The Week That Was and The Week That’s Ahead: How Markets Are Setting Up As We Approach 2026

Calisade is an investment research firm that offers bespoke investment research to institutional clients. It also delivers weekly insights to the retail market via its Calisade Digests. Calisade focuses on creating alpha through robust macro, fundamental, technical, and sentiment research.

“The Week That Was & The Week That’s Ahead” is a weekly market brief highlighting major economic data, policy developments, and corporate earnings shaping investor sentiment. It summarizes the most important events from the past week and outlines key catalysts to watch in the week ahead helping readers stay informed and prepared for upcoming market moves.

The Week That Was (December 22-December 26, 2025)

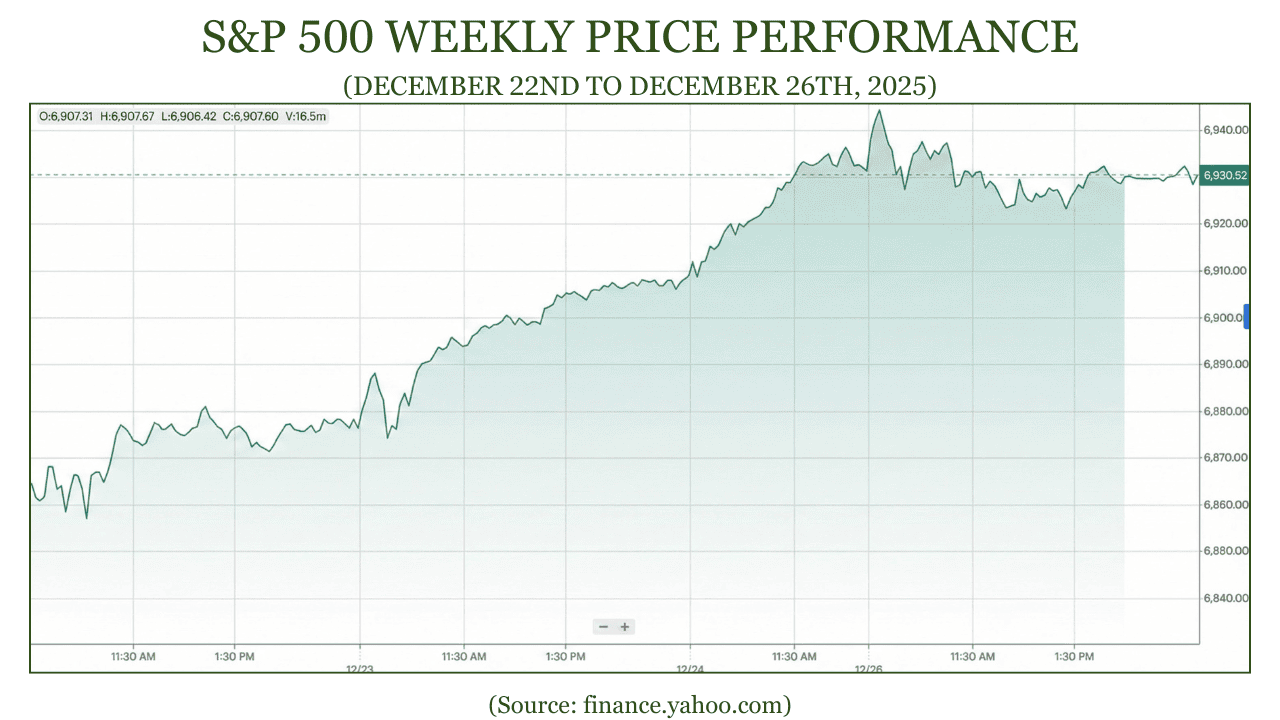

The S&P 500 advanced 0.94% over the week. The index opened at 6,865.21 on Monday, December 22, and closed at 6,929.94 on Friday, December 26. Markets were closed on Wednesday, December 25, in observance of the holiday, and liquidity remaining thin through the remainder of the week. Price action was uneven but constructive, as shallow pullbacks were met with steady buying interest. The index ultimately held near these elevated levels into Friday’s close, reflecting resilient sentiment and investors’ willingness to maintain exposure despite limited catalysts and year-end positioning dynamics.

