The Week That Was & The Week that’s Ahead:

Earnings, Inflation & Fed Signals - Your Weekly Market Briefing

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

As U.S. markets navigate the final stretch of October 2025, investors balanced optimism from strong corporate earnings against lingering uncertainties from political and economic developments. The week saw attention focused on the interplay between inflation trends, monetary policy signals from the Federal Reserve, and the ongoing government shutdown, which has disrupted several key data releases. Against this backdrop, both institutional and retail investors weighed earnings reports from major technology, consumer, and industrial companies while monitoring macroeconomic indicators for clues on the direction of growth and market sentiment heading into November.

The Week That Was (October 20 – October 26, 2025)

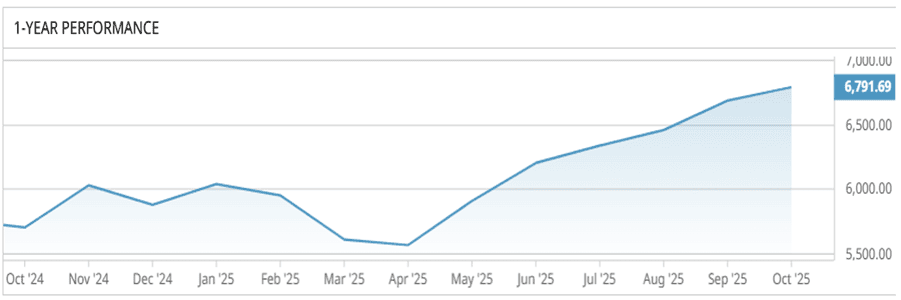

U.S. markets ended the week on a firm note, with all three major indices advancing as investors focused on strong corporate earnings and brushed aside political noise. The S&P 500 gained about 1.9%, the Dow Jones Industrial Average climbed 2.2%, and the Nasdaq Composite rose 2.3%, marking one of their strongest weeks this quarter. Optimism around earnings and easing inflation pressures helped reinforce the positive tone heading into the final days of October.

S&P 500 Over the Past Year

Sentiment improved as fears around regional bank stress eased and trade tensions softened slightly. Still, the mood wasn’t entirely euphoric an ongoing government shutdown stretching into its fourth week continued to delay key economic releases, keeping some uncertainty around the Fed’s next policy steps.

Earnings season was the main driver of market tone. Reports from Tesla, Netflix, Intel, IBM, Procter & Gamble, Coca-Cola, General Motors, and Ford helped reinforce confidence in corporate resilience. According to LSEG IBES data cited by Reuters, S&P 500 earnings were tracking about +9.3% YoY (Year on Year) one of the fastest growth rates in nearly 2 years, driven largely by technology and consumer focused sectors.

Inflation concerns persisted as the September 2025 Consumer Price Index (CPI) was finally released on October 24, following delays caused by the federal government shutdown. The report showed that headline inflation rose 3.0% year on year, slightly below expectations of 3.1% but higher than August’s 2.9%. Core inflation, which excludes food and energy, also increased by 3.0%, indicating that price pressures remain sticky even as momentum slows modestly. The release reaffirmed that inflation remains above the Federal Reserve’s 2% target, keeping markets alert ahead of upcoming policy signals.

The delayed data has left investors without a critical signal on the Federal Reserve’s potential timeline for policy adjustment. Meanwhile, reports of possible tariff revisions involving China, India, and Colombia briefly stirred geopolitical caution, adding another layer of uncertainty to an already fragile market backdrop.

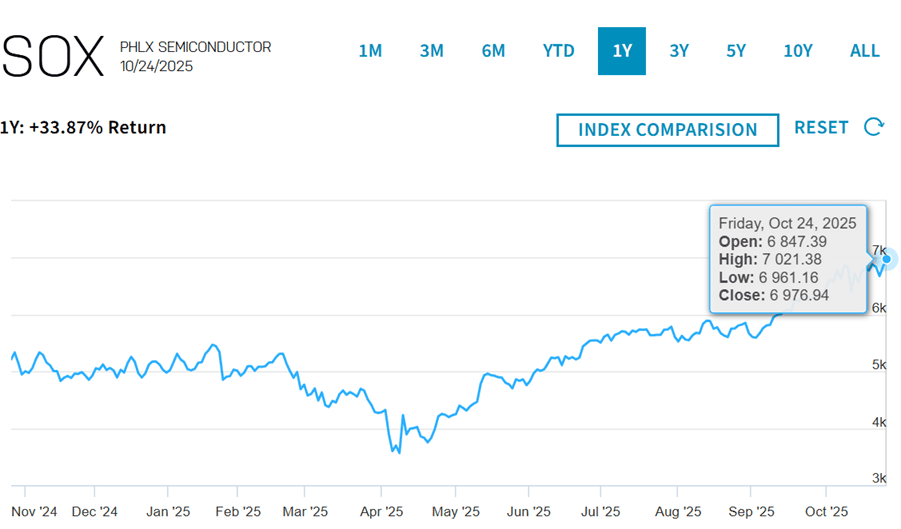

The Philadelphia Semiconductor Index (SOX) climbed to fresh record highs, reflecting continued strength in the chip sector. As of October 24, 2025, the index closed at 6,976.9, after touching an intraday high of 7,021.4, surpassing its earlier peak from October 20. The rally remains fueled by strong demand for AI related semiconductors, with notable gains across major chipmakers. Micron, ON Semiconductor, and KLA were among key contributors, while Micron’s shares rose 2.2% to a record level after Barclays raised its price target, underscoring growing investor confidence in memory and AI chip markets.

