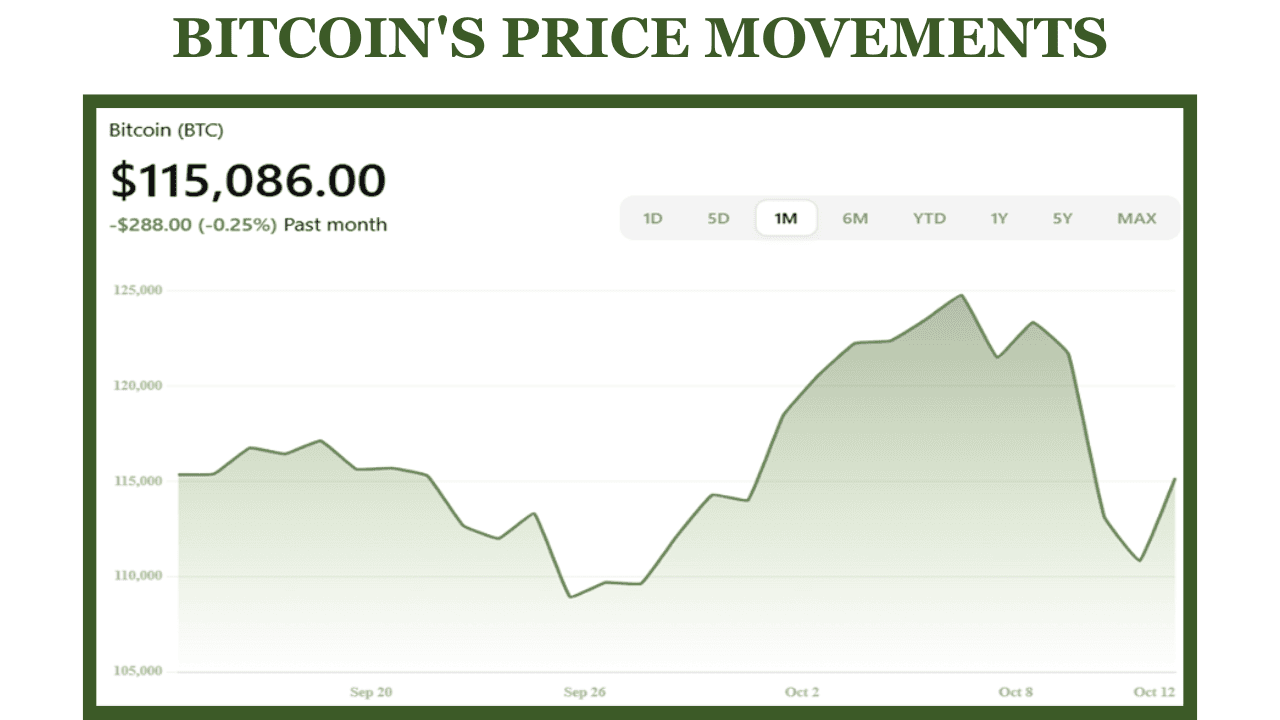

Safe-haven assets such as gold and Treasuries fluctuated amid tariff fears and economic uncertainty, while Bitcoin experienced heightened volatility as investors debated its role as a potential hedge against geopolitical and fiscal risks. With official economic releases largely frozen, markets relied on private inflation measures, Fed commentary, and corporate guidance to gauge momentum. Despite thinner liquidity and persistent policy noise, confidence in a gradual shift toward easier monetary policy remained; reinforcing expectations that rate cuts could materialize before year-end.

The Week That Was (October 6 – October 12, 2025)

The second week of October was defined by resilient market sentiment despite ongoing political gridlock and the continued U.S. government shutdown. With official economic data largely frozen, investors leaned on private indicators and early corporate results to gauge momentum. AI-related optimism, steady consumer spending, and improving corporate updates helped offset uncertainty in fiscal negotiations. Broader risk appetite held firm, reflecting growing confidence that the economy remains on a soft-landing path even amid policy and data disruptions.