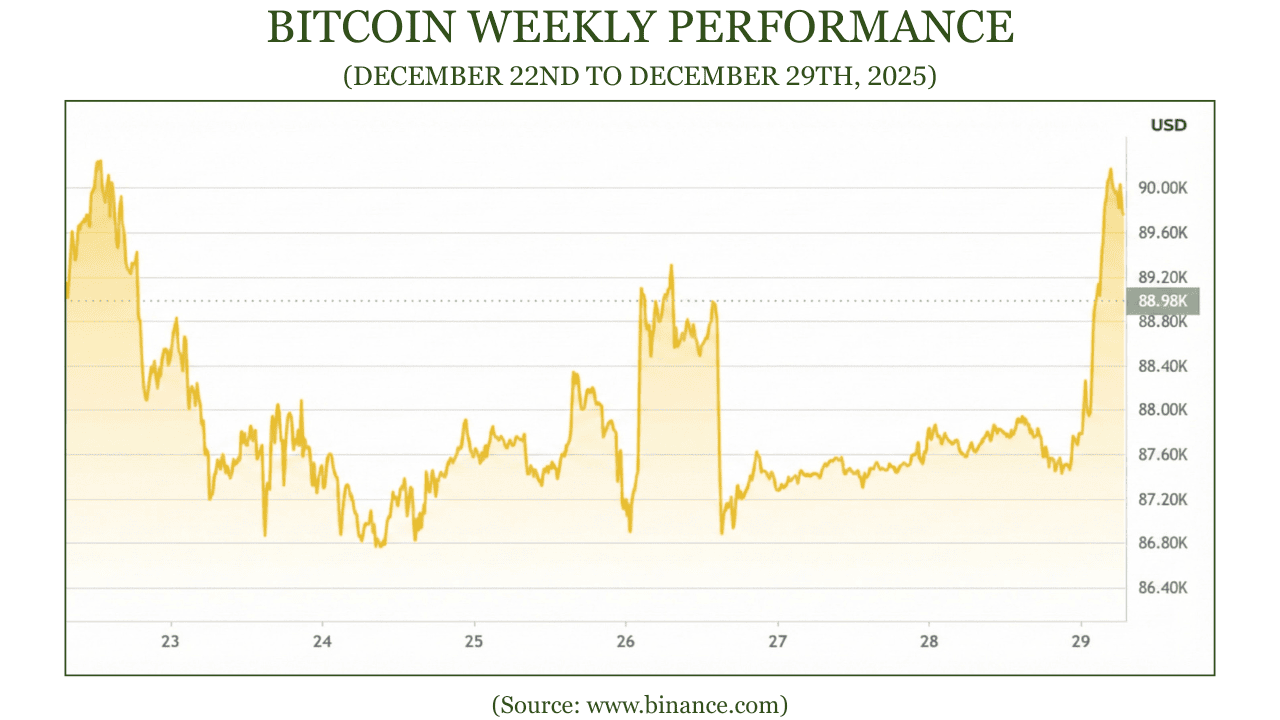

Bitcoin declined by 0.89% over the week, moving from $88,621.40 at the open on Monday, December 22 to $87,835.84 by Sunday, December 28. Trading remained range bound between approximately $87,000 and $90,000, with liquidity thinning as global markets slowed ahead of Christmas. Market participants also navigated a record sized Bitcoin options expiry on December 26 exceeding $23 billion in notional value, which increased the risk of short-term volatility and contributed to choppy price action into the weekend. Spot Bitcoin ETFs recorded notable outflows around Christmas Eve as investors reduced risk exposure before the holiday break.

