The Week That Was and The Week That’s Ahead:

Earnings, Yields, and Commodities as Data Visibility Returns

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

This edition of The Week That Was & The Week That's Ahead breaks down a pivotal stretch for markets as the U.S. government shutdown officially ended, restoring visibility across data and policy signals. With macro releases gradually normalizing, investors focused on earnings, Treasury market tone, and shifts across commodities.

The Week That Was (November 10-November 16, 2025)

Markets enter the week of November 17 just as the 43-day U.S. federal government shutdown, the longest in history has ended. With government operations and data releases resuming, investors will finally get fresh labor, inflation, and production figures lifting some of the fog but also setting the stage for renewed volatility. Caution lingered as markets continued to digest uneven earnings, mixed economic signals, and questions about the durability of U.S. growth.

The S&P 500 declined by 0.76% over the week of November 10 to November 14. The index opened the week at 6,785.36 on November 10, climbed to an intra week high of 6,852.05 on November 12, and then retreated to close at 6734.11 on November 14. The pullback coincided with a noticeable cooling in global equity appetite as investors grew more cautious over lofty technology valuations and signs of softening U.S. labor market conditions. Sentiment toward large technology names weakened further after SoftBank disclosed that it had sold $5.83 billion worth of Nvidia shares, reinforcing the broader risk-off tone during the week.

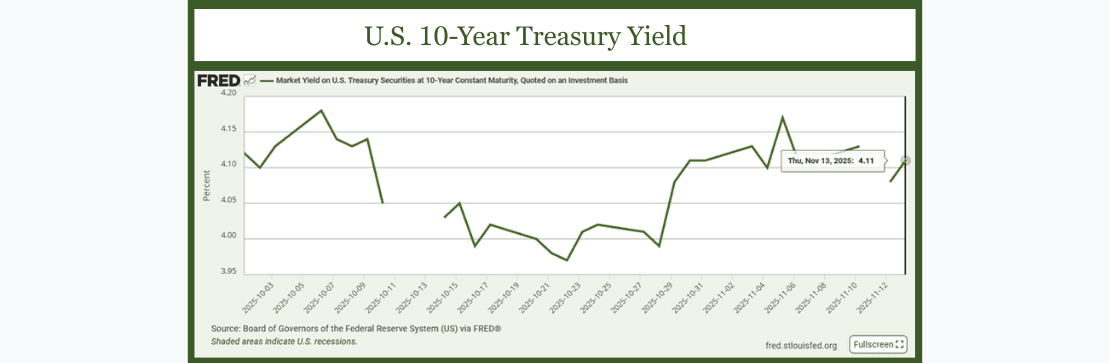

The 10-year US Treasury yield stood at 4.11% on November 13. With uncertainty rising after a tech-led slump in equities and traders positioning more conservatively ahead of key data, yields remained steady despite volatility across risk assets. The backdrop of shifting rate expectations and a more defensive tone in equities helped keep the benchmark yield anchored around the 4.11% mark.

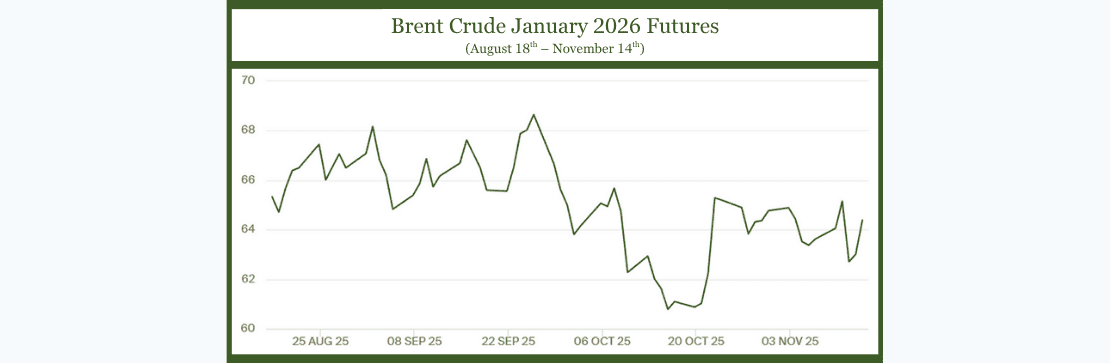

Brent January 2026 futures (BRN) rose about 0.51%, moving from $64.06 per barrel on November 10 to roughly $64.39 per barrel by November 14. WTI January 2026 futures (CL) saw a weekly decline of about 1.62%, starting near $60.94 per barrel and ending close to $59.95 per barrel. Potentially contributing to the rise was a November 14 drone attack on the Russian Black Sea port of Novorossiysk, an important export hub for Russian crude. The incident heightened geopolitical uncertainty and prompted traders to reassess the likelihood of disruptions to Russian oil flows, which supported Brent and kept WTI relatively stable despite broader market caution.

