The Week That Was and The Week That’s Ahead:

Yields, Equities, and Fed Expectations Moving into Year-End

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

“The Week That Was & The Week That’s Ahead” is a weekly market brief highlighting major economic data, policy developments, and corporate earnings shaping investor sentiment. It summarizes the most important events from the past week and outlines key catalysts to watch in the week ahead helping readers stay informed and prepared for upcoming market moves.

The Week That Was (December 8-December 12, 2025)

Global markets entered mid-December with mixed sentiment as investors weighed monetary easing optimism against renewed concerns over inflation, tariffs, and policy direction. The Federal Reserve’s final 2025 meeting brought a rate cut but a hawkish tone, dampening hopes for continued easing. Meanwhile, tariff uncertainty in Washington added volatility to cyclical sectors, and moves in commodities, crypto, and yields reflected a cautious adjustment to slower growth and cooling inflation.

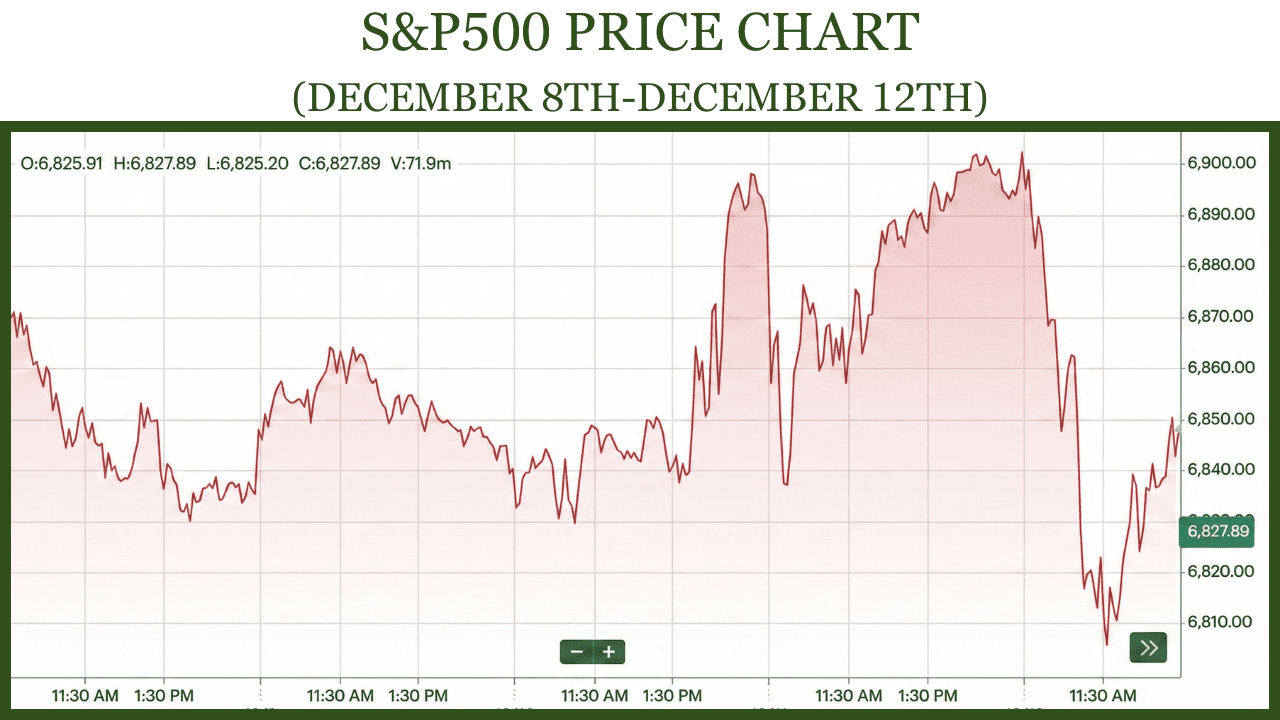

The S&P 500 ended the week of December 8 to December 14 slightly lower after touching new record highs earlier in the week. The index briefly crossed 6900 midweek, lifted by optimism surrounding the Federal Reserve’s policy easing, before slipping on Friday as investors took profits and reassessed valuations in large-cap technology and AI-linked names. Market breadth remained healthy, but sentiment was more cautious toward the end of the week as year-end positioning and volatility in bond yields tempered risk appetite. Despite the mild pullback, the broader tone remained constructive as investors balanced near-term consolidation against expectations of a soft landing.