PHLX Semiconductor Index (As of October 24, 2025)

Commodities were mixed over the week, though sentiment stayed broadly constructive. Gold eased slightly, settling near $4,075 per ounce, as traders booked profits after the prior week’s sharp rally. Despite this pullback, investors maintained a modest defensive bias, supported by ongoing geopolitical and policy uncertainty. Overall, corporate earnings remained resilient, helping offset policy noise and uneven inflation data. With incomplete government releases and upcoming Federal Reserve signals still in focus, markets entered the final stretch of October with cautious optimism.

Gold Price Trend over Last 6 Months

The Week Ahead (October 27 – November 2, 2025)

The upcoming week is packed with key economic data releases and a heavy corporate earnings calendar, which together are likely to guide market sentiment. Investors will closely watch reports on durable goods, consumer confidence, GDP, and employment, while the FOMC meeting could influence monetary policy expectations. Earnings from major technology, healthcare, financial, and industrial companies throughout the week will provide further insight into sector trends and broader economic momentum.

Durable Goods and Regional Manufacturing Data (Monday, October 27)

The week begins with the release of September Durable Goods Orders, following a 2.9% increase in August. The report, compiled by the U.S. Census Bureau, could be delayed if the government shutdown continues. The Dallas Fed Manufacturing Index will also be released, providing insights into regional manufacturing activity.

On the corporate front, earnings from NXP Semiconductors (NXPI), Waste Management (WM), TransUnion (TRU), Brown & Brown (BRO), and CenterPoint Energy (CNP) will set the tone for the week.

Consumer Confidence and Earnings (Tuesday, October 28)

The Consumer Confidence Index and Richmond Fed Manufacturing Index are scheduled for release at 10:00 AM ET. If the government shutdown persists, these reports may be delayed or incomplete, affecting market interpretation.

Earnings include PayPal (PYPL) and UnitedHealth (UNH) before the market open, and Booking (BKNG), Mondelez (MDLZ), and Visa (V) after the close, covering payments, travel, consumer goods, and healthcare sectors.

FOMC, Economic Data, and Heavy Earnings Slate (Wednesday, October 29)

Wednesday features the FOMC policy decision at 2:00 PM ET, alongside economic releases including Advance International Trade in Goods at 8:30 AM ET, the Corporate Bond Market Distress Index (CMDI) at 10:00 AM ET, and the NAR Pending Home Sales Index at 10:00 AM ET.

Corporate earnings are particularly heavy, with ADP, Boeing (BA), Caterpillar (CAT), Etsy (ETSY), Fiverr (FVRR), and Kraft Heinz (KHC) reporting before the open, while Alphabet (GOOGL), Markel (MKL), Meta (META), Microsoft (MSFT), ServiceNow (NOW), Starbucks (SBUX), and Teladoc Health (TDOC) report after the close. These releases cover a broad range of sectors, including technology, industrials, consumer, and healthcare, and are expected to shape market sentiment for the remainder of the week.

GDP and Major Earnings (Thursday, October 30)

Thursday brings the Advance Estimate of Q3 GDP at 8:30 AM ET from the Bureau of Economic Analysis, alongside Durable Goods Shipments and Initial Jobless Claims, both from U.S. federal agencies and potentially delayed due to the government shutdown.

Corporate earnings are heavy, with Apple (AAPL), Amazon (AMZN), Coinbase (COIN), Gilead Sciences (GILD), Illumina (ILMN), Riot Platforms (RIOT), and MicroStrategy (MSTR) reporting after the close, and Bristol-Myers Squibb (BMY), Eli Lilly (LLY), Estée Lauder (EL), Mastercard (MA), Merck (MRK), Takeda (TAK), and Willis Towers Watson (WTW) reporting pre-market. These releases span technology, healthcare, consumer goods, and financial sectors, providing a comprehensive view of economic and corporate trends heading into the weekend.

Employment, Inflation, and Key Earnings (Friday, October 31, 2025)

Friday features the Employment Cost Index (Q3) and Personal Income & Outlays, including the PCE Deflator at 8:30 AM ET, along with the New York Fed Staff Nowcast at 11:45 AM ET. Releases may be delayed due to the ongoing government shutdown.

Key earnings include AbbVie (ABBV), Aon (AON), Chevron (CVX), and ExxonMobil (XOM), covering healthcare, insurance, and energy, offering insights into inflation, spending, and sector performance as markets close out October.

Outlook

As October closes, U.S. markets face a mix of opportunities and uncertainties. Corporate earnings have dominated sentiment, with major technology, healthcare, and energy companies providing guidance that will influence near term trends. On the macro side, key data on wages, inflation, GDP, and consumer spending some potentially delayed due to the ongoing government shutdown will remain closely watched for clues on economic momentum and Fed policy. Investors are likely to remain cautious, balancing strong earnings results against macro policy risks, geopolitical developments, and the uncertainty of delayed economic releases, setting up the tone for November.