The Week That Was and The Week That’s Ahead:

Markets Rose on Fed Cut with Loads of Macro Data on the Way

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

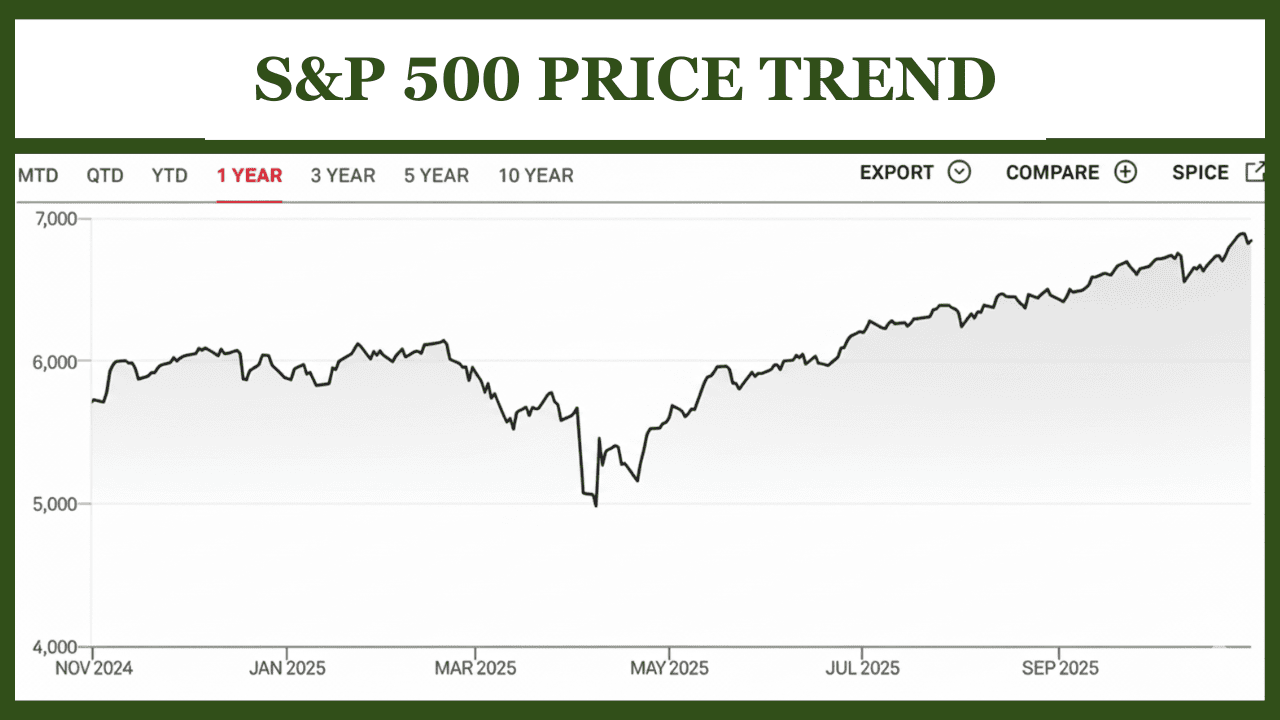

Markets closed October on a strong note as the Federal Reserve delivered its second rate cut of 2025, lowering the benchmark rate by 25 basis points to 3.75%-4.00%. While the move was widely anticipated, the commentary that accompanied it was not. Fed Chair Powell communicated a degree of concern at recent upticks in inflation, while also acknowledging that broader economic weakness provided sufficient justification for a cut. The market generally continued its uptrend on the heels of the news, however, as generally strong corporate earnings (especially from tech) and the promise of a China trade deal supported bullishness. While the ongoing government shutdown continued to cloud portions of economic data, investors largely looked past the noise to the start of November.