The Federal Reserve’s December 10 meeting resulted in a 25-basis-point rate cut, bringing the target range to 3.50%-3.75%. While this marked the third cut of 2025, the tone of the accompanying statement was notably hawkish. Chair Powell emphasized that inflation progress was welcome but not yet sufficient for a sustained easing cycle. Importantly, three members dissented from the decision, preferring to hold rates steady, which reflected the growing divergence within the committee. Markets initially rallied on the cut but soon retraced as traders interpreted the split decision as a signal that the Fed may pause before any further moves in early 2026.

Adding to the uncertainty, renewed debate over tariff policy resurfaced in Washington as investors awaited a potential Supreme Court ruling on the legality of unilateral tariff authority. Speculation about changes to trade enforcement and tariff structures injected volatility into manufacturing and industrial stocks. The possibility of new import duties, or even partial rollbacks depending on the ruling, kept trade-exposed sectors choppy through the week. This uncertainty also influenced bond yields, as higher tariffs could feed through to inflation expectations just as the Fed attempts to balance growth risks with price stability.

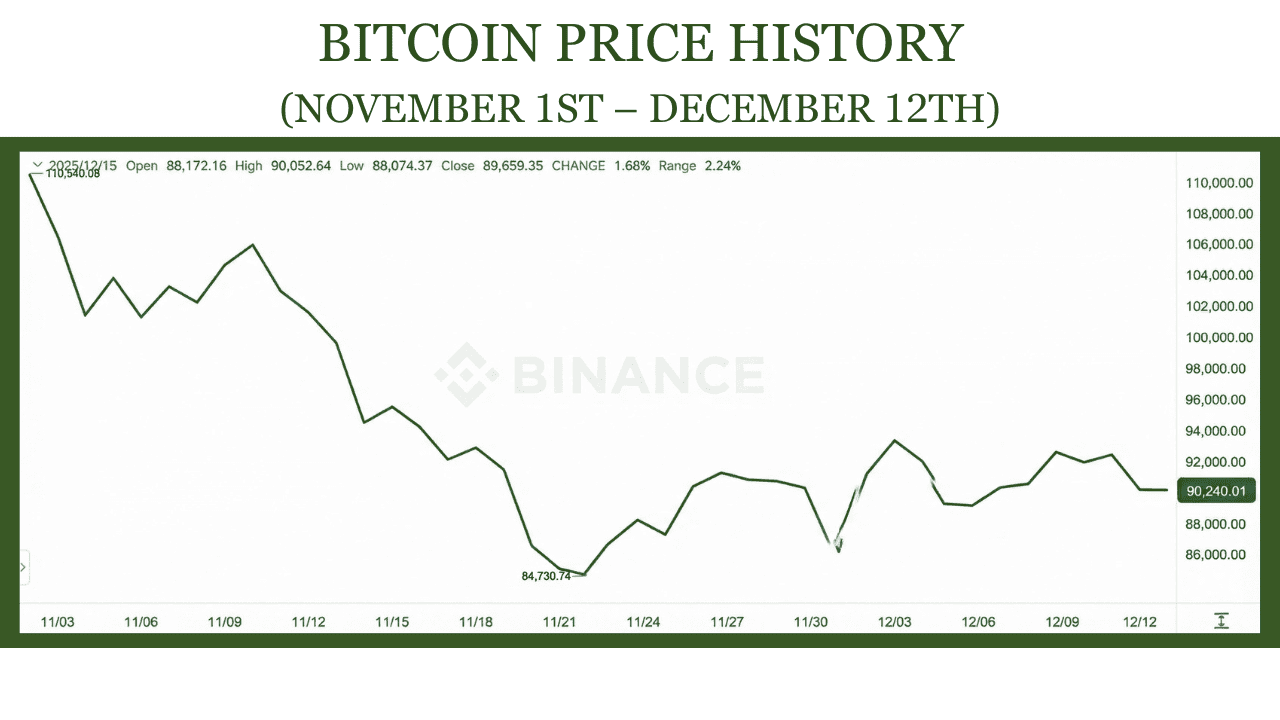

Cryptocurrencies reflected the broader cooling in risk sentiment. Bitcoin dropped below the 89,000 mark during the week, its lowest level in nearly a month, as investors moved into safer assets ahead of key macro data. Trading volumes were thin, and volatility spiked across major tokens. The decline mirrored movements in tech equities and underlined that speculative assets remain sensitive to shifts in liquidity conditions and rate expectations.