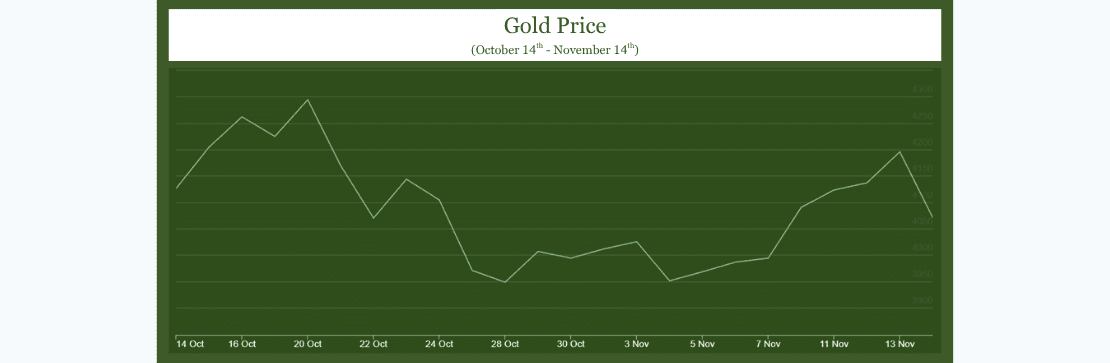

Gold fell by 0.15% for the week, moving from $4,077.60 per ounce on November 10 to $4,071.10 per ounce by November 14. The slight decline was driven by a stronger US dollar amid reduced expectations of an imminent Federal Reserve rate cut in December, based on hawkish commentary from Fed officials.

Corporate earnings delivered meaningful signals last week across commodities, energy, and consumer staples. Barrick Mining (B) posted Q3 2025 EPS of $0.58 versus $0.31 a year ago, slightly above the $0.57 consensus. Gold production rose 4% QoQ, and strong operating and free cash flow, boosted by higher realized prices supported performance. Occidental Petroleum (OXY) reported adjusted EPS of $0.64, beating expectations of $0.50-$0.52, while revenue of $6.72 billion missed the $6.75 billion consensus. Production increased to 1.46 MMboe/day (Million Barrels of Oil Equivalent per Day) from 1.41 MMboe/day, though weaker oil prices pressured revenue. Tyson Foods (TSN) delivered EPS of $1.15 versus $0.85 expected, but revenue of $13.86 billion fell short, underscoring ongoing growth and margin concerns.

Earnings results were mixed but broadly aligned with expectations. Amgen reported revenue of $9.56B with adjusted EPS of $5.64, ahead of consensus of $5.01, supported by steady demand across its therapeutic portfolio. KKR posted non-GAAP EPS of $1.41 versus expectations of $1.30, with revenue rising to $5.53B on continued growth in fee-related earnings. ON Semiconductor delivered EPS of $0.63 (slightly above $0.59 expected), though revenue of $1.55B was essentially in line and reflected softer trends in auto and industrial channels. Meanwhile, Harley-Davidson reported EPS of $3.10, significantly above the $1.64 consensus estimate, supported by pricing discipline and cost control, even as discretionary demand indicators remain uneven.

The Week Ahead (November 17 - November 23, 2025)

With the U.S. government shutdown now over and economic data flow returning to normal, the week ahead offers a clearer view of where momentum is heading into year-end. A heavy slate of macro releases and Fed speakers will help reset expectations after weeks of uncertainty. Alongside this, a broad mix of corporate earnings, from retail to tech and industrials adds fresh insight into the real economy. Overall, markets step into the week with improved visibility but a still cautious tone.