The Week That Was (October 27 – November 2, 2025)

Investor sentiment remained broadly positive through the week, supported by robust corporate earnings, easing trade tensions, and a significant liquidity boost from the Federal Reserve. A preliminary framework in the U.S.–China trade talks lifted global risk appetite, while markets largely brushed off the ongoing U.S. government shutdown. Optimism around the Fed’s rate-cut trajectory and resilient economic data helped extend the market rally, marking another week of gains across major indices. The S&P 500 rose approximately 2.4%, the Nasdaq Composite advanced 3.1% on strong technology earnings, and the Dow Jones Industrial Average added 1.7%, recording its third consecutive weekly gain.

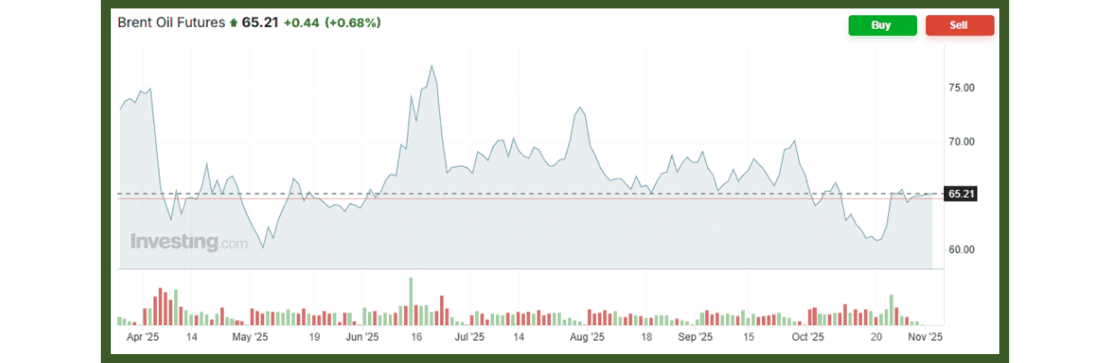

Commodities mirrored this risk-on tone. Gold prices edged down to around US$4,020 per ounce on Friday as investors rotated toward equities. Meanwhile oil, (specifically Brent Crude Oil) stabilized near US$64.77 a barrel, supported by supply discipline from OPEC+ even as demand signals remain mixed.

Market breadth expanded as capital rotated into cyclicals, technology, and select industrials, reflecting confidence that monetary easing will underpin a soft landing rather than a downturn.

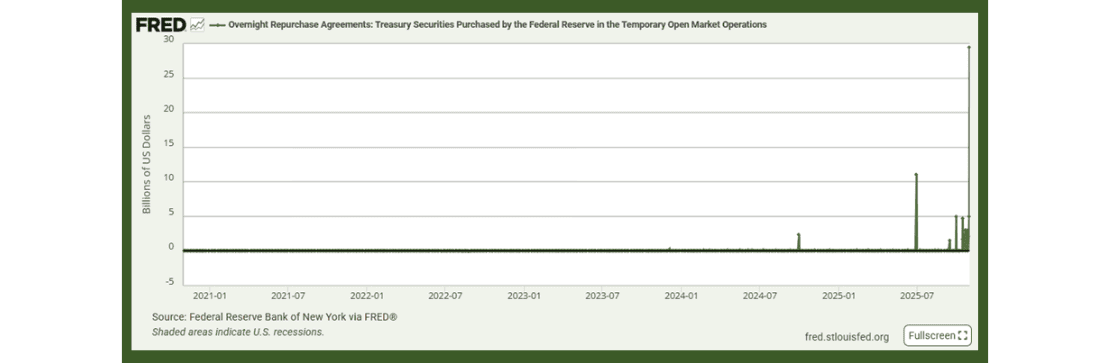

A key development came from the Federal Reserve’s liquidity operations. On October 31, the Fed injected US$29.4 billion via overnight repos and lent a record US$50.35 billion through its Standing Repo Facility, the largest combined injection since the early 2000s. With bank reserves dropping to roughly US$2.8 trillion, a four-year low, this action eased month-end funding pressures and bolstered short-term liquidity. The move reassured investors that the Fed remains proactive in stabilizing market funding conditions, strengthening risk sentiment across equities and credit markets.