Market Sentiment & Tone

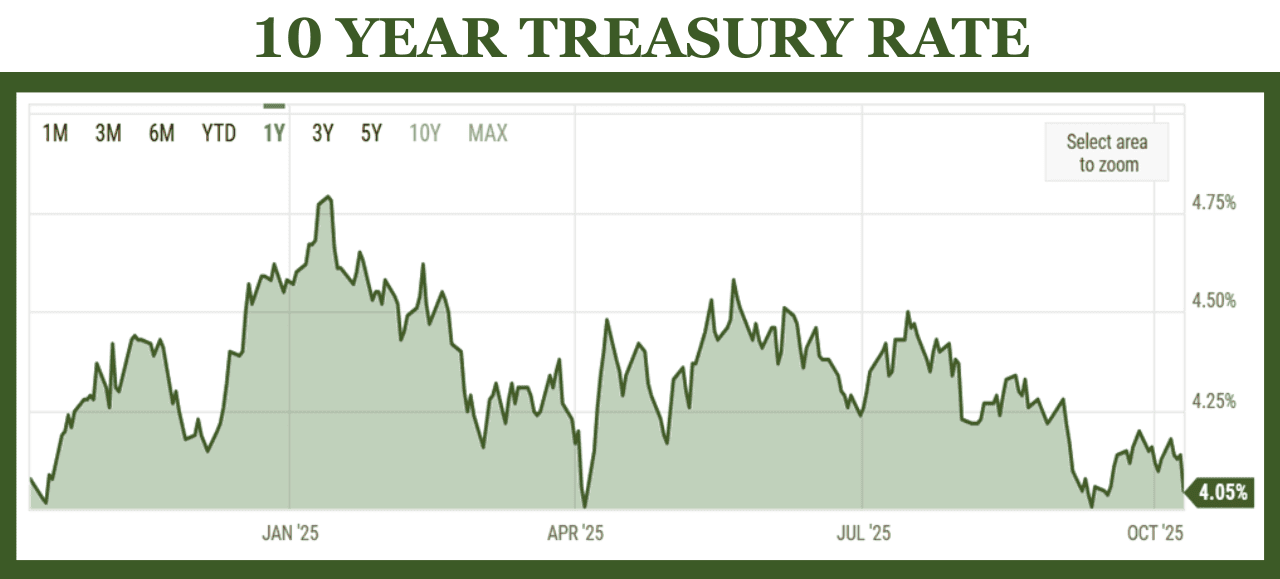

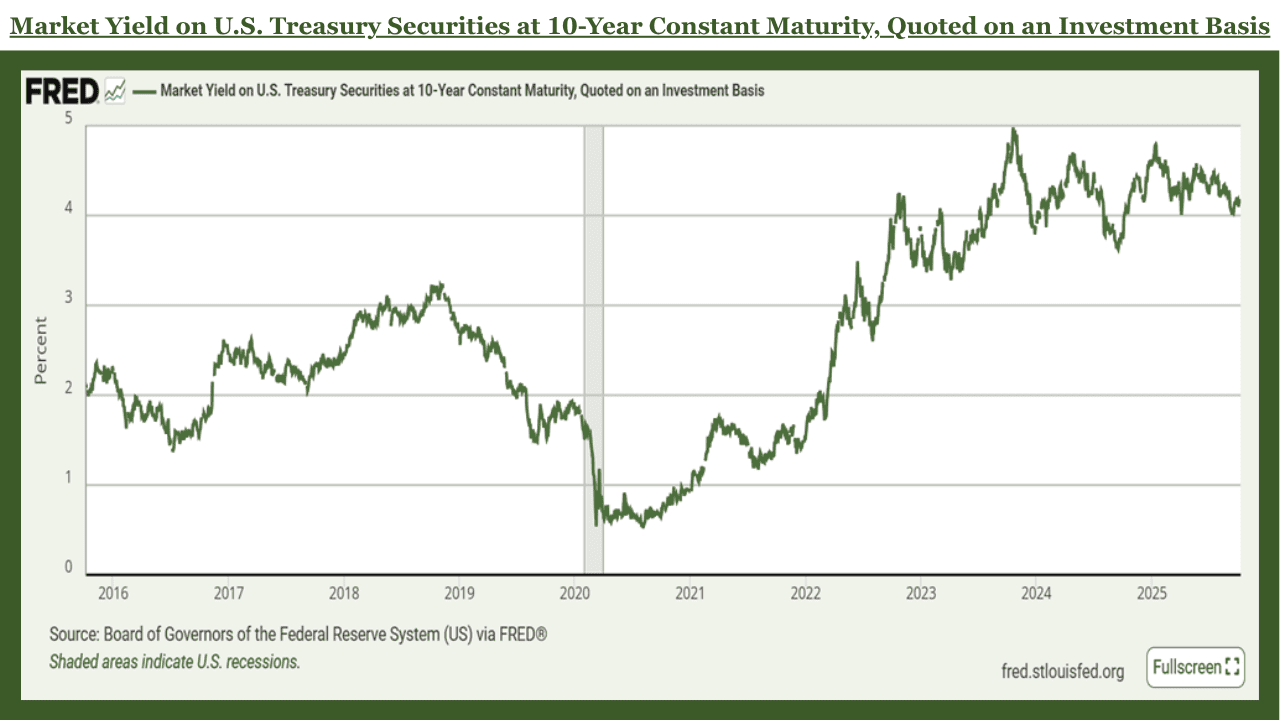

Market sentiment turned volatile after President Trump announced a "massive increase" in tariffs on Chinese imports on October 10, 2025, triggering sharp declines in major U.S. indices. The S&P 500 fell 2.7% that day, its largest one-day drop since April before rebounding in subsequent sessions. The Nasdaq Composite dropped nearly 3.6%, while the Dow Jones Industrial Average declined about 1.9% to 45,480. Treasury yields stabilized near 4.05%, reflecting cautious optimism on interest-rate expectations, while gold traded around $4,078 per ounce, showing resilience amid tariff-driven volatility. Overall sentiment remains mixed as investors absorb the market shock, though expectations for future Fed rate cuts persist, supported by a moderating labor market and easing inflation pressures.

Bitcoin Surge Reinforces Broader Risk Appetite

Bitcoin extended its historic rally this week, briefly surpassing $125,000 before a sharp decline on Friday, October 10, 2025, when it fell 8.4% to $104,782. This drop, the largest single-day fall in the crypto market, was triggered by President Trump's announcement of a 100% tariff on Chinese tech exports and export controls on critical software. The market has since rebounded, with Bitcoin trading around $114,948. The initial surge was fueled by record global ETF inflows, with U.S.-listed spot Bitcoin ETFs capturing a significant share. This reflected renewed investor demand for scarce assets amid fiscal uncertainty linked to the U.S. government shutdown.

Institutional participation continued to deepen, with global crypto ETFs recording nearly $6 billion in inflows during the week, signaling broad-based confidence in digital assets. Corporate holders such as Strategy Inc. maintained sizable Bitcoin treasury positions, reinforcing institutional support. The rally highlighted Bitcoin’s evolving role as both a speculative growth asset and a digital store of value, complementing concurrent strength in equities and gold within a broader cross-asset rebound.

AI Surge Sparks Early Optimism (Monday, October 6)

Markets kicked off the week on a positive note as AMD announced a collaboration with OpenAI to develop next-generation AI chips a move widely seen as deepening competition in the semiconductor space. The announcement reinvigorated the AI trade and lifted the Nasdaq, even as the government shutdown entered its second week, freezing official macro data. Investors instead turned to private surveys suggesting moderating inflation and firm consumer activity. The day’s tone was risk-on, driven by hopes that Fed policymakers could pivot sooner if data weakness persists.