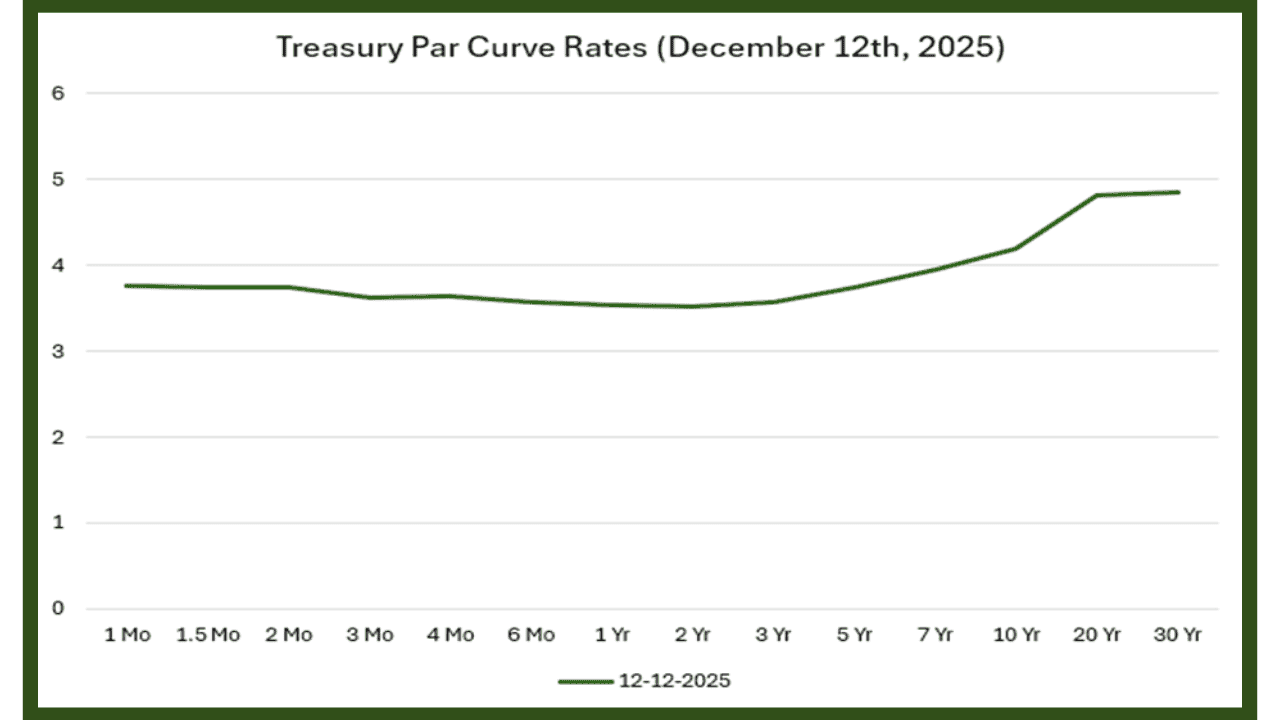

In fixed income, Treasury yields moved unevenly. The 10-year yield traded near 4.17% for most of the week before inching higher as investors digested the Fed’s hawkish tone. Short-term rates, including the one-year Treasury, eased slightly following the rate cut, widening the 1-year to 10-year spread into positive territory. The curve’s modest steepening signaled that markets no longer price an imminent recession but still expect slower growth and gradual disinflation. The overall bond market tone was one of adjustment rather than relief, as investors recalibrated expectations for 2026 policy moves.

Labor market data released last the week reinforced the picture of a gradual cooling. The October Job Openings and Labor Turnover Survey showed openings steady at 7.7 million, hires at roughly 5.1 million, quits near 2.9 million, and layoffs around 1.9 million. The decline in quits pointed to reduced worker confidence and easing wage pressures. Complementing that, the Employment Cost Index for the third quarter showed a 0.8% quarterly rise for civilian workers, with both wages and benefits increasing at the same pace. This was consistent with a slower trend in labor cost inflation, aligning with the Fed’s view that wage growth is normalizing after the rapid gains of 2022 and 2023.