Macro Signals and Mid-Tier Earnings Set the Tone (Wednesday, November 17)

Monday brings the Empire State Manufacturing Index at 8:30 a.m. ET and remarks from Fed Vice Chair Philip Jefferson at 9:00 a.m. ET, offering early direction as macro data flow normalizes post-shutdown.

On the earnings side, Aramark (ARMK) provides a read on services demand, J&J Snack Foods (JSF) on consumer trends, Brady Corporation (BRC) on industrial spending.

Trade, Output & Housing Snapshot (Tuesday, November 18)

Tuesday delivers a packed data schedule, starting with the Import Price Index and Import Prices ex-fuel at 8:30 a.m. ET, followed by Industrial Production and Capacity Utilization at 9:15 a.m. ET, key gauges of pricing pressures and manufacturing momentum. The Home Builder Confidence Index at 10:00 a.m. ET brings a read on housing sentiment, while Fed Governor Michael Barr’s remarks at 10:30 a.m. ET may offer policy cues.

On the earnings side, notable U.S. names include Home Depot (HD), Medtronic (MDT), AECOM (ACM), Powell Industries (POWL), Energizer Holdings (ENR), and Oaktree Specialty Lending (OCSL) providing broad cross-sector signals as the week accelerates.

Housing, Manufacturing & Earnings Pulse (Wednesday, November 19)

Wednesday opens with key U.S. releases at 8:30 a.m. ET: the Philadelphia Fed Manufacturing Survey, Housing Starts, and Building Permits, offering a read on factory sentiment and residential construction. At 2:00 p.m. ET, the FOMC Minutes from October may clarify policymakers’ tone.

On the earnings front, NVIDIA (NVDA) anchors the day with a crucial update on AI and data center demand, joined by Palo Alto Networks (PANW) in cybersecurity and retailers Target (TGT) and Lowe’s (LOW) for signals on holiday-season consumer activity. Rounding out the lineup are Williams-Sonoma (WSM), Viking Holdings (VIK), Dycom Industries (DY), and Valvoline (VVV).

Labor, Housing & Earnings Focus (Thursday, November 20)

Thursday features a busy macro slate, beginning with Initial Jobless Claims at 8:30 a.m. ET, followed by Existing Home Sales and Leading Economic Indicators at 10:00 a.m. ET key reads on labor momentum, housing demand, and forward economic signals. The policy backdrop is active, with remarks from Fed Governor Lisa Cook, Chicago Fed President Austan Goolsbee, and Philadelphia Fed President Anna Paulson through the day.

Earnings are headlined by Walmart (WMT), offering a crucial view on consumer spending, alongside Intuit (INTU) for small-business trends, Ross Stores (ROST) and The Gap (GAP) for retail sentiment, Veeva Systems (VEEV) for healthcare SaaS demand, and Elastic (ESTC) for enterprise software activity, forming a broad cross-sector snapshot.

PMI Checkpoint & Retail-Energy Earnings Mix (Friday, November 21, 2025)

Friday delivers a focused macro lineup, starting with remarks from Fed Governor Michael Barr at 8:30 a.m. ET and Fed Vice Chair Philip Jefferson at 8:45 a.m. ET, followed by Dallas Fed President Lorie Logan at 9:00 a.m. ET. Markets then turn to high frequency indicators with the S&P Global Flash Services PMI and Manufacturing PMI at 9:45 a.m. ET, key gauges of November business activity, alongside the final Consumer Sentiment reading at 10:00 a.m. ET.

On the earnings front, the day is lighter but notable: BJ’s Wholesale Club (BJ) offers a snapshot of value-focused retail demand, VinFast (VFS) reflects EV market momentum, Moog (MOG-A/MOG-B) signal industrial activity.

Outlook

As the week of November 17, 2025 begins, markets transition from a data-intensive stretch into a period where the focus shifts toward broader year-end positioning. The steady return of U.S. economic releases after the shutdown has restored much needed visibility, and this week’s mix of labor indicators, housing data, PMIs, and Fed commentary offers a clearer read on underlying momentum.

Corporate earnings spanning retail, tech, industrials, and financials add further texture, highlighting where demand is holding firm and where pressure is emerging. Overall, investors head into the final weeks of the year balancing cautious optimism with macro sensitivity: the AI trend continues to drive the US economy forward, but policy expectations, consumer durability, and sector specific results remain the key drivers shaping market tone moving forward.