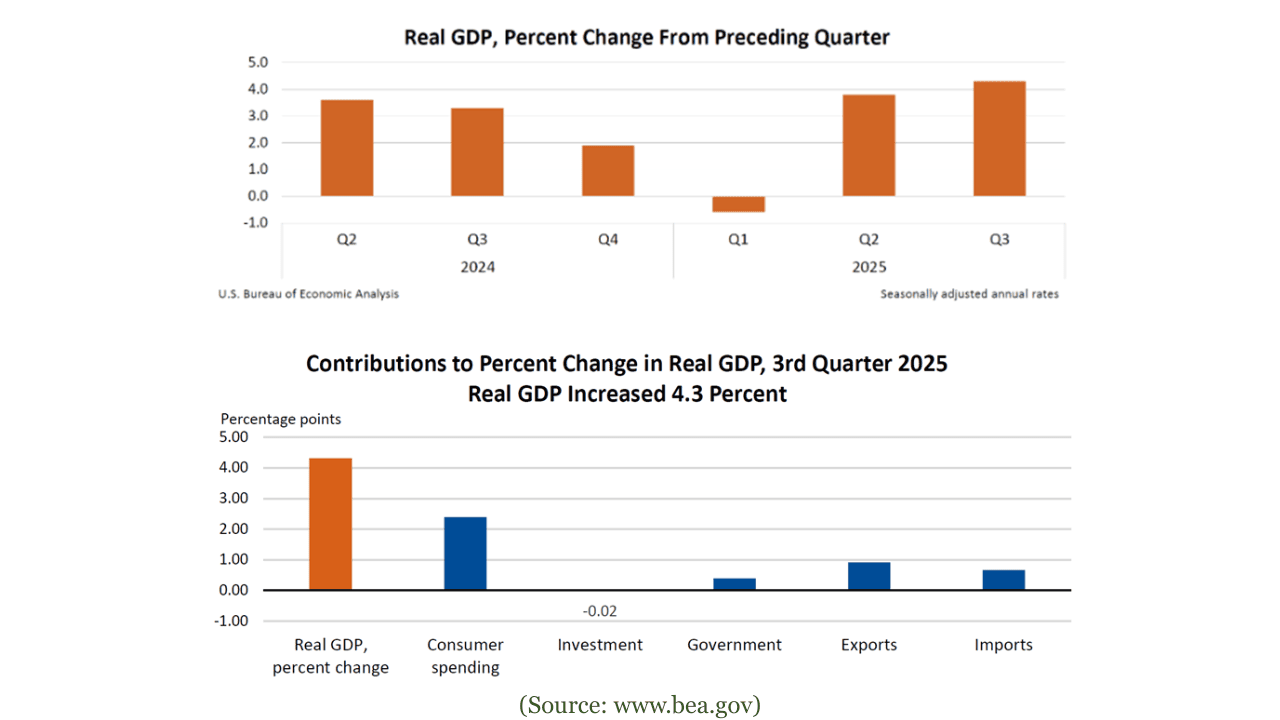

In the Q3 2025 initial GDP estimate released on December 23, the U.S. economy was reported to have grown at a solid annualized pace of 4.3% in Q3 2025, supported primarily by consumer spending, exports, and government outlays, while private investment was a drag.

However, preliminary corporate profits declined in the third quarter, reflecting the impact of several large legal and regulatory settlements that were finalized during the period. The BEA noted that these settlements reduced reported profits despite otherwise resilient underlying economic activity. As a result, the divergence between strong headline growth and weaker corporate profit figures highlighted ongoing margin pressures and the role of one-off costs in shaping near-term earnings dynamics.