Corporate earnings provided mixed signals but underscored resilience in core sectors. Adobe’s results highlighted robust demand in its digital media and creative cloud businesses, while Synopsys posted strong growth in its semiconductor design software segment. Oracle reported continued traction in cloud infrastructure, Broadcom beat estimates on the back of networking and software strength, and Costco showed steady same-store sales growth driven by solid U.S. consumer demand. The combination of stable corporate performance and macro caution helped the broader market hold near record levels despite short-term volatility.

The Week Ahead (December 15 – December 19, 2025)

The upcoming week features a concentrated set of economic releases that will close out the 2025 data cycle, including key updates on labor markets, inflation, wages, and consumer behavior. These reports, combined with a heavy earnings schedule, will help investors refine expectations for early 2026 policy and growth momentum.

Employment Situation Report (December 16, 2025)

The Employment Situation Report for November will be released on December 16 and will provide the most comprehensive update on labor market conditions. This report is critical because it consolidates payroll growth, unemployment trends, hours worked, and wage dynamics. As the most influential labor dataset of the month, it shapes expectations for Federal Reserve policy and informs assessments of overall economic momentum.

Business Employment Dynamics Q1 2025 (December 17, 2025)

The Business Employment Dynamics report will be released on December 17 and will offer detailed insights into job gains and losses from establishment openings, closings, expansions, and contractions. This dataset is important because it reveals underlying labor market churn and business cycle strength beyond headline payroll numbers, supporting deeper analysis of job creation patterns.

Metropolitan Area Employment and Unemployment September 2025 (December 17, 2025)

This report will be released on December 17 and will provide local level labor market conditions across major metropolitan areas. It helps identify geographic pockets of strength or weakness that may not appear in national data. Policymakers and investors track this release to understand how employment trends vary across regions, especially in housing driven and service oriented metros.

US Consumer Price Index CPI (Released on December 18, 2025)