Earnings season added further support to the rally. In technology, Microsoft posted a 13% YoY revenue rise to US$76.4 billion, driven by cloud and AI demand, while Apple reported US$94 billion in revenue with record services income. Semiconductor firms like NXP guided higher for Q4, hinting at early stabilization in chip demand. Industrials such as Caterpillar and Boeing highlighted solid construction and aerospace momentum.

Consumer and financial names like Visa, Mastercard, and Mondelez reported steady spending trends, underscoring resilient demand. Healthcare and energy also performed strongly, with Eli Lilly, Merck, ExxonMobil, and Chevron all exceeding forecasts.

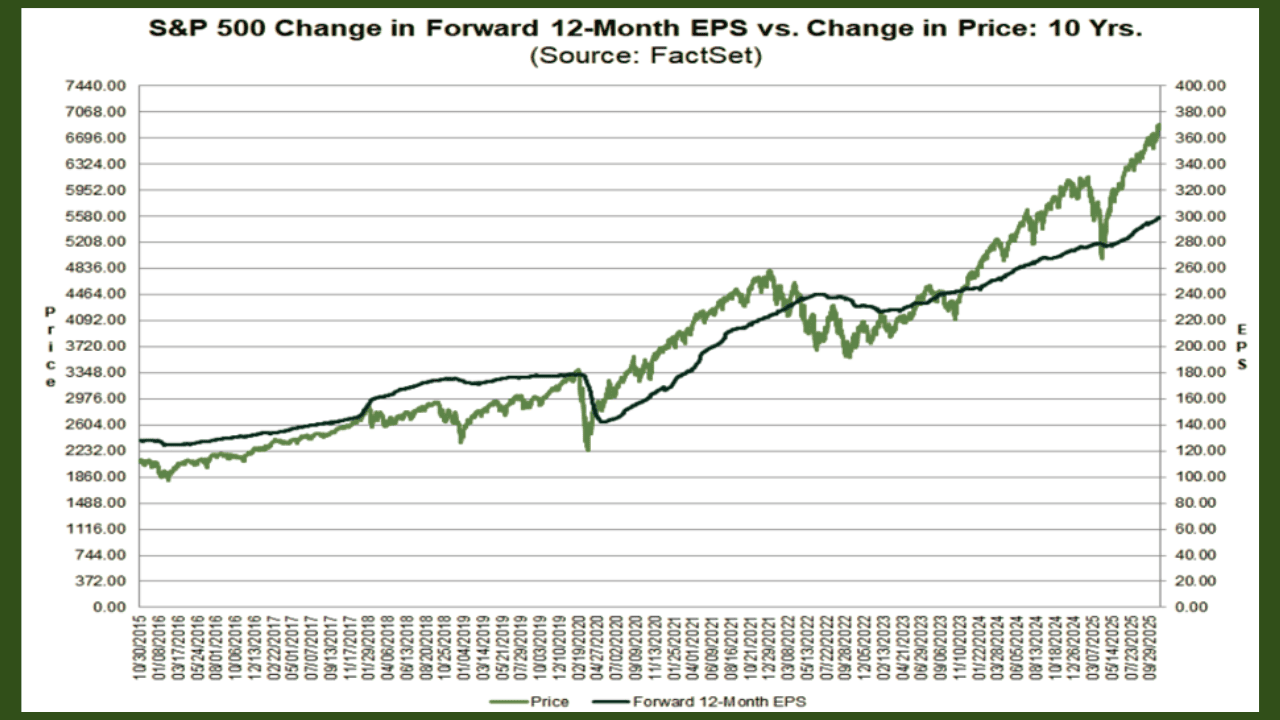

About 83% of S&P 500 firms have beaten Q3 earnings estimates, according to last week’s FactSet data, underscoring resilient profitability amid tightening liquidity. Upside surprises remain concentrated in technology, communication services, and industrials, where AI and automation investment continues to drive earnings strength.

The Week Ahead (November 3 – November 9, 2025)

The first week of November brings a busy lineup of economic data and corporate earnings as investors gauge momentum heading into year end. Focus will center on manufacturing, labor, and consumer trends, with key releases including the ISM Manufacturing Index, ADP Employment Report, and October Jobs Report. However, the ongoing government shutdown may delay several federal data points such as construction spending and trade figures. Major earnings from tech, biotech, and consumer firms will further shape sentiment and guide expectations for the Fed’s December policy outlook.