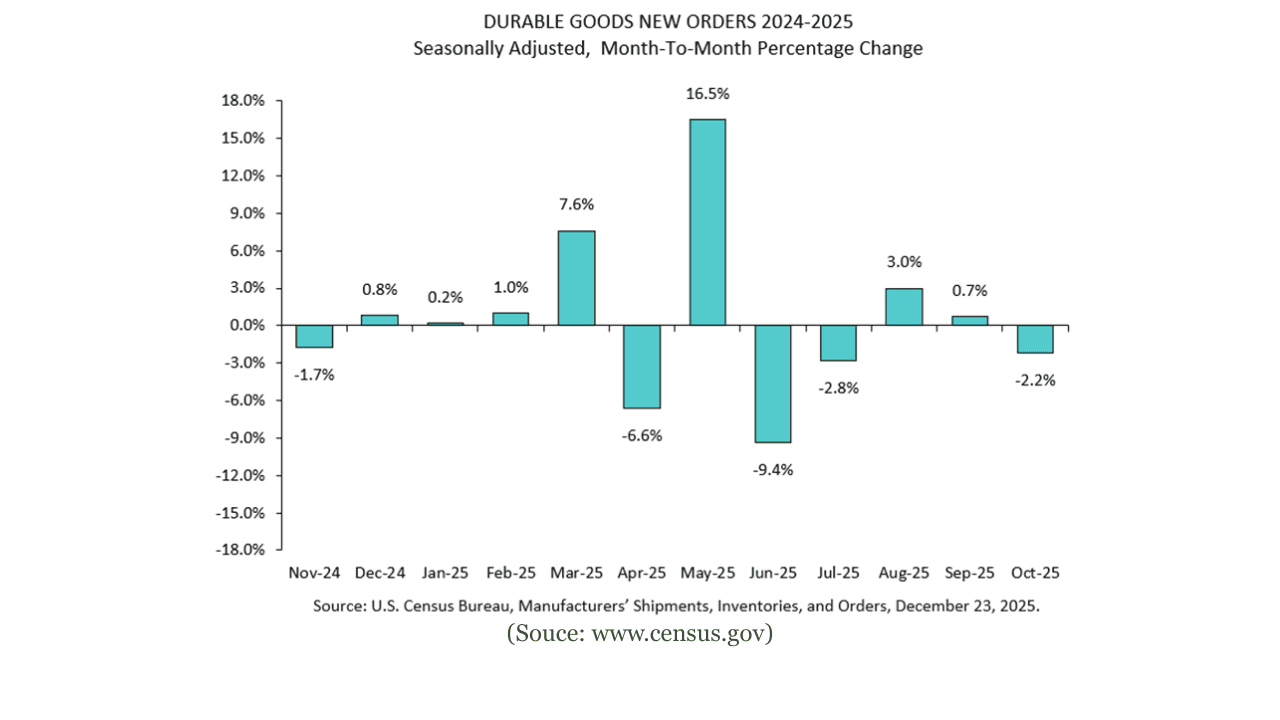

On Tuesday, December 23, the U.S. Census Bureau reported that new orders for manufactured durable goods fell 2.2% in October, declining to $307.4 billion. The pullback followed two months of gains and was driven primarily by a sharp decline in transportation equipment orders, which weighed on the headline figure. Overall, the report pointed to softer manufacturing demand late in the quarter, despite some support from shipments and existing order backlogs.

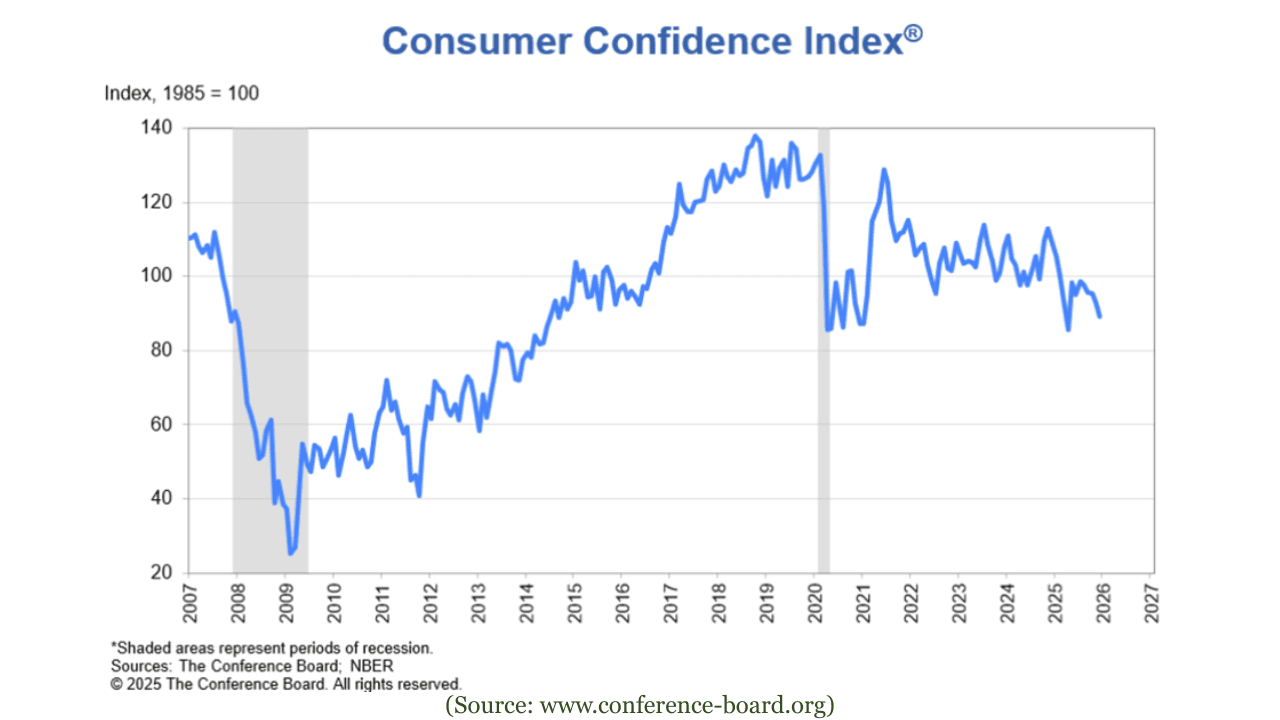

The Conference Board reported that U.S. consumer confidence declined for a fifth consecutive month in December, with the headline index falling 3.8 points to 89.1.