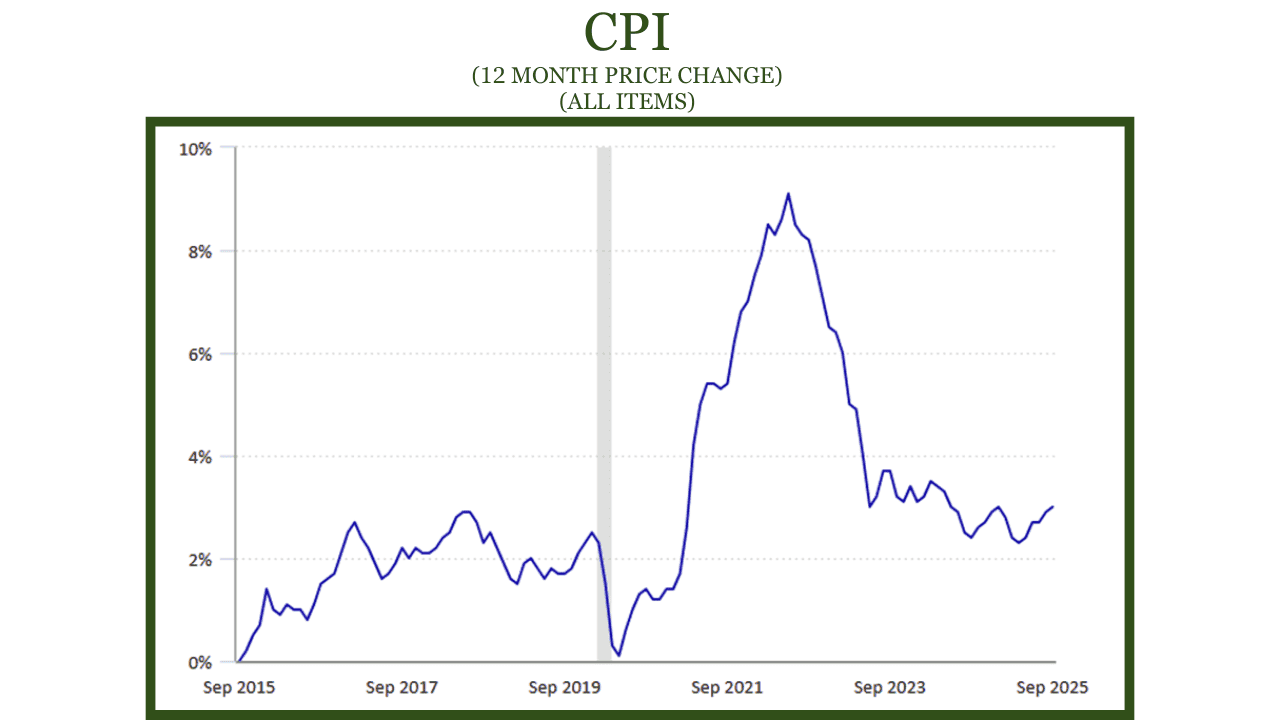

The November CPI will be released on December 18 at 8:30 AM ET and will serve as the final inflation update of 2025, making it a key input for early 2026 policy expectations. The last CPI report was released in September and showed inflation at 3.0 percent year over year, a level that remained above the Federal Reserve target and clearly inflationary.

Real Earnings November 2025 (December 18, 2025 at 8:30 AM ET)

Real Earnings for November will be released on December 18 at 8:30 AM ET and will update the inflation adjusted trajectory of worker income. This release matters because it reflects the actual purchasing power of households and helps determine whether wage growth is keeping pace with rising prices. It is a critical input for understanding consumer resilience.

County Employment and Wages Q2 2025 (December 19, 2025)

This report will be released on December 19 and will offer detailed wage and employment data across United States counties. It is important because it highlights localized labor market differences and wage pressures that aggregate data may mask. The report also helps identify structural wage trends relevant for regional planning and economic development.

Consumer Expenditures 2024 Annual Report (December 19, 2025)

The annual Consumer Expenditures report will be released on December 19 and will provide a comprehensive view of household spending patterns across income groups and categories. This release is significant because it reveals long term consumption trends, shifts in household budgets, and the distributional effects of inflation. It serves as a key reference point for consumer driven sectors.

Corporate Earnings Calls This Week

- Lennar (December 16, 2025)

- Micron Technology (December 17, 2025)

- General Mills (December 17, 2025)

- Jabil (December 17, 2025)

- Accenture (December 18, 2025)

- Nike (December 18, 2025)

- FedEx (December 18, 2025)

- Cintas (December 18, 2025)

- Darden Restaurants (December 18, 2025)

- FactSet (December 18, 2025)

- CarMax (December 18, 2025)

- Paychex (December 19, 2025)

- Carnival Corporation (December 19, 2025)

- Conagra Brands (December 19, 2025)

This concentrated set of earnings reports provides valuable insight across housing, semiconductors, logistics, and consumer markets. Companies such as Micron and FedEx influence expectations for technology spending and global trade, while Nike, Darden, and CarMax highlight household budget trends. Together these updates help shape preliminary views on demand conditions entering early 2026.

Outlook

Markets are entering year-end with cautious optimism. The Fed’s rate cut supported the soft-landing view, but its hawkish tone and committee split kept investors on edge. Equities may stay range-bound as valuations adjust and yields stabilize. Treasury markets suggest slower growth but no imminent recession. The next move will hinge on inflation, labor data, and early-2026 policy signals.

Frequently Asked Questions (FAQs)

1. What were the key factors driving markets last week?

Markets were primarily influenced by the Federal Reserve’s December rate cut and its hawkish forward guidance, movements in Treasury yields, inflation expectations, and year-end investor positioning. Additional volatility stemmed from tariff policy uncertainty and mixed macro data, while corporate earnings provided selective support.

2. Why did equities pull back despite a Federal Reserve rate cut?

Although the Fed delivered a 25-basis-point cut, investors focused on the cautious tone of the accompanying statement and dissenting votes within the committee. This signaled that further easing may pause in early 2026, prompting profit-taking in equities and a reassessment of risk assets.

3. What did Treasury yield movements reveal about economic expectations?

Treasury yields moved unevenly, with short-term rates easing and longer-term yields holding firm. The resulting modest yield-curve steepening suggested markets are no longer pricing an imminent recession but instead expect slower growth and gradual disinflation.

4. How did corporate earnings influence market sentiment?

Corporate earnings helped stabilize markets amid macro uncertainty. Strong results from technology, cloud, and consumer-facing companies highlighted underlying demand resilience, allowing equities to remain near record levels despite higher volatility and cautious investor sentiment.