Manufacturing and Construction Pulse (Monday, November 3, 2025)

The week opens with key releases, including the ISM Manufacturing Index for October, Construction Spending for September, and Domestic Vehicle Sales for October. While the ISM and vehicle sales data are expected to be released on schedule, the Construction Spending report compiled by the U.S. Census Bureau could be delayed if the government shutdown continues.

On the corporate side, Palantir Technologies (PLTR) and Vertex Pharmaceuticals (VRTX) are set to report earnings after market close, offering early insights into the tone for the week.

Trade and Factory Data Take Center Stage (Tuesday, November 4, 2025)

Key releases include the U.S. Trade Balance (8:30 AM), Factory Orders (10:00 AM), and final Durable Goods Orders (10:00 AM) for September, though all may be delayed due to the Census Bureau shutdown.

On the corporate front, it’s a heavy earnings day with major reports from Amgen (AMGN), Ball Corp (BALL), Pfizer (PFE), Shopify (SHOP), Spotify (SPOT), and Uber (UBER) before the market opens, while Advanced Micro Devices (AMD), Arista Networks (ANET), Marathon Digital (MARA), Pinterest (PINS), Rivian (RIVN), Super Micro Computer (SMCI), and Upstart Holdings (UPST) will announce results after the close, spanning sectors from biotech and autos to AI hardware and digital platforms.

Labor Market and Services in Focus (Wednesday, November 5, 2025)

Key private-sector releases include the ADP Employment Report (8:15 AM) and the ISM Non-Manufacturing Index (10:00 AM) for October, neither impacted by the ongoing government shutdown. These indicators will give investors a clearer view of labor market strength and service sector resilience.

On the corporate front, earnings from McDonald’s (MCD), Novo Nordisk (NVO), Fiverr (FVRR), Unity (U), and Markel (MKL) arrive pre-market, while Qualcomm (QCOM), Snap (SNAP), ARM (ARM), AMC Entertainment (AMC), and Lucid (LCID) report after the close, keeping midweek momentum high across tech and consumer names.

Productivity Data and Corporate Highlights (Thursday, November 6, 2025)

Thursday’s key data include Q3 Productivity & Costs (8:30 AM) and final Wholesale Inventories (10:00 AM) for September, both subject to delay if the government shutdown persists, as they come from federal sources.

Investors will also turn their attention to another wave of major tech and platform earnings, with Moderna (MRNA) and Viatris (VTRS) reporting pre-market, followed by Airbnb (ABNB), Block (SQ), Cloudflare (NET), Take-Two Interactive (TTWO), and The Trade Desk (TTD) after the bell, spotlighting digital, biotech, and consumer trends.

Jobs, Sentiment, and Credit Trends Wrap the Week (Friday, November 7, 2025)

Friday features a trio of important economic releases: the October Employment Report (8:30 AM), the University of Michigan Consumer Sentiment Index (10:00 AM) for November (preliminary), and Consumer Credit (3:00 PM) for September. While the labor and sentiment reports are expected to be released as scheduled, Consumer Credit data from the Federal Reserve could be delayed if the government shutdown continues.

On the corporate side, AngloGold Ashanti (AU) reports pre-market, offering insights into the commodities and mining sector as investors assess global demand and inflation-linked asset trends.

Outlook

As November begins, markets face a mixed backdrop of solid corporate earnings and lingering policy uncertainty. The ongoing government shutdown threatens to delay key economic releases, yet sentiment remains supported by signs of moderating inflation, steady employment conditions, and expectations of eventual rate stabilization.

Technology and healthcare sectors are likely to extend their leadership, while industrials continue to display cyclical resilience. Commodities and energy prices may stay volatile amid uneven global demand. Bond yields appear set to consolidate following recent volatility, and the dollar’s direction will hinge on upcoming inflation data. Overall, investors enter November with measured optimism and an emphasis on data driven clarity.