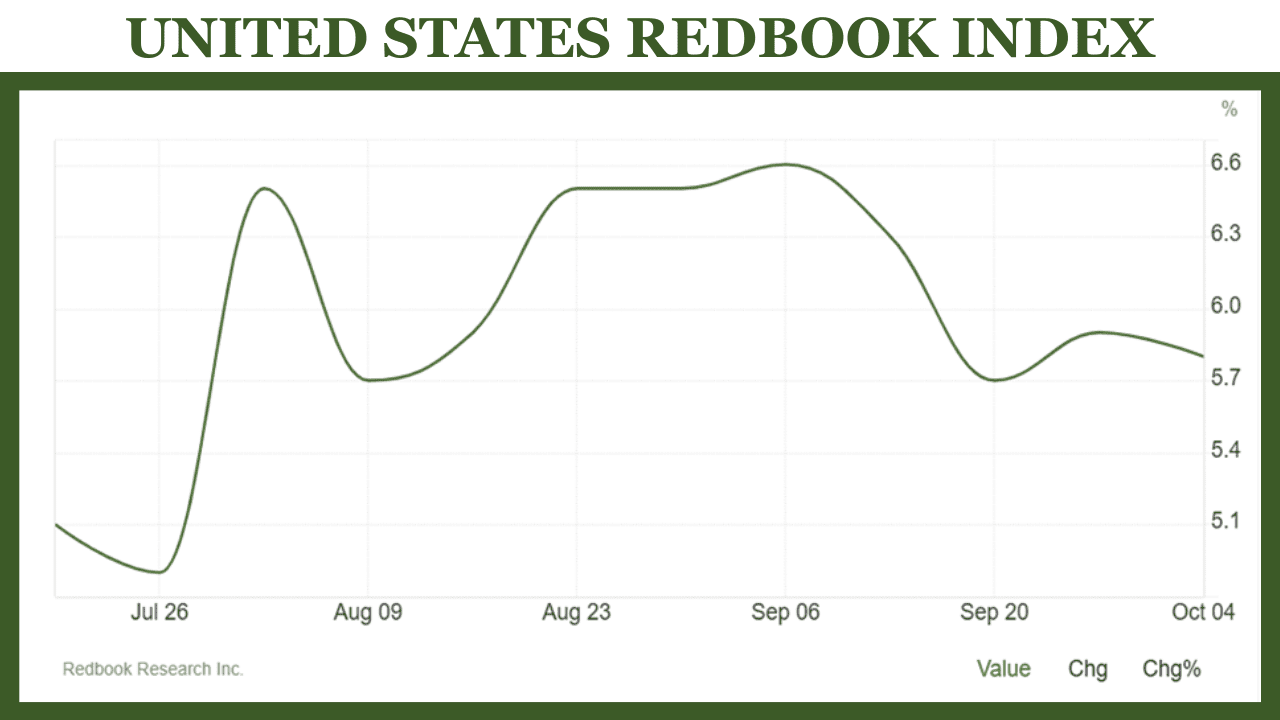

Private Inflation Gauges Hold Firm (Tuesday, October 7)

With CPI and PPI reports postponed, traders leaned on private inflation trackers such as the Truflation daily index, which showed annualized inflation hovering near 2.3 %, down from over 3 % earlier in Q3. The Redbook Retail Sales report indicated a 5.8 % YoY increase for the week ending September 28, pointing to still-solid consumer spending despite credit tightening. The data mix supported expectations for a soft landing and reinforced the view that price pressures are easing without a collapse in demand.

Labor Market Update (Wednesday, October 8)

Private indicators highlighted a cooling U.S. labor market amid delayed official reports. Federal Reserve Governor Michael Barr cautioned that persistent inflationary pressures, particularly from tariffs, warranted a cautious approach to interest rate adjustments, projecting core PCE inflation above 3% through 2025. Meanwhile, JPMorgan estimated weekly jobless claims rose to 235,000 for the week ending October 4, up from 224,000, partly due to early layoffs during the ongoing government shutdown. Together, the data suggested a moderation in labor momentum without signaling a sharp downturn.

Shutdown Drags, Treasury Volatility Returns (Thursday, October 9)

Markets softened on Thursday, October 9, as Congressional negotiations on government funding stalled, prolonging the US government shutdown. The absence of key economic data releases, including weekly jobless claims and Federal Reserve meeting minutes, left investors without important policy signals. Treasury market liquidity decreased, contributing to volatility, with the 10-year yield fluctuating between 4.14% and 4.18%.

Gold prices declined 0.6% to about $3,890 per ounce as some investors took profits. In equities, defensive sectors such as utilities and health care showed relative strength amid cautious market sentiment.

Corporate Earnings Resilience Lifts Mood

Private data suggested modest improvement in logistics and freight volumes, hinting at steady goods demand. Corporate updates from Delta Air Lines (strong travel demand, easing jet-fuel costs) and PepsiCo (flat volumes but pricing power intact) reinforced resilience in consumer and transport sectors. Traders also monitored early bank pre-announcements showing stable credit quality and loan growth, setting a constructive tone heading into next week’s financial-sector earnings.

Delta Air Lines (DAL)

Delta reported adjusted EPS of $1.71, beating estimates of $1.53, on $15.2 billion in revenue (+4% YoY). Strong corporate and premium travel demand helped lift operating margins to 11.2%, and management guided Q4 EPS between $1.60 and $1.90, maintaining a full-year target of $6.

PepsiCo (PEP)

PepsiCo posted EPS of $2.29, slightly above expectations of around $2.26, with revenue rising 2.7% YoY to $23.94 billion. Net income fell 11% due to higher costs and weak beverage and snack volumes. The company named Walmart’s Steve Schmitt as its new CFO, signaling possible operational shifts.

Helen of Troy (HELE)

Helen of Troy delivered EPS of $0.59, topping estimates, with revenue of $431.8 million. The beat was driven by better performance in beauty and home segments along with disciplined expense management.

Tilray Brands (TLRY)

Tilray broke even with EPS of $0.00, outperforming forecasts of –$0.04, on revenue of $209.5 million. Growth in its beverage-alcohol business helped offset continued weakness in cannabis sales.