The Present Situation Index dropped to 116.8, indicating weaker assessments of current business and labor market conditions, while the Expectations Index remained subdued at 70.7, well below the recession warning threshold, reflecting continued caution around jobs, income, and the broader economic outlook.

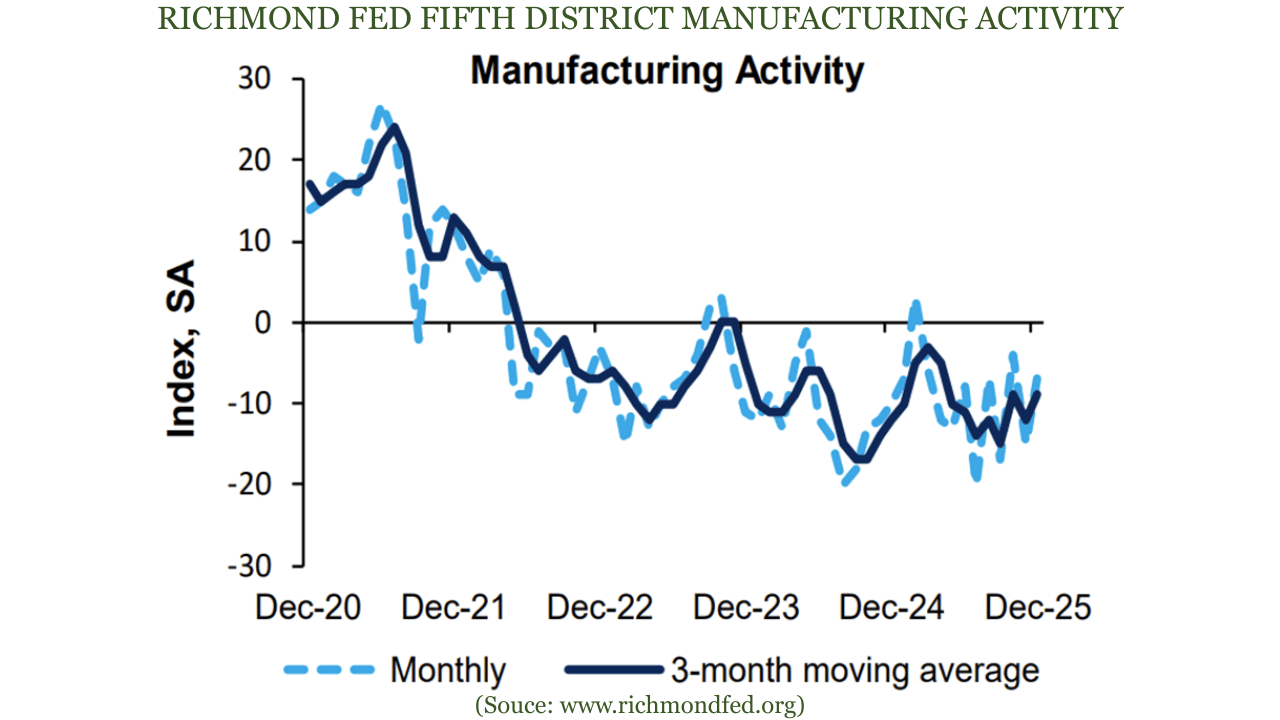

The Richmond Fed Manufacturing Index improved in December, rising to −7 from −15 in November, but remained in negative territory, signaling continued contraction in manufacturing activity across the Fifth District. (The Fifth Federal Reserve District is the region covered by the Federal Reserve Bank of Richmond, which includes Virginia, Maryland, North Carolina, South Carolina, Washington DC, and most of West Virginia. Economic data for the Fifth District reflect regional conditions rather than the national economy)

While new orders, shipments, and employment all showed some improvement, the index staying below zero indicated that overall conditions remained weak despite tentative signs of stabilization toward year-end.

The Week Ahead (December 29, 2025 – January 2, 2026)

As markets transition from the holiday period into the final days of the year and the opening of a new one, trading conditions are expected to remain thin, with many investors still in year-end and holiday mode. Activity is likely to pick up selectively as participants begin to position for the year ahead, but overall liquidity should remain subdued. Against this backdrop, the focus will be on a limited set of U.S. economic updates for signals on how momentum is carrying into the new year. With portfolios largely set, the focus will be on whether these releases affirm expectations of economic stability or prompt a reassessment of the outlook as markets turn the calendar to 2026.

Pending Home Sales (November) – Monday, December 29

The Pending Home Sales report from the National Association of Realtors tracks contract signings for existing homes and serves as a forward-looking indicator of housing market activity. Because signed contracts typically translate into completed sales over the following one to two months, this data is used to assess near-term momentum in housing demand, sensitivity to mortgage rates, and implications for construction activity and consumer spending. It can assist in gauging whether recent movements in interest rates are stabilizing or further weighing on housing conditions.

State Job Openings and Labor Turnover - (Tuesday, December 30)

The State Job Openings and Labor Turnover release from the Bureau of Labor Statistics will provide a detailed, state-level view of labor market conditions, including job openings, hires, quits, and layoffs. The data helps investors assess regional labor tightness, worker confidence, and emerging signs of cooling or resilience across states. In a thin year-end trading environment, the release will assist in shaping expectations around wage pressures, economic momentum, and the broader Federal Reserve policy outlook.

Federal Reserve FOMC Minutes (December Meeting) – (Tuesday, December 30)

The minutes of the FOMC detail how policymakers interpreted recent inflation, labor market, and growth data when setting interest rates, as well as the range of views within the committee. Investors use the minutes to understand how the Fed reacts to incoming economic data, what indicators it prioritizes, and how close officials believe the economy is to conditions that would justify a policy shift. It helps markets refine expectations for future rate decisions, the path of financial conditions, and liquidity in the system—key drivers of equity valuations, bond yields, and currency movements—particularly when forward guidance is limited.

S&P CoreLogic Case-Shiller Home Price Index (November) – Tuesday, December 30

The S&P CoreLogic Case-Shiller Home Price Index measures changes in home prices across major U.S. metropolitan areas. Markets follow the index as a key indicator of housing inflation and household wealth effects, which can influence consumer behavior and broader inflation trends. Although it is backward-looking due to its reporting lag, sustained shifts in home price growth can shape longer-term expectations for interest rates and Federal Reserve policy.

Outlook

As we head into the new year, we wish our readers a very happy and prosperous New Year. While headline GDP growth in Q3 was notably strong, it remains backward looking and reflects conditions earlier in the year rather than the current economic pulse. More recent indicators point to a softer and increasingly uneven picture, with consumer confidence, manufacturing activity, and new orders all showing signs of cooling. The upcoming week’s data on housing, labor market dynamics, and Federal Reserve deliberations will be closely watched for clearer signals on where sentiment is heading and what it may imply for growth, rates, and market direction in the early part of 2026.

Frequently Asked Questions (FAQs)

1. What were the key drivers of markets this past week?

Markets were shaped by thin holiday liquidity, movements in Treasury yields, Federal Reserve expectations, and incoming economic data. Equity markets held firm despite limited catalysts, while investor sentiment reflected a balance between strong backward-looking GDP data and softer signals from consumer confidence and manufacturing activity.2. Why are Federal Reserve minutes important for weekly market outlooks?

Federal Reserve minutes offer insight into how policymakers view inflation, labor market conditions, and economic momentum. Investors analyze these details to refine expectations around interest rates, liquidity conditions, and future policy decisions—key drivers of bond yields, equities, and overall market sentiment.

3. How do interest rates and yields affect equities and Bitcoin?

Changes in interest rates and Treasury yields influence borrowing costs, equity valuations, and risk appetite. Higher yields can pressure stock prices and weigh on risk assets, while stable or declining yields often support equities and Bitcoin by improving liquidity conditions and investor confidence.

4. What should investors watch in the week ahead?

Investors should focus on upcoming economic data, including housing and labor market indicators, along with Federal Reserve communications. These releases will help clarify whether recent market trends are likely to persist as markets transition into the new year.