Applied Digital (APLD)

Applied Digital reported an adjusted quarterly loss of $0.03 per share for fiscal Q1 2026, exceeding the expected loss of $0.14 per share. Revenue was $64.2 million, representing an 84% year-over-year increase. The company continues to face profitability challenges while expanding its data-center and AI infrastructure capacity, including new leasing deals and construction of additional facilities.

The Week Ahead (October 13 – October 19, 2025)

The upcoming week will be pivotal for markets as earnings season accelerates, and Fed commentary dominates in the absence of major economic data. With the government shutdown delaying key inflation releases, investors will rely on private indicators and corporate guidance to gauge economic direction. Early results from major banks will set the tone for third-quarter earnings, while updates from healthcare and asset-management leaders will provide insight into sector resilience. Market sentiment may hinge on whether Fed officials maintain a cautious stance or signal growing confidence in disinflation, shaping rate expectations into year-end.

Fed Remarks (Monday, Oct 13)

Fed officials John Williams (New York Fed) and Austan Goolsbee (Chicago Fed) are scheduled to speak, marking key appearances during the pre-FOMC data blackout period. Markets will parse their tone on inflation persistence, policy patience, and the balance between growth and price stability. A more hawkish tilt could push Treasury yields higher, while any hint of dovishness may ease rate-cut expectations for early 2026. Meanwhile, Fastenal Co. (FAST) will kick off the week’s earnings season, offering an early read on U.S. industrial demand and construction activity.

Bank Earnings Kickoff (Tuesday, Oct 14)

The third-quarter bank earnings season begins with Citigroup, JPMorgan, and Wells Fargo reporting results. Investors will focus on consumer credit quality, loan growth momentum, and net interest margins, which are expected to compress slightly as funding costs remain elevated. Commentary on deposit trends and exposure to commercial real estate will be closely watched as indicators of financial-sector health heading into 2026.

Inflation Data Uncertainty (Wednesday, Oct 15)

The Consumer Price Index (CPI) report for September 2025 was scheduled to be released on Wednesday, October 15, 2025, at 8:30 a.m. Eastern Time, while the Producer Price Index (PPI) report for September 2025 was scheduled for Thursday, October 16, 2025, also at 8:30 a.m. Eastern Time. Due to the government shutdown, these official releases are likely delayed, prompting traders to rely on alternative private inflation measures such as Truflation and the Cleveland Fed’s inflation nowcast to gauge inflation trends. This absence of official CPI and PPI data may increase market volatility and impact short-term rate expectations ahead of the upcoming Federal Reserve meeting.

Major U.S. companies releasing earnings on Wednesday, October 15, 2025, include Bank of America (BAC), Morgan Stanley (MS), Abbott Laboratories (ABT), Progressive (PGR), Prologis (PLD), and PNC Financial Services (PNC). These reports, particularly from large banks and financial institutions, mark significant moments in the Q3 earnings season, providing early insights into consumer strength, loan growth, and credit quality trends across sectors.

Key Earnings to Watch (Thursday, October 16)

Investors will closely monitor a slate of U.S. financial firms and global IT companies reporting earnings, offering insight into market trends across sectors. Cohen & Steers, Inc. will report its third-quarter 2025 results after market close, with a conference call on October 17 at 10:00 a.m. ET. U.S. Bancorp will release Q3 earnings before market open, while Marsh McLennan will hold its Q3 conference call at 8:00 a.m. ET. BNY Mellon will publish its third-quarter results at 7:30 a.m. ET, followed by a webcast and call. Globally, Wipro Ltd. (WIT) will report its Q2 FY26 earnings, with a press conference and investor call providing insights into IT services trends, client demand, and digital transformation spending.

Capital Markets Insight (Friday, Oct 17)

Key releases on Friday include earnings from Ally Financial (ALLY), American Express (AXP), Schlumberger (SLB), State Street (STT), Truist Financial (TFC), Fifth Third Bancorp (FITB), Regions Financial (RF), and Huntington Bancshares (HBAN). These reports will cap a busy week for the financial sector, offering fresh insight into credit conditions, consumer spending, and capital market trends. Management tone on deal activity and market outlook could influence how equities close the week, especially in a post-shutdown environment.

Outlook

The near-term outlook for U.S. markets remains constructively cautious. While AI optimism and resilient corporate fundamentals continue to offer support, the absence of official macro data leaves room for volatility and mispricing. If large banks deliver solid credit quality and upbeat guidance, risk sentiment could extend its upward leg. Conversely, a prolonged shutdown or weak corporate commentary could renew defensive positioning in gold and Treasuries. Overall, investors appear willing to ride the AI-led momentum, but the coming week will test how much optimism can withstand political noise and data darkness.